The Essential Investor appears right into a junior that’s buying and selling at all-time lows in the meanwhile and may very well be an attention-grabbing alternative.

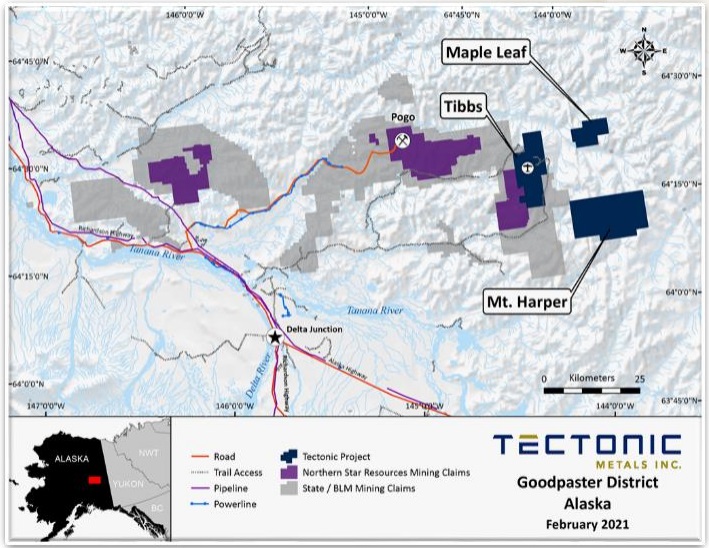

Hardly ever do you get the chance to spend money on a junior at all-time low ranges in the beginning of what is perhaps a brand new bull market, with a administration staff that has been on the core of success story Kaminak Gold Corp. (acquired for CA$520M by Goldcorp, now Newmont Corp. [NEM:NYSE], in 2016). Tectonic Metals Inc. (TECT:TSX.V; TETOF:OTCQB) is backed by numerous blue-chip traders together with Crescat Capital (suggested by well-known Quinton Hennigh), which has been accumulating available in the market lately, pushing their share possession degree to effectively over 10%, making it the corporate’s second largest shareholder. Sitting at first is Doyon, one in every of Alaska’s main Native Regional Firms and largest landholder within the state. By working intently with Doyon, Tectonic has taken ESG to an entire new degree, garnering media and trade consideration.

Tectonic owns and explores three tasks in Alaska that might every be capable of emulate and even surpass the mineral endowments of Kaminak’s Espresso gold challenge on a stand-alone foundation. Eira Thomas, Rob Carpenter, Curt Freeman, and Tony Reda based Tectonic privately in 2017, and listed the corporate in September 2019 on the Toronto Enterprise Alternate. Tectonic raised roughly CA$20M in whole over time, spending most of it on exploration, adopted by challenge era and acquisition, and regardless of some spectacular sampling and drill outcomes, for no matter purpose traders have been reluctant to reward the corporate’s progress within the open market. On the contrary, each financing accomplished by Tectonic has been oversubscribed, attracting a few of the finest useful resource funds the house has to supply. COVID-19, the Russia-Ukraine battle, different adverse worldly affairs, and one thing of a malaise within the junior mining sector hasn’t helped their trigger both. Buying and selling at all-time lows now, even beneath the founders value base, Tectonic presents a pretty worth proposition for my part. The corporate is likely one of the few juniors sensible sufficient to safe a drill rig final 12 months and is now within the strategy of formalizing exploration plans, which if profitable will hopefully place the corporate for a big re-rating, additionally higher reflecting the caliber of its administration and tasks.

Native, Capital Backing

Tectonic Metals is a mineral exploration firm backed by one in every of Alaska’s largest Native Regional Firms (Doyon) and complicated, extremely regarded useful resource funds (for instance Crescat Capital). Tectonic is concentrated on the acquisition, exploration, discovery, and growth of mineral sources from district-scale tasks in politically secure jurisdictions.

