Whatever new dawn is ahead for the world economy, for businesses, for investors and even for the social and family lives we have long cherished, the world has undeniably changed, and in ways not seen in our lifetimes. The chaos wrought on economies, businesses, individual liberties and of course on the financial markets has been dramatic and shocking to all. What then is the next phase for Asia’s wealthy investors as the world struggles to escape the straitjacket of lockdowns, economic malaise, burgeoning government debt, financial market volatility and possibly even major social unrest? In a mini survey in which over 100 respondents participated, sponsored by Hong Kong and Singapore-based precious metals firm J. Rotbart & Co., Hubbis took the temperature of the Asian wealth management community to find out what they are advising their clients these days, and where gold and precious metals feature in those plans. As the era of a rising tide lifting most mainstream asset valuations worldwide gives way to a new era requiring greater selectivity, deeper analysis and far more care, many of the wealthier HNW and UHNW investors in Asia have been turning increasingly to alternative assets, allocating more towards relative illiquid private assets and at the same time there is also a strong and rising inclination towards the combination of safety, non-correlation and liquidity that gold and some other precious metals offer. This mini survey is simply a gauge of sentiment and approach, we did not plan to delve too deeply into asset allocation or other theories, but instead tried to keep our collective eyes firmly set on the key implications, for HNW and UHNW investment portfolios, whether self-directed, driven by advisory or handled on a discretionary basis.

Many would argue that this Covid-19 crisis has wrought a fundamental change in all aspects of our lives and that investing is going to be fundamentally different. They maintain that we need to focus on how to derive true alpha, whilst the concept of beta is potentially less appealing going forward. Advisors, asset managers and investors must do far more to differentiate between who is going to survive in the new world and who will struggle or fail.

There is no doubt that RMs and wealth management leaders need to be having more discussions that delve into the real meat of how HNWIs and ultra-wealthy investors should invest, not simply applying the ‘old’ thinking, but seeing a new reality ahead in the markets and assets classes.

Advice for the post-pandemic world

- Wealth protection is far higher in priority than wealth expansion at this time.

- Lessons from crises are seldom learned and/or soon forgotten.

- Risk must be better measured against return.

- Asset allocation models must adapt to the new world.

- Leverage must be more cautiously applied.

- Seek out more assets that are non-correlated to mainstream markets.

- Be prepared to look out over longer time frames for returns.

- The WM industry has an opportunity to elevate the investment dialogue.

- The WM industry must prove its worth by the curation of new ideas for the new world ahead.

Time to realign portfolios

After the worst of the market route earlier this year, investors might have seen many of their holdings recover fairly well when the markets started to bounce, but they should not forget the misery of the massive sell-off in major markets worldwide, when prices and liquidity of many assets fell off the edge, and when many clients suffered the compounding effect of margin calls and excess leverage on their portfolios, and suffered in many cases the further ignominy of not being able to buy into the recovery to repair more of the damage. Moreover, it is also very difficult to remediate portfolios in the aftermath, even if there is wreckage out there to be picked up cheap.

Many investors had, after a decade of rising asset prices, simply forgotten the dangers of excessive focus on return and insufficient focus on risk management and exposure mitigation. Bankers and other advisors know all too well how in the more clement market conditions, it was remarkably difficult to persuade private clients to build in greater portfolio resilience; investors, they often recount, baulk at paying up for downside protection when investing seems to be so easy. But most can now see that the reality is that those defences needed to be in there in good and bad conditions. In the current environment, the wealth industry needs to be bold in getting these messages out, even if they are difficult conversations.

Greater risk protection needed

The errors made were common investment portfolio construction errors – driven by an excess of exuberance – and were not simply Covid-19 derived, but with the world now facing continuing uncertainty, there is great need to get these messages of more optimal and more responsible portfolio construction out, rapidly, and loud and clear.

The wealth industry is also somewhat to blame. The communication of risk and risk management by the RM community has historically been poor and remains thus today, although there is a more widespread effort gradually taking place to offer investors risk models and different outcomes under different scenarios and with different asset allocation models. Framing the conversations in this way should be natural for private banks with their resources, as well as natural for the IAM/EAM community, who pride themselves on being able to offer greater personalisation and less product-pushing type mentality.

Looking to the longer-term

In times of excessive volatility, illiquid, long-term investments such as private equity, private debt and other such assets are shielded from dramatic price fluctuations, as there is no market price or mark to market for these assets. There had in recent years already been a growing trend towards greater allocation of investment portfolios – especially for the upper end of the HNW segment and of course the UHNW market – to such private assets in any case, as investors began to worry more and more about strained valuations in the main exchanges; this actually led even in 2018 and 2019 to many market practitioners complaining that their core problem was securing private investments rather than locating investor demand for such assets. Our mini survey again highlights how alternative assets will continue to take a win in a growing role in shaping the portfolios of Asia’s wealthy.

