When glancing by means of information articles about treasured metals costs, you’ll usually come throughout references to the efficiency of varied gold and silver mining inventory indexes, in addition to the change traded funds (ETFs) which can be benchmarked towards these indexes.

Whereas previous timers shall be aware of the XAU and HUI indexes, there at the moment are a plethora of different gold and silver mining firm fairness indexes to deal with, from GDM to IMI, and from indexes maintained by MSCI, to indexes calculated by MVIS, Solactive, and Prime, to call however a number of.

And with the gold and silver mining sector probably benefitting from renewed curiosity in commodities / laborious property, in addition to the shares on this sector being leveraged to any gold and silver worth upside, now’s nearly as good a time as any to brush up on what these indexes are all about. By the way, many individuals mightn’t know that I used to at one time handle fairness portfolios at Dimensional Fund Advisors (DFA), so I’m aware of passive funds and their indexes and issue investing.

A notice about terminology. On this planet of economic markets, it’s right to discuss with the plural of index as both indices or indexes, so for consistency, one should be chosen, and on this event, I’ve chosen to make use of ‘indexes’. However ‘indices’ is equally right. See here on the NASDAQ web site for a dialogue of this indexes vs indices problem.

One other notice about indexes vs funds and ETFs. Generally within the monetary markets, an index supplier or a financial institution decides to create an index (fairness index, bond index, commodity index or no matter) as they assume will probably be helpful for capturing the efficiency of a sector or a set of issue returns, and following this, varied funds or ETFs, in a type of pure evolutionary approach, may begin to use that index as a efficiency benchmark.

Different occasions, particularly extra just lately, the creators of a fund or ETF that’s about to be launched will resolve to create a customized index towards which to benchmark that new fund or ETF. This might be as to cut back monitoring error, but in addition in order to keep away from utilizing a widely known index which may make their fund / ETF efficiency look worse. Additionally they may argue {that a} new index is extra ‘investable’ for his or her fund than a longtime index.

So on the planet of economic indexes, it’s typically a hen and egg scenario, i.e. which got here first, the Index or the ETF?

HUI – Gold BUGS

The HUI was launched in December 1996 by the American Inventory Change (AMEX) because the AMEX Gold BUGS Index. BUGS is an acronym for – Basket of Unhedged Gold Shares. Because the identify suggests, the index was launched to seize and monitor the efficiency of the fairness shares of a bunch of listed gold mining firms which don’t hedge their manufacturing (technically it’s gold miners who don’t hedge their manufacturing past 18 months). Notably, the HUI doesn’t embrace silver mining shares.

You may see an previous archived web page from the AMX web site from 1997 here. In 2008, when NYSE Euronext took over AMEX, the AMEX Gold BUGS Index modified possession to the NYSE and adjusted identify to the NYSE Arca Gold BUGS Index. Observe, the ‘Arca’ comes from the truth that the NYSE acquired the Archipelago exchange in 2006 and fashioned NYSE Arca.

The HUI index is now owned by the Intercontinental Change (ICE), after ICE took over NYSE Euronext in 2013.

So at present, HUI is owned by ICE, and often known as the NYSE Arca Gold BUGS Index. As per its authentic remit, at present HUI makes an attempt to “monitor the efficiency of firms concerned within the mining of gold ore that don’t hedge their manufacturing past 1.5 years.

” What the HUI is attempting to do right here is to ensure that the gold miners that it contains have publicity to close time period actions within the gold worth.The HUI is a ‘modified equally weighted’ index, its eligible securities are restricted to US listed shares or American Depository Receipts (ADRs), and the index has quarterly reconstitutions (i.e 4 occasions a yr firms will be kicked out or added to the index). ‘Modified equally weighted’ right here implies that all eligible shares are ranked excessive to low by free-float market cap (MCAP) after which the 2 largest get a 15% weighting every, the third largest will get a ten% weighting, and all the remaining share the remaining 60% of the weighting equally.

HUI guidelines and methodology will be seen here.

Again within the Nineteen Nineties there have been about 18 gold mining shares within the HUI. In the present day, there are 24. The parts will be seen in XLS format here. All the large and well-known names are parts within the HUI reminiscent of Newmont, Barrick, Franco Nevada, Gold Fields, Concord, Eldorado, Royal Gold, Agnico, and many others. and many others.

