The miner is creating the historic Homestake Mining properties in South Dakota.

Dakota Gold Corp. (DC:NYSE), previously the somewhat clumsily named Dakota Territory Useful resource Corp., was the topic of an e mail alert despatched out earlier than the open this morning about it and Purple Cat Holdings, with the related components of it studying as follows…

“There’s huge information on 2 of our shares. Dakota Territory Useful resource Corp, DTRC, $5.00, that we haven’t checked out for some time, ceased buying and selling on the finish of March pending its itemizing on the NYSE, and can begin buying and selling on this market this morning beneath the brand new and fewer clumsy title Dakota Gold. With its new discovered respectability, particularly as its value is excessive sufficient to draw institutional curiosity, it’s prone to meet up with the massive gold’s rallies of latest weeks, made extra possible by what appears to be like like a bull Flag / Pennant forming since mid-February. So we keep lengthy and it’s rated a powerful purchase right here.

There may be inadequate time to jot down these 2 shares up correctly earlier than the opening this morning. So this e mail alert is meant to present you an early “heads up” earlier than buying and selling begins. Articles on each of them will likely be posted afterward the location.”

These of you who purchased close to to the open have accomplished properly, because it opened little modified from when it was halted on thirtieth March pending its NYSE itemizing, however is now up 23% on the day on the time of writing after having risen a lot increased.

Dakota is a inventory that we’ve adopted for fairly some time and we profited from its huge runup in early to mid-2021. After its somewhat dramatic peak in the summertime of 2021 that may be seen on its 15-month chart beneath, it initially reacted after which ran off into a protracted horizontal buying and selling vary that continued proper as much as at present.

Early in February it ran sharply as much as resistance on the prime of the buying and selling vary after which reacted again to settle right into a Flag/Pennant consolidation sample which implied that it was setting as much as break strongly increased, as has occurred this morning. Two extra optimistic components that we will observe on this chart are the best way that the Accumulation line has improved over the previous couple of months and the 200-day shifting common catching as much as the value after being manner beneath it for a lot of final 12 months, which partly explains why the inventory stalled out for therefore lengthy.

Along with exhibiting latest motion in far more element, the 6-month chart reveals varied extra helpful components in play. One is the upside quantity construct up of the previous couple of weeks, one other is the MACD crossing its shifting common within the latest previous after virtually absolutely unwinding its earlier overbought situation. Lastly, there was bullish cross of the shifting averages a few weeks in the past.

There are a number of huge the explanation why Dakota Gold is taken into account to be one of many prime investments within the sector. Most likely the largest is that the corporate is creating the previous Homestake Mining properties in South Dakota, which have been prodigiously productive even utilizing the comparatively primary mining strategies of the day, about 90 years in the past – now in fact they’re much extra refined. One other, as already talked about, is that the inventory will entice huge traders within the sector because it now trades on the NYSE. Lastly, because the world strikes in the direction of hyperinflation it is going to be unimaginable for any manipulative or repressive forces to stop gold and all gold investments hovering. So Dakota Gold has every thing going for it.

We last bought Dakota Gold on the 3rd February at a pretty good price of about $4.50, and in case you heeded this morning’s e mail alert you will have purchased it or purchased it once more early this morning at one thing above $5.02, so we’re already properly up. No additional motion is required on our half save to say that positions could also be added to or new purchases made on dips, similar to we at the moment are seeing as the value has simply backed off considerably from this morning’s highs into shopping for territory.

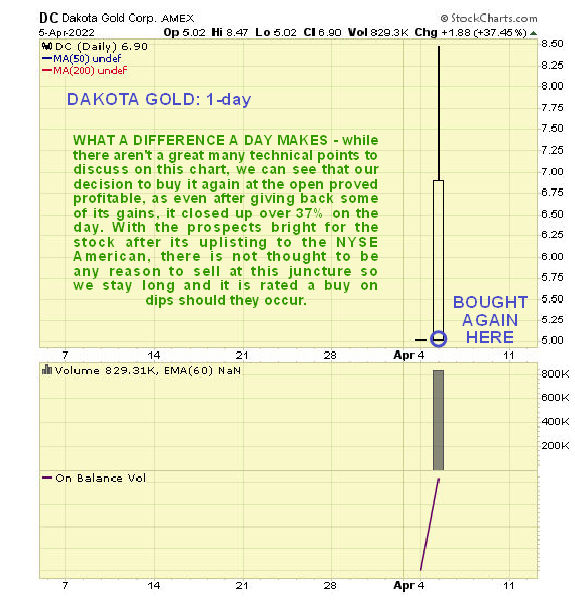

Postscript added the next morning (sixth). The brand new Dakota Gold had an excellent day yesterday, closing up 37% on the day after having risen increased nonetheless intraday, as we will see on its 1-day chart for yesterday beneath. When you purchased quickly after the open as recommended, you should have accomplished properly. Given the good prospects for the corporate there’s considered little motive to promote at this juncture.