Active decisions gain sway

This survey is set against a background of the broad body of work that Hubbis constantly conducts in the Asian wealth management industry. Hubbis has also discovered through many of our events and interviews in recent months that active fund management is more appealing today to Asian investors than it has been for the past decade. Why? Because there is so much uncertainty and performance will be far more company or sector-specific than for many years.

In the pre-Covid-19 world of wealth management, there was a growing sentiment that alpha had lost its way, while passive strategies had won the heart and minds of investors. This was largely because in the past decade there was a rising global tide of valuations, almost all assets rising around the world and new valuation norms being applied to justify such heights. However, there appears little doubt henceforth that investors will need to be far more selective in terms of asset classes, sectors and geographies in the foreseeable future, as there will be far greater performance divergence throughout economies, sectors and corporations.

Moreover, the shift towards DPM propositions has no doubt been enhanced and accelerated by the pandemic, as the value in such external assistance, rather than self-directed investing, can be seen more clearly amidst markets that are in disarray.

Advisory and DPM rise

And for those who want to retain a good degree of control on their portfolios, advisory is also rising in importance, as investors more easily acknowledge the value in third-party advice and expertise. Many therefore see a shift towards an independent advisory model, on a semi-discretionary basis; this approach has proved to be relatively more resilient in protecting client portfolios amidst the market volatility, due to no inherent conflicts of interest or aggressive product pushing by banks irrespective of client risk assessments.

This transition to DPM and advisory is no longer simply wishful thinking on behalf of the wealth management providers, as we are indeed seeing a firm albeit gradual shift in Asia away from the dominant self-directed investment approach of wealthy investors and major growth in DPM and advisory. It will take time, but this is a good time to make this transition.

Investing amidst ongoing uncertainty

- Patience is needed – although markets have bounded vigorously from the lows, we might be in a period of false hope and expectation.

- There are numerous uncertainties still out there, from the virus to geopolitics.

- Asset allocation models must be challenged and made fit for the environment ahead.

- Portfolios must be more closely aligned to risk appetite and client objectives.