XAU – From Philadelphia

The opposite ‘well-known’ treasured metals mining inventory index is the XAU, which is formally referred to as the Philadelphia Gold and Silver Index. As per the identify, this index was created by the Philadelphia Inventory Change (PHLX). Nevertheless, in 2007, NASDAQ acquired PHLX, and in addition the identical yr NASDQAQ merged with OMX. So now the PHLX is known as NASDAQ OMX PHLX. You may see an previous imprint of the PHLX web site here from 2007 which lists the XAU as one of many tickers on the left hand body.

XAU was launched in January 1979, so has been round for a powerful 43 years to this point. XAU is a modified capitalization weighted index, and because the identify “Philadelphia Gold and Silver Index” suggests, its parts are drawn from the equities of change listed gold and silver mining firms. There are presently 30 gold and silver mining firm shares within the XAU, an inventory of which will be seen here.

Eligible securities for inclusion in XAU are principally frequent equities and ADRs, and securities must be listed on one in all 4 US based mostly exchanges, particularly NASDAQ, NYSE, NYSE American or CBOE BZX Change (BZX = formally BATS). The minimal market cap (MCAP) of a inventory for potential inclusion in XAU is not less than US$ 100 million. XAU is rebalanced 4 occasions a yr in March, June, September and December.

As a consequence of a few of the treasured metals miners having very massive MCAPs and to forestall then dominating the index, the XAU has a bunch of guidelines to restrict the utmost weight of a element, and the weighting calculations iterate by means of varied phases beginning with 1) get the load of every element by dividing its MCAP by the mixed MCAP of all of the parts, after which 2) restrict the 5 largest names to a max weighting of 8% every and all different parts to a max 4% weighting every.

Past this, there are an entire lot extra parameters and guidelines round capping the element weights. For these , the index development methodology of the XAU will be seen here.

Well-known element shares of the XAU embrace massive and medium sized gold miners reminiscent of Barrick, Eldorado, Concord, Newmont, Gold Fields, Seabridge, AngloGold Ashanti, and Kinross, and the massive major silver miners reminiscent of First Majestic, Hecla, Coeur, and Pan American. Mainly the XAU is a who’s who of all of the very well-known gold and silver miners which have listings on US exchanges.

I first got here throughout the HUI and XAU in about 2001 after the web inventory bubble had burst and when gold and silver mining shares have been starting to take off. I keep in mind again then studying commentary and charts concerning the HUI and XAU from Adam Hamilton at ZEAL.

Past HUI and XAU there are various different treasured metals indices. Let’s have a look.

NYSE Arca Gold Miners Index

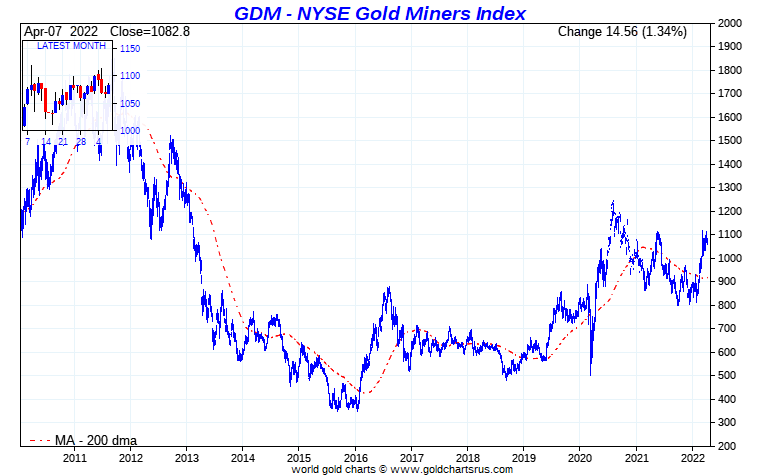

Many readers shall be aware of the large Van Eck Gold Miners ETF (ticker GDX), an ETF which has property of about US$ 15.3 billion.

GDX is an index tracker and goals to trace the efficiency of an index referred to as the NYSE Arca Gold Miners Index (GDM), or within the phrases of Van Eck, GDX “seeks to duplicate as intently as potential, earlier than charges and bills, the value and yield efficiency of the NYSE Arca Gold Miners Index”.

Just like the NYSE Arca Gold BUGS Index (HUI), the NYSE Arca Gold Miners Index is owned and maintained by Intercontinental Change (ICE), particularly ICE Information Indices.