Tectonic Metals is operated by an skilled and well-respected technical and monetary staff with a observe report of wealth creation for shareholders, as key members of the Tectonic staff have been concerned with Kaminak Gold, elevating CA$165M to fund the acquisition, discovery, and development of the Espresso Gold Venture within the Yukon Territory by to the completion of a bankable feasibility research, earlier than promoting the 5Moz gold challenge to Goldcorp (now Newmont) for CA$520M in 2016. Key folks inside Tectonic are founder, President and Chief Government Officer Tony Reda, Strategic Advisor and co-founder Eira Thomas, Chair Allison Rippin Armstrong and up to date addition Peter Kleespies, vice chairman of exploration.

Reda was the VP of company growth for Kaminak, an organization the place he principally labored for his whole profession from 2005 to 2016 till the buyout. He was instrumental in elevating CA$165M, arranging the JV’s/strategic alliances, and overseeing IR and advertising and marketing at a excessive degree, as Kaminak was chosen as one in every of 4 out of 1,971 TSX Enterprise corporations as Greatest IR by IR Journal in 2015. He places his cash the place his mouth is, as he owns 4.47M shares of Tectonic himself, and invests all his time and vitality into making the corporate successful.

Mining Legend and strategic advisor Eira Thomas was the president and chief govt officer of Kaminak from 2013 till the buyout. Eira comes from a prolific mining household, as her father Grenville Thomas is a Canadian Mining Corridor of Famer, as he and Eira found Canada’s second largest diamond mine, Diavik. Eira, together with mining titan Lukas Lundin and well-known former colleague Catherine McLeod Seltzer, based and leads (since 2018) Lucara Diamond Corp. (LUC:TSX.V) as chief govt officer.

Chair Allison Rippin Armstrong is an trade legend in her personal proper, as she has over 25 years of expertise in allowing, regulatory processes, and environmental compliance, working with Indigenous organizations, useful resource corporations, regulatory businesses, and indigenous, territorial, and federal governments. She served because the vice chairman of sustainability at Kaminak till it was acquired by Goldcorp in 2016. She additionally served on the board of Yukon Ladies in Mining as vice chairman for 3 years, is a founding member of the Yukon College Basis Board and has served on NWT and Nunavut Chambers of Mines in addition to numerous working teams for the PDAC, and has received quite a few awards in associated fields.

Vice President of Exploration Peter Kleespies was concerned with the invention and delineation of a number of giant deposits, amongst these the 8.5Moz Au Hope Bay deposit in Nunavut that was bought to Newmont for $1.5B in 2007. Peter has over 30 years of technical and administration expertise in mineral exploration masking North and South America, Australia, and Africa.

Curt Freeman, who additionally co-founded Tectonic and serves as director, brings over 40 years of expertise and is taken into account to be one of many main geologists in Alaska and the Yukon. As well as, Tectonic’s board is lucky to incorporate Mick Roper, one other veteran geologist with 40 years of trade expertise, most lately with Agnico Eagle. Each of those administrators present invaluable insights and contributions to Tectonic’s exploration packages.

Regardless of its robust staff, tasks and present excessive metallic costs, it appears just like the Tectonic share worth is bottoming now. With the present excessive inflation atmosphere, the adverse actual charges, being the primary (at the very least for me) sentiment driver for gold, appear stronger than ever, so it appears just like the gold worth appears set for a transfer even greater quickly. A rising tide actually helps with lifting all boats normally.

Some primary data on share construction: Tectonic Metals has a 161.68M shares excellent, and trades at a mean every day quantity of 317,926k shares. There are 61M warrants (with virtually half expiring earlier than the tip of June 2022 and the remaining warrants priced at C$0.17, expiring in June 2023,) and solely 1M choices (400k at CA$0.33 expiring in July 2025, 400k at CA$0.20 expiring in August 2026), so the totally diluted quantity stands at 223.69M in the meanwhile. Administration and BoD have plenty of pores and skin within the sport as they maintain 17%, Doyon holds 15%, and numerous resource-focused funds (for instance Crescat Capital) maintain 31%.