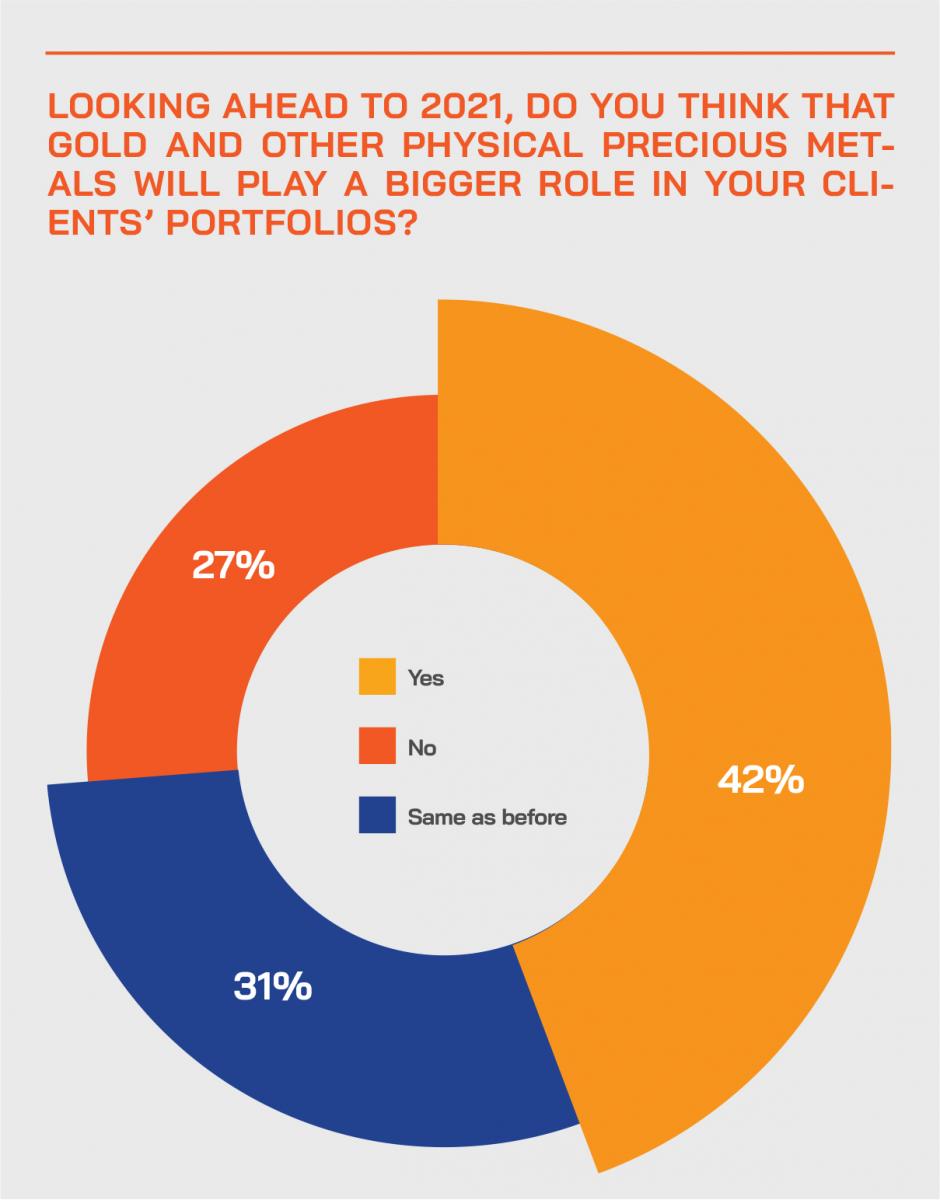

- Precious metals, especially gold, are winning a larger share of high-wealth portfolios.

- ESG investing is valuable as a means of filtering out the highest quality corporations.

- Private assets away from the volatility of public market pricing will gain greater sway.

Seeking non-correlated assets

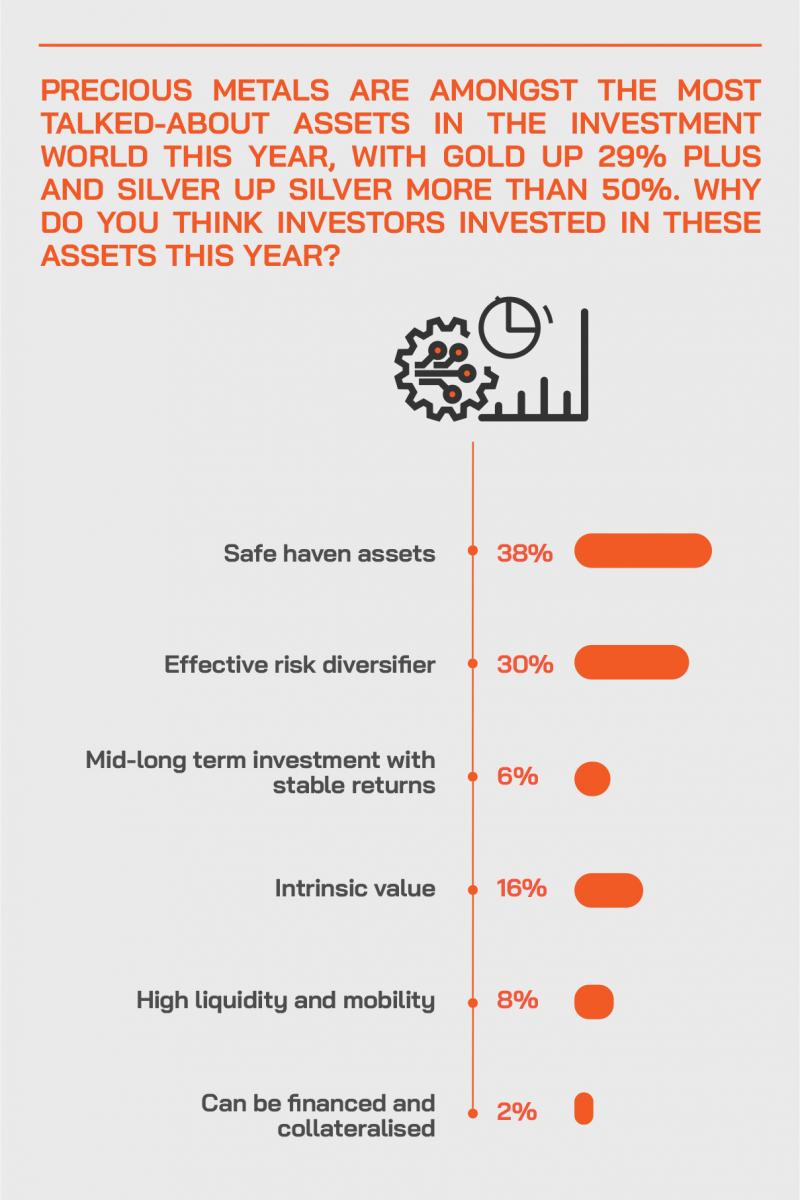

And there is a much more significant emphasis today on assets that are non-correlated to mainstream markets, or at least less so. Gold and other precious metals slot tidily into the basket of alternative investments, and they are also non-financial investments, in that they offer no financial return in terms of yield and defies any traditional valuation metrics, and always have.