Dakota Gold Corp. website

Dakota Gold Corp., DC, buying and selling at $6.19 at 11.58 am EDT on fifth April 2022.

Initially posted on CliveMaund.com at 12.45 pm EDT on fifth April 2022.

Clive Maund has been president of www.clivemaund.com, a profitable useful resource sector web site, since its inception in 2003. He has 30 years’ expertise in technical evaluation and has labored for banks, commodity brokers and stockbrokers within the Metropolis of London. He holds a Diploma in Technical Evaluation from the UK Society of Technical Analysts.

| Wish to be the primary to find out about fascinating Gold funding concepts? Signal as much as obtain the FREE Streetwise Experiences’ e-newsletter. | Subscribe |

Disclosures

1) Clive Maund: I, or members of my instant family or household, personal shares of the next firms talked about on this article: None. I personally am, or members of my instant family or household are, paid by the next firms talked about on this article: None. My firm has a monetary relationship with the next firms talked about on this article: None. CliveMaund.com disclosures beneath. I made up my mind which firms could be included on this article based mostly on my analysis and understanding of the sector.

2) The next firms talked about within the article are sponsors of Streetwise Experiences: None. Click on here for essential disclosures about sponsor charges. The data supplied above is for informational functions solely and isn’t a advice to purchase or promote any safety.

3) Statements and opinions expressed are the opinions of the writer and never of Streetwise Experiences or its officers. The writer is wholly accountable for the validity of the statements. The writer was not paid by Streetwise Experiences for this text. Streetwise Experiences was not paid by the writer to publish or syndicate this text. The data supplied above is for informational functions solely and isn’t a advice to purchase or promote any safety. Streetwise Experiences requires contributing authors to reveal any shareholdings in, or financial relationships with, firms that they write about. Streetwise Experiences depends upon the authors to precisely present this info and Streetwise Experiences has no technique of verifying its accuracy.

4) This text doesn’t represent funding recommendation. Every reader is inspired to seek the advice of along with his or her particular person monetary skilled and any motion a reader takes on account of info offered right here is his or her personal duty. By opening this web page, every reader accepts and agrees to Streetwise Experiences’ phrases of use and full authorized disclaimer. This text isn’t a solicitation for funding. Streetwise Experiences doesn’t render basic or particular funding recommendation and the knowledge on Streetwise Experiences shouldn’t be thought of a advice to purchase or promote any safety. Streetwise Experiences doesn’t endorse or suggest the enterprise, merchandise, companies or securities of any firm talked about on Streetwise Experiences.

5) Every now and then, Streetwise Experiences LLC and its administrators, officers, staff or members of their households, in addition to individuals interviewed for articles and interviews on the location, might have a protracted or quick place in securities talked about. Administrators, officers, staff or members of their instant households are prohibited from making purchases and/or gross sales of these securities within the open market or in any other case from the time of the choice to publish an article till three enterprise days after the publication of the article. The foregoing prohibition doesn’t apply to articles that in substance solely restate beforehand revealed firm releases. As of the date of this text, officers and/or staff of Streetwise Experiences LLC (together with members of their family) personal securities of Dakota Gold, an organization talked about on this article.

Charts supplied by the writer.

CliveMaund.com Disclosures

The above represents the opinion and evaluation of Mr. Maund, based mostly on knowledge accessible to him, on the time of writing. Mr. Maund’s opinions are his personal, and are usually not a advice or a suggestion to purchase or promote securities. Mr. Maund is an impartial analyst who receives no compensation of any form from any teams, people or companies talked about in his stories. As buying and selling and investing in any monetary markets might contain severe danger of loss, Mr. Maund recommends that you simply seek the advice of with a professional funding advisor, one licensed by applicable regulatory businesses in your authorized jurisdiction and do your personal due diligence and analysis when making any form of a transaction with monetary ramifications. Though a professional and skilled inventory market analyst, Clive Maund isn’t a Registered Securities Advisor. Subsequently Mr. Maund’s opinions available on the market and shares can solely be construed as a solicitation to purchase and promote securities when they’re topic to the prior approval and endorsement of a Registered Securities Advisor working in accordance with the suitable laws in your space of jurisdiction.