Michael Ballanger goes bearish on silver and breaks down why a “heretofore uninteresting” junior developer has lately caught his eye.

In the event you take the time to learn by way of all the commentary on silver that’s freely accessible by way of the myriad of social media retailers and popularized content material suppliers, you come away completely bewildered by the huge array of opinions, arguments, and theories protecting silver’s position on this planet financial kingdom in addition to its functions within the electrification motion and expertise basically. As a commentator, I’m astounded on the lack of precise analysis utilized by lots of my colleagues to the precise economics of silver and whereas newcomers to the world of investing have gravitated to the (mis)use of the phrase “due diligence”, the proof abounds that they haven’t any actual understanding of the phrase and what it truly entails.

“The identical group that ramped AMC for $2 to $70 on gaseous vapors of hopium are actually being hand-delivered on a silver platter the singular most promotable, ramp-able, moon-rocket-of-a-stock owned by mining legend and billionaire Eric Sprott…”

I learn an article this week that had the creator hyperventilating by way of an overheated keyboard over the belief that each one of this forex debasement was going to exacerbate the “present world scarcity state of affairs” (in silver). As I vainly tried to keep away from choking on the mouthful of Cabernet-Sauvignon I used to be “sipping,” I assumed to myself “What publications might this chap be studying and in what decade had been they penned?”

I had simply completed studying an interesting article on “Kupferschiefer-style” mineralization which happens within the area close to the Germany-Poland border which carries roughly ten components copper for each one half silver, however primarily based upon the sheer quantity of this type of mineralization, it has been decided that it constitutes the most important historic silver useful resource on the planet. The importance of this lies in the truth that these deposits are primarily copper deposits carrying silver credit together with them so whereas we’re generally proven what are deemed to be “stand-alone” silver deposits as a part of a junior’s advertising and marketing pitch, the silver provide is dominated by base metallic operations.

I recall again in 2013 whereas attending the Prospector and Builders’ Conference in Toronto chatting with a Glencore govt a couple of 30-million-ounce silver deposit in Peru and simply on the level the place I used to be about to ship my “knockout punch”, he held up each palms and proceeded to inform me that Glencore’s zinc operation in Peru had slag heaps (waste dumps) with ten occasions that quantity of silver that had been considered as “unremarkable” at finest. I skulked away to the Royal York Resort’s well-known “Library Bar” to drown my embarrassment instantly thereafter.

Within the historical past of world mining, there has by no means been a “world silver scarcity”. In contrast to gold, the place many of the metallic ever mined now resides in vaults managed by the central banks, silver enjoys no such controls so each ounce produced has to seek out both a financial or industrial purchaser.

So, when a brand new participant to the world of silver begins tripping the sunshine unbelievable in a celebratory jig in regards to the outlook for silver costs, I search for remarks about provide as a queue to proceed with the article. Moreover, if the phrase “scarcity” seems within the first two paragraphs, I transfer alongside.

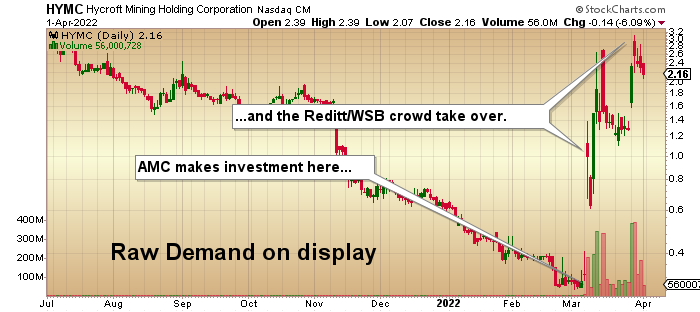

Now that I’ve cloud-seeded the primary a part of this missive with what is likely to be construed as a “bearish” tilt towards the silver market, it’s the different aspect of the equation that has my consideration (and what prompted me to purchase a couple of silver contracts this week) was the implications for pricing that might develop in upcoming weeks and months by the arrival of unanticipated demand. What steered me within the course of the doable resurgence of such demand was a growth that has left me completely aghast – the efficiency of a heretofore uninteresting junior gold developer known as Hycroft Mining Holding Corp. (HYMC:NASDAQ).