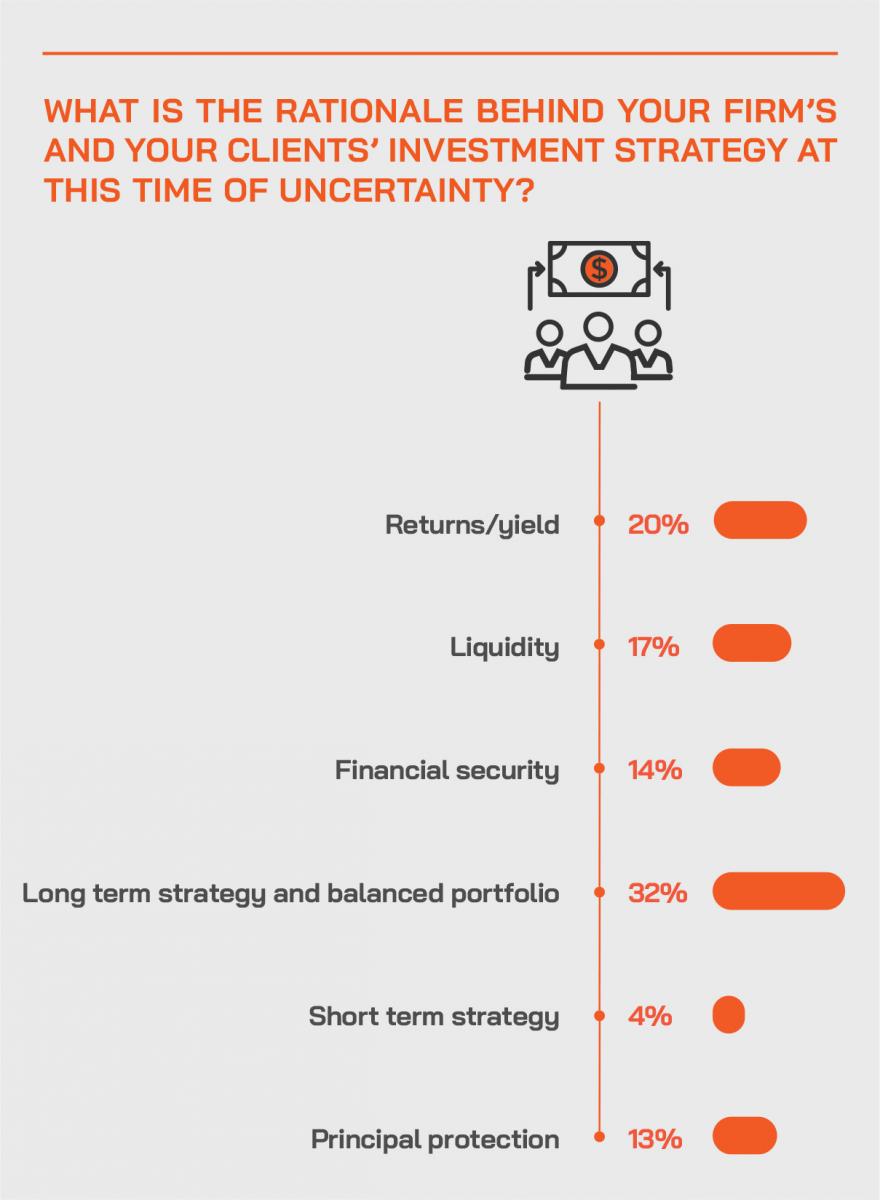

Little surprise then that in our survey we found that respondents from the WM industry in Asia are either seeing or advising a roughly 13% exposure to precious metals, which is considerably higher than the roughly 3% to perhaps as much as 8-9% advised in the past, the higher end of those brackets being in times of great global financial turmoil. In short, 13% is a very high level gauged on a historical perspective.

Go for (real) gold

As to gaining exposure to precious metals as part of this expanded portfolio allocation, the experts and indeed many others who have experienced the benefits, assert, quite rightly we would argue, that physical gold remains the best, most liquid and most appealing safe-haven option for investors seeking non-correlated assets and wanting to build a greater hedge against all types of uncertainties.

These proponents also tend to strongly advise against paper gold, such as ETFs, arguing that ETFs are really a sort of promissory note, although this survey shows that many in the WM industry in Asia are still proposing ETFs or gold-related funds to their clients as the means to pick up these exposures.

However, looking back at April, there was actually a huge disruption in the futures market because if anyone that had traded futures and wanted physical delivery, actually there was no physical gold available. Accordingly, back in April, there was actually an arbitrage of USD80 per ounce which is almost a 5% arbitrage between the gold price in the futures market and the gold price in London at the time, because to fulfil this futures contract on COMEX, the gold had to be shipped from London to New York. Market insiders reported the first half of the year saw huge amounts of gold moving from Switzerland, from Hong Kong from Singapore and from London, over to New York to fill the COMEX vault.