The money place is estimated at CA$1M, with no debt, and administration is seeking to elevate extra quickly. The present share worth is CA$0.06, leading to a present, tiny market cap of CA$9.7M, and due to folks, tasks, backing, and bullish metallic sentiment, I imagine this little junior might simply develop into a multi-bagger with the best drill outcomes. Let’s take a look at their tasks to see why I imagine this sort of potential may very well be there.

Specializing in Alaska

Tectonic Metals designed a challenge portfolio primarily based on numerous standards, coupled with a complete exploration technique. They’re specializing in Alaska now. As 52.3% of its land is open for declare staking, it has at all times ranked as a prime mining jurisdiction (13 out of 77 for Coverage Notion Index, indicating mining-friendly insurance policies, in accordance with the Fraser Survey of Mining Firms), and has seven producing mines (Pogo, Fort Knox, and so forth.).

For dimension, Tectonic is aiming at district-scale tasks, which have the potential to generate multi-million ounce deposits. For ESG, they raised the bar much more by positioning Rippin Armstrong as chair, and purpose at working along with First Nations very intently, as is illustrated by their agreements with Doyon, a top-tier Alaska Native Regional Company. For infrastructure, they’re on the lookout for well-established infrastructure and close by operations. For mineralization, they’re taking a look at giant scale, close to floor, good restoration kind of tasks, ideally gold.

Administration outlined an intensive exploration technique, together with most well-known strategies, to optimize one of the best targets.

- Their geological strategy serves to outline the floor geology, and is finished by mapping and trenching.

- Their geochemical strategy is constructed across the evaluation of geological supplies, by sampling goal metals and pathfinder components for big areas to ascertain mineral potential.

- Their geophysical strategy appears for mineral potential sub-surface, by doing all types of surveys (IP/EM, airborne, for magnetic, conductivity, radioactivity, density).

- Drilling, to ascertain precise mineralization, through the use of three strategies so as of accuracy: rotary air blast (RAB), reverse circulation (RC) and diamond drilling (DD).

This all resulted within the present portfolio of three giant exploration tasks in Alaska: Tibbs, SeventyMile and Flat, all acquired from Doyon.

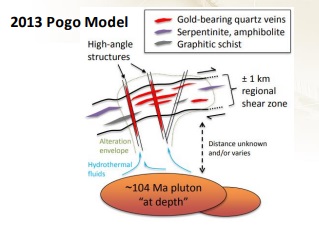

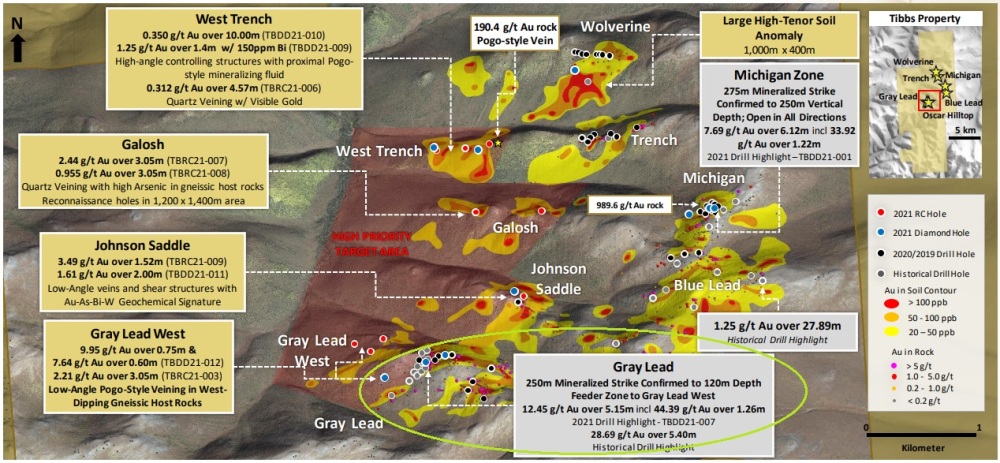

Tectonic’s totally owned flagship is the Tibbs challenge, masking 29,280 acres, 35km east of the 200koz Au each year Pogo Mine. Excessive-grade gold mineralization at Tibbs happens in steeply dipping veins, crossing a number of decrease grade low-angle veins much like the Pogo Mine, which serves as an analogy.