The NYSE Arca Gold Miners Index (whose ticker is GDMNTR however we’ll name it GDM) measures the efficiency of the publicly listed fairness (shares) of the ‘bigger’ capitalization major gold and silver mining firms worldwide (principally miners however some streamers). So GDM is a world index. The GDM methodology doc refers back to the eligible universe of potential index parts as ‘highly-capitalised’ gold and silver miners, and it units a minimal MCAP of $750 million (not free float adjusted) for any inventory to be eligible for inclusion within the index, in addition to varied common day by day buying and selling metric minimums. Eligible securities of GDM embrace frequent fairness, ADRs, and International Depository Receipts (GDRs) listed on US or Canadian exchanges.

GDM presently has 56 element shares from the very massive reminiscent of Newmont, Barrick Franco-Nevada, Newcrest, Kirkland Lake, and Goldfields, right down to mining firms with the smallest index weights reminiscent of Westgold Assets and Argonaut Gold. All the massive North American listed major silver mining firms reminiscent of First Majestic, Hecla, Coeur and Pan American are additionally parts of GDM.

The index is a modified market cap weighted index and has a algorithm to attempt to restrict the weights of the very massive gold miners, in order to forestall them dominating the index and to offer extra diversification potential among the many different parts.

Nonetheless, Canadian listed firms dominate the nation weightings with a whopping 43%, highlighting the powerhouse which is the Canadian listed useful resource sector. That is adopted by the US, with a 20% weighting and Australia with a 13% weight. Collectively the highest 10 holdings of the index characterize over 60% of the entire weight, that means that the value actions of those handful of main gold mining firms may have a really massive affect on the index and the GDX ETF.

Whereas the GDM index has an inception date of 1 October 2004, the Van Eck Gold Miners ETF (ticker GDX) was launched in May 2006, and it might have been the case that the GDM index (NYSE Arca Gold Miners Index) was created particularly for the Van Eck GDX ETF to trace it, however that it was calculated again to 2004 simply to offer index knowledge for GDX to align with.

The NYSE Arca Gold Miners Index methodology doc will be seen here.

MVIS International Junior Gold Miners Index

Staying with the ETF supplier Van Eck, Van Eck additionally provides a widely known ETF referred to as the “VanEck Junior Gold Miners ETF (GDXJ)”, which tracks an index referred to as that “MVIS International Junior Gold Miners Index”. GDXJ has property of about US$ 5 billion.

Van Eck says that GDXJ “invests within the shares of small gold miners, a few of that are within the early phases of exploration”. So it contains each treasured metals producers and explorers. Greater than 50% of the shares in GDJX are categorized as ‘Canadian’ (i.e. GDXJ holds the Canadian line of the inventory), a reality which highlights the powerhouse of the Canadian useful resource sector. The second highest nation focus is Australia, making up 17% nation weighting.

The MVIS International Junior Gold Miners Index has a ticker MVGDXJTR – the TR that means Complete Return. Let’s name it “MV GDXJ”.

The GDXJ ETF was launched in November 2009, and the MVIS International Junior Gold Miners Index has an inception date of 31 August 2009, so this appears to be like like a transparent case of the index having been created particularly for the Van Eck GDXJ ETF to trace.

The MVIS International Junior Gold Miners Index is calculated and maintained by a German firm referred to as MV Index Options, whose head workplace is in Frankfurt, and which is an entirely owned subsidiary of Van Eck. By the way, Van Eck’s European headquarters can be in Frankfurt.

On its web site, MVIS says that the MVIS International Junior Gold Miners Index “tracks the efficiency of probably the most liquid small-cap firms within the world gold and silver mining industries”.

“MV GDXJ” is a “modified market cap-weighted index”, and “solely contains firms that make investments primarily in gold or silver, generate not less than 50% of their income from gold or silver mining”. The minimal MCAP for inclusion within the index is a gold or silver miner with a market cap of not less than US$ 150 million and there are additionally varied buying and selling liquidity minimums for eligibility. The index is rebalanced quarterly, and presently has 97 gold and silver miner inventory parts, which will be seen here. The max weight per inventory element is capped at 8% and the most important weights presently are in Pan American Silver (5.52%), Yamana Gold (5.21%) and Evolution Mining (5.13%).

With each GDX and GDXJ well-liked amongst treasured metals buyers who additionally need publicity to the gold and silver mining sector, its good to not less than know what GDX and GDXJ are investing in.