Get to know the market

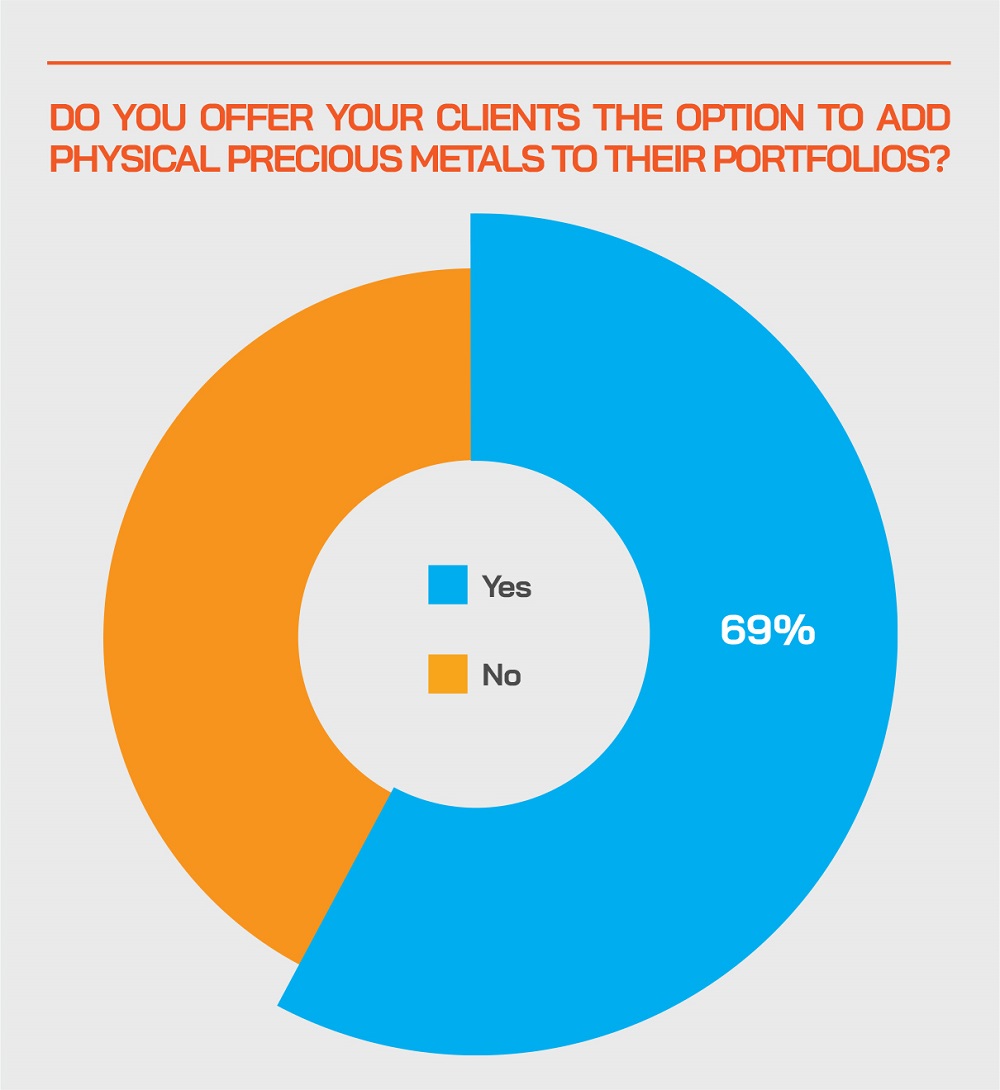

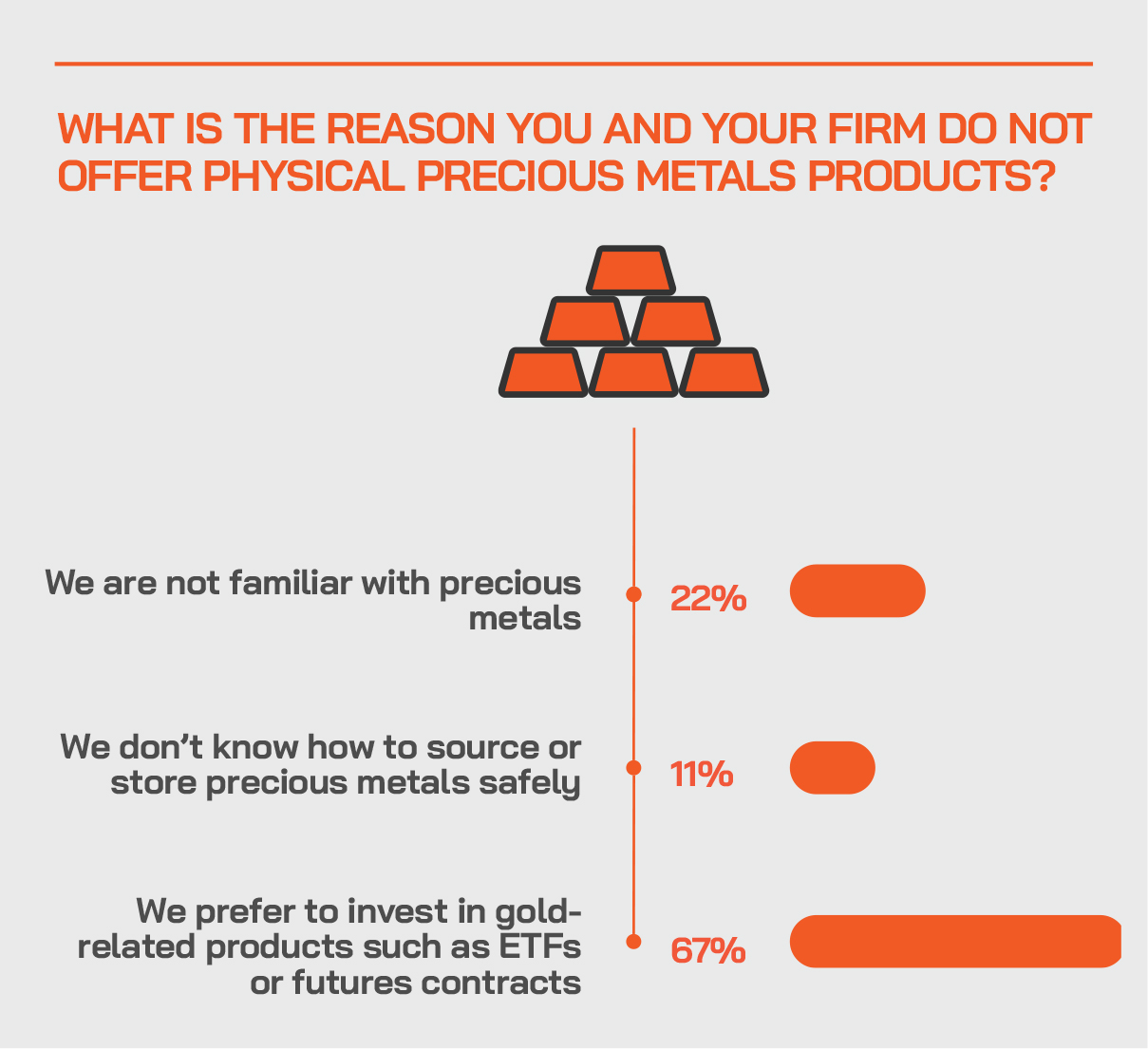

We also see from this survey that the WM industry is sometimes hesitant over gold and other metals because they have little comprehension of how the world of physical metals works. But physical gold is not complex to deal with; there is today a professional, extensive and trustworthy network of bullion dealers, secure vaults, specialist logistics companies, insurers and other parties to ensure that these precious metals are delivered and secured and can then be easily traded.

Although an alternative asset, gold does not suffer from the relative lack of liquidity of many alternatives, whether private equity or even fine art. In fact, gold is immensely liquid and very easy to transact in volume, and gold has a proven track record of remaining incredibly liquid throughout the crises seen in the past decades, indeed centuries. And so too it has been proven again this year.

Still plenty to go for

As to the outlook for precious metals, gold and silver market bulls observe that the world is very far from out of the woods. We are in a recession, uncertainty is greatly elevated, negative yield bonds proliferate, and central bank interest rates in the developed markets are almost zero at the moment or turning negative.