For these unfamiliar with the small print, an organization traditionally concerned in film theatres, AMC Leisure (AMC:US) caught the eye of the Reddit/WSB crowd and ramped the inventory from below $2 in early 2021 to over $70/share for completely no basic purpose however in doing so raised a mountain of contemporary capital in its wake. I applaud the choice to make use of the pump as a funding conduit however that’s the place my adulation goes off a cliff.

On the giddiness of a fats treasury after years of “subsistence farming”, AMC determined to foray into the perilous halls of the junior mining menu however with all the asset-rich, valuation-challenged junior miners all scrambling for consideration, AMC opted to take a cloth chunk of Hycroft (previously bankrupted catastrophe inventory Allied Nevada Company).

Now, publications with far better sway and affect than the GGM Advisory have already lined up the AMC/Hycroft deal of their crosshairs and have roasted the deal and the Hycroft Mine with whole acidity and malice of intent. That mine is definitely “challenged” by way of each metallurgy and optics – and – if we’re to imagine the armchair mining analysts that determined to assail the deal – it’s going to undoubtedly crush anybody that takes a place.

That was all at round $1.30 per share and even I used to be tempted to inquire of the mortgage put up on the agency I exploit if I might borrow a couple of hundred thousand shares with the intention to revenue from the upcoming crash within the inventory – after which it hit me. The identical group that ramped AMC for $2 to $70 on gaseous vapors of hopium are actually being hand-delivered on a silver platter the singular most promotable, ramp-able, moon-rocket-of-a-stock owned by mining legend and billionaire Eric Sprott within the type of HYMC and since they know nothing about mineral economics, they’re free to belief solely within the energy of their investor group which, after the AMC experience, permits the court docket of funding judgement to be decided solely by value and quantity.

On March 27, HYMC traded at $3.10 and closed out the week at $2.16. That’s up 138% or 66% from the value when the Doomberg group (amongst others) issued the demise sentence.

What that tells me is that silver wants no supply-demand equilibrium with the intention to generate profits. Silver wants nothing within the type of “fundamentals” nor does it require traders to conduct something that may come near resembling “due diligence”. With all the money sloshing across the system from unbelievable market strikes like AMC and Gamestop and Tesla, primarily based purely on momentum and FOMO, all that’s required are the steely nerves of the novice crap shooter, as a result of silver’s future lies within the randomness of the riverboat on line casino or the back-alley cube recreation. Why ought to we not take a place in silver, the place the important thing to efficiency lies within the sudden sudden look of monstrous, unbridled demand?

On condition that skyrocketing base metals costs are encouraging the mobilization of previously sub-economic provide, will the arrival of this doable new provide additionally stimulate the accompaniment of the silver bi-product? Who cares? Fundamentals do not matter. I believe not. If the previous adage of “security in numbers” might be utilized to gang warfare, it’s of even better significance within the inventory pump recreation and if there us one factor that HYMC and AMC have demonstrated to the funding world with the utmost of emphasis and energy of objective, it’s that measurement issues.

In case your investor group decides that as a collective, they will revalue a nugatory company issuer to a degree thought-about borderline fraudulent, then let free market capitalism reside on and reward the believers.

Because of this, I believe silver goes to hit $50 per ounce within the subsequent transfer as a result of a bunch of video-game-trained Millennials found out learn how to vanquish the “bosses” within the type of conventional Wall Road energy brokers referred to as bullion banks. In late February of 2021, the SilverSqueeze motion went right into a gunfight armed with machetes and acquired taken out behind the proverbial woodshed. Nonetheless, they’ve lately regrouped and bolstered their ranks with income taken within the rise to all-time highs in lots of if the “meme shares”.

The ascendancy of Hycroft Mining to a market cap of absolute absurdity represents the sounding of the clarion name of the advancing armies being known as to service and it’s with nice irony that that I declare that there’s completely no purpose from both an financial or event-driven perspective that this transfer will happen.

I can’t present time frames or value targets with any actual readability or certainty however on the finish of the day, that is what occurs when residents the world over lose all respect for the integrity of their house forex. When the worry of shedding cash — i.e. the popularity of danger — vacates {the marketplace}, it’s as a result of cash has misplaced its shortage worth. When central banks are allowed to create forex and credit score with little or no controls or limitations, that shortage worth evaporates and bubbles — one after the opposite — come speeding in.