The Tibbs property is near current infrastructure and an lively mill, and has seen plenty of exploration, starting from sampling, airborne geophysical surveys, trenching to drilling. Drill highlights are 28.95m at 6 g/t Au, 5.3m at 15.7 g/t Au, 5.7m at 19.1 g/t Au, 1m at 104.5 g/t Au, and 5.1m at 12.45 g/t Au. These are very substantial outcomes, and probably the most spectacular drill outcomes have been obtained on the Grey Lead space:

Part 2 drilling already established a 1000m by 350m mineralized zone, the place nearly all of drill outcomes returned grades over 5 g/t Au, and inside this excessive grade, steeply dipping veins with grades as much as 127 g/t Au. It’s nonetheless early days, but when we’d guesstimate a mineralized envelope of 1000m by 350m by 5m by 2.75t/m3 density, this could lead to 4.8Mt, and at a mean grade of say 5 g/t this might already lead to a hypothetical 770koz Au. And remember the fact that that is solely a small a part of the complete challenge. Under the Grey Lead goal, one other goal space is situated: the Denims Ridge prospect, the place profitable sampling as much as 50.3 g/t established a 450m lengthy gold-in-soil anomaly.

In response to administration, a serious growth of the 2021 Part 2 drilling program that seems to have been largely ignored by the market was the invention of 4 stacked low-angle veins at Grey Lead West. That is important as a result of the lacking piece of the puzzle obligatory to verify Tibbs as a real Pogo analog was a low-angled vein that had beforehand confirmed elusive at Tibbs. This issues as a result of the Pogo mine discovery was itself hosted in a low-angle vein. Tibbs now displays all the components of the “Pogo Exploration Mannequin.” The subsequent step for Tectonic might be to find out whether or not these low-angle veins exhibit the identical swelling or widening tendency as seen at Pogo’s East Deep goal.

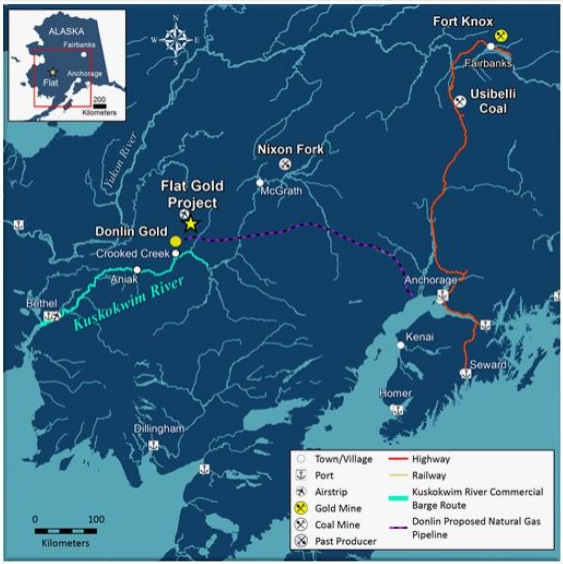

The 100%-owned Flat gold challenge is Tectonic’s newest challenge acquisition and is situated 40km north from the 45Moz Au Donlin Gold challenge, collectively owned and operated by Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT). Flat gold consists of 92,160 acres of Native-owned land (Doyon) accessible by air with its 4,100-foot airstrip, which might accommodate a Hercules plane, and as soon as on web site, there’s a community of roads and trails, and supplies might be barged to and from by way of a commercially navigable close by river.

The 2 essential goal areas are Rooster Mountain and Black Creek/Golden Horn. Mineralization is hosted in veins and disseminated sedimentary and volcanic rocks, much like Fort Knox (Kinross) and Eagle (Victoria Gold), and historic drilling from 1997 returned attention-grabbing highlights, like 24.7m at 12.5 g/t Au, 36.6m at 1.36 g/t Au, and 31.7m at 1.28 g/t Au.