Many also argue that the inflation-adjusted price of gold especially is still relatively low and at the end of the day, even when the pandemic passes, the world will still long suffer the consequences, geopolitical tensions will again take centre stage, possibly even societal unrest, and of course, the very low or negative interest rates are essentially irreversible until the global economies see some resumption of highly robust growth, but that seems a distant, possibly imaginary, hope right now.

Equities, and more broadly risk assets, it would appear, will diminish as a percentage of well-constructed investment portfolios, as the seemingly safer holdings in gold/precious metals and fixed income assets are likely to eclipse new demand for equities. This is in line with the anticipated de-risking of portfolios in the post-pandemic world, at least until a much clearer picture of the shape and timeframe of the anticipated economic recovery emerges. We also know from many past discussions, features and surveys, that private assets will also see rising demand, as investors, especially the wealthier with greater holding power, sacrifice some liquidity for a longer-term strategy that avoids near-term volatility in valuations. At 13% of suggested allocations, precious metals, dominated by gold, would represent a considerably higher portion of a portfolio than in the past, where the norm might have been some between 3% and higher single-digit percentages. As a non-correlated, high liquidity asset that offers a hedge against, inflation, dollar weakness and even deflation, gold is clearly a natural buy, especially as it has been on a multi-year rise as investors worldwide have wanted to hedge increasingly against a feared mainstream asset price collapse and ensuing financial market chaos.