My biggest worry is the cut-off date when folks lose all curiosity in incomes a residing as a result of authorities eliminates the requirement for the “incomes” half. What historical past has proven relating to all monetary crises because the Crash of ’87 is that it’s the accountability of the federal government to guard traders from any and all dangers, be they subprime banking fraud or well being points such because the 2020-2022 pandemic. Now, with inflation raging at almost 8%, they’re contemplating stimulus cheques designed to offset the impression of rampaging gasoline and meals costs proving as soon as once more that these legislators have by no means taken and positively by no means handed any programs in economics.

I do know that there are numerous gifted analysts on the market that may present related statistical causes for proudly owning silver and I acknowledge that my disillusionment with conventional basic evaluation could come throughout as a blasphemy of kinds, however till the sanctity of cash and respect for financial savings have been restored by a return to the rules of sound cash and prudent fiscal habits, I’ll now not try to supply a logical rationale for possession.

As an alternative, I’ll merely bear in mind the immortal phrases of the croupier when the appropriate quantity reveals up in that great carpet of inexperienced felt: “Winner, winner, rooster dinner!”

Initially printed April 1, 2022.

Observe Michael Ballanger on Twitter @MiningJunkie. He’s the Editor and Writer of The GGM Advisory Service and might be contacted at [email protected] for subscription data.

Initially educated throughout the inflationary Nineteen Seventies, Michael Ballanger is a graduate of Saint Louis College the place he earned a Bachelor of Science in finance and a Bachelor of Artwork in advertising and marketing earlier than finishing post-graduate work on the Wharton Faculty of Finance. With greater than 30 years of expertise as a junior mining and exploration specialist, in addition to a stable background in company finance, Ballanger’s adherence to the idea of “Onerous Property” permits him to focus the apply on deciding on alternatives within the world useful resource sector with an emphasis on the dear metals exploration and growth sector. Ballanger takes nice pleasure in visiting mineral properties across the globe within the endless hunt for early-stage alternatives.

[NLINSERT]

Disclosures

1) Statements and opinions expressed are the opinions of Michael Ballanger and never of Streetwise Experiences or its officers. Michael Ballanger is wholly liable for the validity of the statements. Streetwise Experiences was not concerned in any facet of the article preparation. Michael Ballanger was not paid by Streetwise Experiences LLC for this text. Streetwise Experiences was not paid by the creator to publish or syndicate this text.

2) The next firms talked about on this article are billboard sponsors of Streetwise Experiences: None. Click on here for necessary disclosures about sponsor charges. The data supplied above is for informational functions solely and isn’t a suggestion to purchase or promote any safety.

3) This text doesn’t represent funding recommendation. Every reader is inspired to seek the advice of together with his or her particular person monetary skilled and any motion a reader takes because of data introduced right here is his or her personal accountability. By opening this web page, every reader accepts and agrees to Streetwise Experiences’ phrases of use and full authorized disclaimer. This text shouldn’t be a solicitation for funding. Streetwise Experiences doesn’t render common or particular funding recommendation and the knowledge on Streetwise Experiences shouldn’t be thought-about a suggestion to purchase or promote any safety. Streetwise Experiences doesn’t endorse or suggest the enterprise, merchandise, providers or securities of any firm talked about on Streetwise Experiences.

4) On occasion, Streetwise Experiences LLC and its administrators, officers, workers or members of their households, in addition to individuals interviewed for articles and interviews on the positioning, could have a protracted or quick place within the securities talked about. Administrators, officers, workers or members of their quick households are prohibited from making purchases and/or gross sales of these securities within the open market or in any other case from the time of the choice to publish an article till three enterprise days after the publication of the article. The foregoing prohibition doesn’t apply to articles that in substance solely restate beforehand printed firm releases.

Michael Ballanger Disclaimer

This letter makes no assure or guarantee on the accuracy or completeness of the info supplied. Nothing contained herein is meant or shall be deemed to be funding recommendation, implied or in any other case. This letter represents my views and replicates trades that I’m making however nothing greater than that. At all times seek the advice of your registered advisor to help you together with your investments. I settle for no legal responsibility for any loss arising from the usage of the info contained on this letter. Choices and junior mining shares include a excessive degree of danger which will outcome within the lack of half or all invested capital and subsequently are appropriate for knowledgeable {and professional} traders and merchants solely. One needs to be accustomed to the dangers concerned in junior mining and choices buying and selling and we suggest consulting a monetary adviser when you really feel you don’t perceive the dangers concerned.