When speaking to CEO Reda, he acquired so captivated with Flat that it appeared he and his staff even have the largest hopes for this challenge. There are a number of causes for this. For starters, Flat is situated within the fourth largest placer mining district in Alaska and has a historical past courting again to 1908. Extra lately the property was explored by corporations like Fairbanks Gold (based and financed by Robert Friedland), and has 11,000 meters of diamond and RC drilling into it. The primary goal, Rooster Mountain, hosts a sturdy 4km lengthy gold-in-soil anomaly the place drilling indicated gold mineralization over a kilometer, and is the possible supply of nearly all of the historic 1.4Moz of placer gold mined within the space. Historic metallurgical knowledge means that the gold at Flat may very well be free milling in addition to having untested oxide potential. Tectonic is taking steps to verify each traits and finally the potential for heap leaching on the web site.

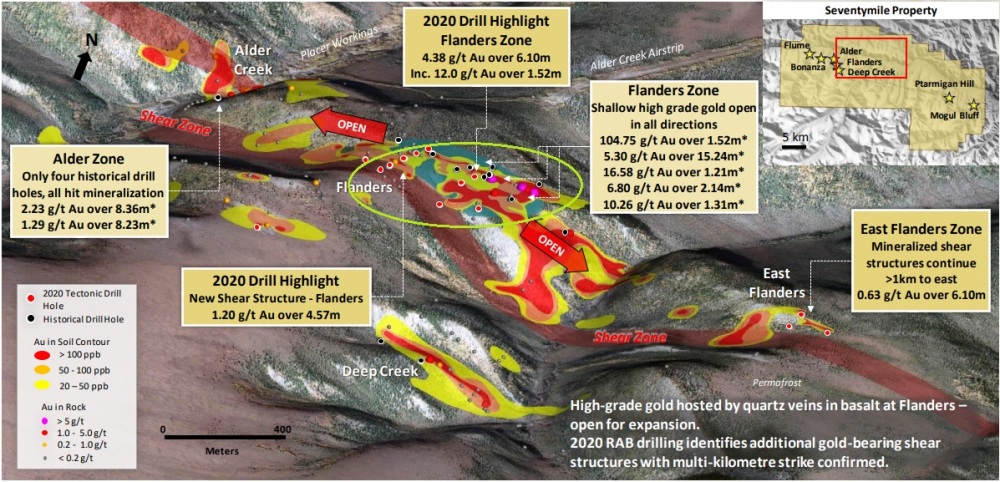

Tectonic’s third challenge is the Seventymile challenge, a part of an underexplored, totally owned 40km lengthy Greenstone belt, situated 270km east of Fairbanks, Alaska. The property is simply accessible by air (small plane and helicopter), and within the winter by a winter path.

Seventymile is an orogenic gold system, with lode-style excessive grade quartz mineralization occurring in shear zones and faults. Drilling highlights are 5.5 g/t Au over 15.0m, 1.1m at 205.9 g/t Au, 6.1m at 2 g/t Au, 19.8m at 1.37 g/t Au, and 6.1m at 4.38 g/t Au.

On a closing word, exploration packages are mentioned in the meanwhile between administration and their technical staff, and might be introduced quickly, as are the plans for an upcoming, obligatory financing.

Conclusion

At a present market cap of simply C$9.7M, proudly owning three very attention-grabbing gold tasks with district potential and a formidable, well-known staff on the helm, backed by Alaskan natives and a roster of revered shareholders, Tectonic presents a pretty worth proposition. The corporate is within the midst of formalizing its exploration plans and planning a elevate, probably turning 2022 right into a pivotal 12 months for Tectonic Metals, with a number of probabilities at giant scale discoveries, which might result in a considerable re-rating.

I hope you’ll discover this text attention-grabbing and helpful, and could have additional curiosity in my upcoming articles on mining. To by no means miss a factor, please subscribe to my free e-newsletter at www.criticalinvestor.eu, as a way to get an e-mail discover of my new articles quickly after they’re printed.