There is no doubt that the ongoing pandemic will require more portfolio rebalancing and conservativism around investment decisions. Most private clients will or at least should take on a more conservative stance keeping ample liquidity. Overall, this more cautious approach will include more hedging, while investors will keep their powder dry for opportunistic investments into sectors which will prove to be resilient in the post-Covid-19 world.

As clients will continue to be confused with the ongoing uncertainty, they will require a lot of information on the risk exposures for various asset classes and will likely also seek more active management and constant updates from their advisors. Though the focus now should be back on long-term goals, with the world so jittery, with the uncertainty surrounding what the new normal is and how long this pandemic will last, and the after-effects and the undercurrents, most clients will require constant feeding of information, and a formulation of their portfolio being adapted into the new normal environment. A core message to be driven home is that such crises do happen, and they happen again and again, and therefore it is vital to be financially fit for the future.

Gold has for millennia been a store of value, providing a natural hedge against global financial markets and volatility in all sorts of asset prices. It is non-correlated to the mainstream asset markets. It is not a financial asset, it has no yield, it is outside the global financial system, and it has proven itself to offer investors who take a medium to long-term view solid returns, in fact since the 1960s, for example, dramatically outperforming cash, and substantially outperforming the major equity indices.

In recent years, gold has been rising steadily, from a recent decade low of around USD1,062 in late 2015 to a shade over USD1950 on November 6. And relative to equities, even after a phenomenal couple of decades from 2000, gold has outperformed.

The S&P 500 Index at the end of 1999 was at 1,458, and an ounce of gold stood at USD290. Today gold is roughly USD1950 and the S&P 500 stands at about 3,550, so gold is up more than 670% while during the same time the S&P 500 is up only just over 243%. That is a remarkable outperformance. Gold is very evidently an excellent medium to long-term hold.

And the worldwide trend amongst HNW and UHNW investors in recent years has been towards alternatives of all types. Gold sits ideally in that basket but unlike many of the main alternatives such as private equity or private debt, offers great liquidity and transparency of pricing.

As to the outlook for gold prices, in particular, the world is in a global recession, except perhaps for China, uncertainty is high, negative yield bonds proliferate, and central bank interest rates in the developed markets are almost zero at the moment or negative. Gold appeals to many investors as a hedge against inflation which many believe to be a real concern given the massive government money printing and stimulus packages around the globe.

Yet despite all these clear signals that gold and perhaps other precious metals should be physical core holdings for wealthy investors – to the tune even of 13% of portfolios – we can see considerable reluctance to engage with clients on physical gold, driven we surmise from the survey by a preference still for paper derivatives, such as ETFs, or from a misunderstanding or lack of knowledge of the physical gold market, its infrastructure and its nuances.

Yet physical gold is not complex to deal with. There is a deep and professional infrastructure available throughout the world and across Asia Pacific nowadays, allowing for completely trustworthy purchasing, storage, insurance and trading as and when required. The precious metals investment industry has nowadays become highly professionalised in Asia, with an outstanding infrastructure of secure storage and logistics service providers, and insurance coverage, with specialists that work in an entirely professional approach with clients who seek to buy, store and sell physical metals, especially gold bullion.

Gold is also highly liquid, with owners able to transact USD10 million or more almost instantly and with very rapid settlement.

The precious metals market itself is monitored by the London Bullion Market Association, which supervises the refiners, the logistics operators, and the entire precious metals ecosystem to ensure it is professional and sound. As long as investors stay within this ecosystem, all will be fine.

This mini survey highlights fairly precisely what Hubbis had imagined in terms of the results. We see major ongoing uncertainty, a far greater need for security, a growing drive towards more ‘new world’ portfolio allocation, and a greater demand for alternative, private and also non-correlated assets. We also learned again that the wealth industry in Asia still takes the relative plain vanilla – and not necessarily advisable – route of directing clients towards gold derivatives, in considerable part because they do not understand how mature the physical bullion markets worldwide and across Asia have now become. With the pandemic still wreaking havoc worldwide, now is an ideal time for the wealth industry across Asia to significantly improve its knowledge of this market, for the benefit of what is a client base that is increasingly receptive to the appeals of gold and other precious metals.

Gold in the Spotlight – Observations in a Time of Crisis from Joshua Rotbart

Joshua Rotbart, Founder and Managing Partner of Hong Kong-based precious metals and bullion firm, J. Rotbart & Co., is passionate about gold, real gold. He knows how throughout history, gold has proven its sustained value time and again, and how the longer someone keeps it, the more it will appreciate. Hubbis has selected some of his opinions and insights here to help explain his approach towards gold and why he believes that investors seeking exposure to gold should be buying bullion, which is immensely liquid and outside the global financial system, and not paper derivatives.