Solactive Indexes

Subsequent up is the Solactive Gold Miners Customized Elements Index. Solactive is a German monetary index supplier, and like MVIS, it’s headquartered in Frankfurt. If you happen to haven’t heard of Solactive or the Solactive Gold Miners Customized Elements Index, you in all probability have heard of the Sprott Gold Miners Change Traded Fund (ticker SGDM) which tracks the Solactive Gold Miners Customized Elements Index.

In line with Sprott, the Solactive Gold Miners Customized Elements Index (ticker (ticker SOLGMCFT however let’s name it SOLGM) “goals to trace the efficiency of larger-sized gold firms whose shares are listed on Canadian and main U.S. exchanges.”

In line with Solactive, the SOLGM index aims to “monitor the value actions of a portfolio of gold mining firms, which can be weighted based on a rules-driven mannequin the place gold mining firms with robust elementary knowledge are rewarded and these with weak elementary knowledge are penalized.”

Right here’s a latest pdf reality sheet for the SOLGM index here. Because the identify suggests, this index solely comprises gold mining firms and never major silver miners. There are 33 names within the index proper now, the most important weights being Barrick and Newmont (each with 13% weights), adopted by Franco Nevada (10%), Wheaton, Royal Gold, Yamana, and Agnico, which in complete characterize about 58% of the entire weight of the index.

Sprott says that SGDM and the index SOLGM keep in mind ‘Elements that Matter’ which have been collectively designed by Sprott and Solactive and which seem like a proprietary approach of tweaking the inventory choice and weights of the gold mining shares with an overlayed multi-factor strategy. Classical Eugene Fama and Ken French elements are things like dimension (small vs massive) , worth (progress vs worth) and typically momentum, and whereas Sprott doesn’t discuss an excessive amount of about what elements it takes into consideration, it does say that its “custom-made elements are chosen as a result of they’ve traditionally confirmed to be robust predictors of inventory efficiency, and embrace elementary metrics reminiscent of income progress, long-term debt-to-equity and worth momentum.”

In a short time, there may be additionally a Solactive Junior Gold Miners Custom Factors Index (ticker SOLJGMFT) which one other Sprott ETF, referred to as the Sprott Junior Gold Miners ETF (SGDJ) tracks. This index goals to trace “the efficiency of small-capitalization gold firms whose shares are listed on regulated exchanges”, and targets shares with an MCAP vary of between US$ 200 million and US$ 2 billion. Just like the Solactive massive cap gold miner ETF, the junior model additionally overlays an element strategy on things like income progress and worth momentum.

There are presently 37 shares within the SGDJ, and curiously, about 39% of the element shares are Australian juniors, about 39% are Canadian listed juniors, and about 13% are UK listed juniors. The biggest parts of the index are Aurelia Metals (Aus), Pan African Assets (UK), Skeena Assets (Can), Eldorado Gold (Can), Wesdome Gold Mines (Can) and Westgold Assets (Aus). A latest pdf factsheet for the index will be seen here.

Conclusion

The above provides a fast rundown on the well-known HUI and XAU, in addition to the indexes (NYSE Arca and MVIS) behind the Van Eck GDX and GDXJ ETFs, and the Solactive indexes behind the Sprott gold miners and gold junior minors ETFs.

Whereas that’s fairly sufficient indexes to soak up in a single go, there are loads extra, so half 2 of this text will take a look at a number of such because the MSCI ACWI Choose Gold Miners Investable Market Index, the US International GO GOLD and Treasured Steel Miners Index, the Barron’s Gold Mining Index (BGMI), and possibly some nation particular treasured metals mining indexes reminiscent of on Canada’s TSX, South Africa’s JSE and the Aussie ASX.

For the silver surfers and silver foxes, Half 2 may even take a look at some silver mining indexes from Prime (Prime Junior Silver Miners & Explorers Index), Solactive (Solactive International Silver Miners Index) and MSCI (MSCI ACWI Choose Silver Miners IMI Index).

Half 2 may even take a look at the truth that investing in treasured metals mining shares or gold and silver mining ETFs will not be the identical as holding the bodily treasured metals, and that even when you diversify away inventory particular danger by holdings a basket of treasured metals mining shares, you’re nonetheless left with the sectoral danger. However that is probably not a nasty factor, when you consider that gold and silver costs are going to go rather a lot greater.

If anybody has solutions of different gold and silver mining indexes to incorporate in Half 2, please add a suggestion within the Disqus feedback under.