This text can be printed on www.criticalinvestor.eu. To by no means miss a factor, please subscribe to my free e-newsletter, as a way to get an e-mail discover of my new articles quickly after they’re printed.

All offered tables are my very own materials, until said in any other case.

All footage are firm materials, until said in any other case.

All currencies are in US {Dollars}, until said in any other case.

Please word: the views, opinions, estimates, forecasts or predictions relating to Tectonic’s useful resource potential are these of the writer alone and don’t signify views, opinions, estimates, forecasts or predictions of Tectonic or Tectonic’s administration. Tectonic Metals has not in any method endorsed the views, opinions, estimates, forecasts or predictions supplied by the writer.

The Critical Investor is a e-newsletter and complete junior mining platform, offering evaluation, weblog and newsfeed and all types of details about junior mining. The editor is an avid and significant junior mining inventory investor from The Netherlands, with an MSc background in building/challenge administration. Quantity cruncher at challenge economics, on the lookout for high-quality corporations, principally progress/turnaround/catalyst-driven to keep away from an excessive amount of dependence/affect of long-term commodity pricing/market sentiments, and sometimes on the lookout for long-term deep worth. Getting burned up to now himself at junior mining investments by following overly optimistic sources that most of the time prevented to say (hidden) dangers or crucial flaws, The Essential Investor discovered his lesson effectively, and goes just a few steps additional ever since, offering a recent, extra in-depth, and significant imaginative and prescient on issues, therefore the title.

The writer shouldn’t be a registered funding advisor, and has a protracted place on this inventory. Tectonic Metals is a sponsoring firm. All details are to be checked by the reader. For extra data go to www.tectonicmetals.com and browse the corporate’s profile and official paperwork on www.sedar.com, additionally for vital danger disclosures. This text is supplied for data functions solely, and isn’t supposed to be funding recommendation of any sort, and all readers are inspired to do their very own due diligence, and speak to their very own licensed funding advisors prior to creating any funding choices.

[NLINSERT]

Streetwise Stories Disclosures

1) The Essential Investor’s disclosures are listed above.

2) The next corporations talked about within the article are sponsors of Streetwise Stories: None. Click on here for vital disclosures about sponsor charges. The data supplied above is for informational functions solely and isn’t a advice to purchase or promote any safety.

3) Statements and opinions expressed are the opinions of the writer and never of Streetwise Stories or its officers. The writer is wholly accountable for the validity of the statements. The writer was not paid by Streetwise Stories for this text. Streetwise Stories was not paid by the writer to publish or syndicate this text. Streetwise Stories requires contributing authors to reveal any shareholdings in, or financial relationships with, corporations that they write about. Streetwise Stories depends upon the authors to precisely present this data and Streetwise Stories has no technique of verifying its accuracy.

4) The article doesn’t represent funding recommendation. Every reader is inspired to seek the advice of along with his or her particular person monetary skilled and any motion a reader takes on account of data offered right here is his or her personal accountability. By opening this web page, every reader accepts and agrees to Streetwise Stories’ phrases of use and full authorized disclaimer. This text shouldn’t be a solicitation for funding. Streetwise Stories doesn’t render common or particular funding recommendation and the knowledge on Streetwise Stories shouldn’t be thought of a advice to purchase or promote any safety. Streetwise Stories doesn’t endorse or suggest the enterprise, merchandise, providers or securities of any firm talked about on Streetwise Stories.

5) Once in a while, Streetwise Stories LLC and its administrators, officers, staff or members of their households, in addition to individuals interviewed for articles and interviews on the positioning, might have a protracted or quick place in securities talked about. Administrators, officers, staff or members of their rapid households are prohibited from making purchases and/or gross sales of these securities within the open market or in any other case from the time of the choice to publish an article till three enterprise days after the publication of the article. The foregoing prohibition doesn’t apply to articles that in substance solely restate beforehand printed firm releases. As of the date of this text, officers and/or staff of Streetwise Stories LLC (together with members of their family) personal securities of Barrick Gold Corp., an organization talked about on this article.