A wonderful five years of opportunity

“For the past five plus years, since founding his business at a remarkably opportune moment, he has been enthusiastically advising the wealth management community in Asia to stock up on gold, and he has been proven correct, as the price has been rising robustly since 2015, and even more vigorously this year. Even before the global Covid-19 pandemic, he had been spreading the word of how the stars were aligned for gold, and why Asia’s HNWIs should keep a significant portion of their wealth in physical gold. He offers some brief comments on why, in a world of exploding government debt, imploding interest rates and collapsing economic fortunes, gold is set to retain its shine for a good long time to come.

Gold is non-correlated and outside the global financial system

“Gold in its physical form is a purely non-correlated asset relative to mainstream financial assets, it is a hedge against inflation and currency depreciation, it can easily be bought, stored and insured outside the global financial system, it is highly liquid and, above all else, it has stood the test of the past several millennia as both a store and an enhancer of value.”

Uncertainty will prevail for some long time to come

“Nouriel Roubini, a well-known and often-quoted financial expert and commentator who rose to great prominence in the global financial crisis of 2008 onwards, has said that as a result of this pandemic, the best economic outcome that anyone can hope for is a recession deeper than that following the 2008 financial crisis, and that given the flailing global policy response so far, the chances of a far worse outcome have been increasing by the day. But remember how strongly gold came into favour after the global financial crisis arrived in 2008. The world’s largest economy, the US, reported its gross domestic product contracted by 32.9% in the second quarter of 2020, and the World Bank reports that this will be the harshest global recession since World War II. But as well as being non-correlated to the financial markets, gold is a proven store of value over millennia, a hedge against dollar weakness and inflation, even disinflation, and an ideal diversification tool.”

Gold bullion is remarkably liquid

“Gold is also remarkably liquid; it is even one of the easiest assets you can sell. Sometimes our private clients do not believe how easy it is to sell, even as much as USD10 million, or more, at one time.

Gold is ideal for wealthy Asian investors

Gold is much loved in Asia, especially as a symbol of wealth adorning husbands, wives, and newly-weds. But Asian investors also increasingly realise that gold offers long-term appreciation, in fact, the last 10 years saw gold appreciate about 5% a year, and it has been doing especially well this year, as fear grips the global economies and markets and gold has a very strong negative correlation to the market, so the deeper the dip is in the market, the better gold performs, as we have been seeing in recent months. When private banks and other wealth managers advise their clients in Asia, they can genuinely report that gold is a great hedge against economic and financial market weaknesses, and also explain that it is a good hedge against some of the domestic currencies of this region, for example, the weaker Philippine peso or Indian rupees. So, in dollar terms for some investors in Asia, gold can perform even better than the headline dollar appreciation.”

There is excellent and highly professional bullion infrastructure nowadays

“Physical gold is not a financial product. It can be held privately and directly by the client, or at secure logistics storage facilities in different countries, and clients can then also have access to it. If clients sell, they can get a same-day settlement as it is highly liquid with excellent infrastructure and a robust ecosystem. It is also outside the global financial system. “But gold is also leverageable, as it is easy to arrange finance against bullion as collateral. Accordingly, owners of gold can retain liquidity for other opportunities, as well as the inherent value of the gold itself.”

Bullion is best, beware the derivatives

“Private clients should always buy physical gold, not paper gold. Even the best gold ETFs are not backed 100% with physical gold, as they use derivatives and other instruments to maintain the daily fluctuations. We therefore strongly urge clients who want to do more than simply speculate on gold prices to buy physical for medium to long term holdings. If the ETFs had to be redeemed, they simply would not have enough gold to cover that. Moreover, real gold is immune from a global financial crisis, as it is not a financial instrument.”

Lower and negative rates make gold even more appealing

“Lower interest rates make gold even more attractive to investors as a non-yielding asset. Before Covid-19 reared its head, the US Federal Reserve lowered interest rates from 2.5% May 2019 to 1.75% by March 2020 and the Fed has since slashed the country’s interest rate to 0%. The UK has cut from 0.75% to 0.1%, meanwhile. Investors across the globe are buying more and more negative yield bonds, in fact negative-yielding sovereign debt stood at USD10.7 trillion even by April, amounting to 18% of the global bond market, and has been rising since.”

Diversification is of immense value at any time and especially in times of uncertainty

“We firmly believe the wealth community should be driving both towards diversification and security for the wealth of their clients. Relationship managers have a great lead into these discussions during times of crisis such as this, as there is so much uncertainty. For example, the fallout for global unemployment seems inevitable, there are fears of the possible arrival of significant inflation or perhaps disinflation or stagflation, the likely proliferation of negative interest rates, the continuing potential logistics/supply-chain disruption, further potential weakness in mainstream financial markets, massive government debt across the globe and further QE, uncertainty about the direction of the US dollar or even worries about fiat currencies per se, the possibility of rising social unrest, the list seems to go on and on. Little surprise then that Bank of America in April predicted that gold could appreciate to USD3,000 by October 2021. It is up almost 30% this year to USD1950, so it is well on its way.”