Editor’s note: Seeking Alpha is proud to welcome Dave Holland as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Kinesis is a transformational monetary system that digitalizes the value of gold, silver, and cryptocurrency into spendable money. Kinesis blossomed out of the Allocated Bullion Exchange, which started as an Australian gold and silver physical bullion storage company in 2011. By combining blockchain technology with the longstanding dependability of gold and silver bullion, Kinesis represents an alternative to unreliable fiat currencies.

The Kinesis premise: An investor can exchange cash or cryptocurrency for physical gold or silver and store it in one of the company’s eight international vaults across four continents. The purchased gold (KAU) and silver (KAG) are stored at no cost, and the investor can easily transfer these to other Kinesis members. Each transaction is recorded using the blockchain as a public ledger, thus keeping track of who actually owns the physical gold and silver in the vaults. The Kinesis vaults are audited on a semiannual basis by an independent auditing service that has been in business for over 100 years.

The Kinesis system thereby provides a digital currency, backed by precious metals, that will appeal to both investors and consumers alike. Kinesis can be used as an investment tool for those looking to hold precious metals in a secure and economical way. Kinesis also aims to leverage this system to provide financial services to the underbanked citizens of the world on a large scale. This has particular relevance to developing countries, where smartphone adoption drastically outpaces the availability of traditional banking services. A share in the topline revenue of the company can be purchased as Kinesis Velocity Tokens (KVTs). A KVT will pay a dividend derived from transaction fees charged by Kinesis. Thus, Kinesis offers two distinct investment opportunities: a modern, easily transferable, and secure modality by which to purchase and store precious metals, and a stake in a potentially revolutionary global financial service (KVT). The ability to invest in the company at this early stage provides a unique investment opportunity.

Purchasing precious metals with Kinesis

When you “mint” in the Kinesis system your purchase directly brings physical gold or silver into the Kinesis vaults and a blockchain token is created. KAU is the gold token and KAG is the silver token. Each subdivision of a gram of gold or ounce of silver is legally titled and held by a single person on the blockchain. The tokens are easily divisible into smaller fractions similar to bitcoin. The gold and silver is fully allocated on a 1:1 basis and legally owned by the investor as opposed to the iShares Silver Trust (SLV) and SPDR Gold Trust (GLD). With the SLV and GLD funds the investor is buying an ownership interest in the trust and has no ability to take direct ownership of the underlying precious metal. In contrast, Kinesis allows the investor to withdraw their physical precious metals at the time of their choosing.

Redemption of physical precious metals

Kinesis investors have the ability to withdraw their physical gold and silver out of the vaults and have it shipped directly to their home. This will cost about 8% in fees on 200 ounces of silver, in contrast to the recent 15-30% premium over the spot price for silver bars. Using Kinesis to acquire physical silver or gold at a discount will likely catch on with people who want to accumulate the physical precious metals and should be a strong revenue stream for Kinesis. Kinesis is able to do this because they are able to buy large format used bars from the wholesale bullion markets. If you remove your metal from the Kinesis vaults the corresponding KAU or KAG are removed from the blockchain to keep the tokens in a direct 1:1 ratio.

Kinesis allows you to store gold and silver with no cost in their allocated, insured vaults. How does the company make money?

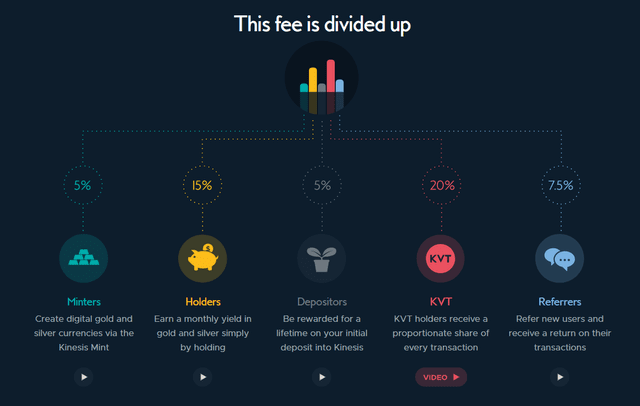

Kinesis charges a 0.45% fee when you send gold or silver to another user. When you buy or sell precious metals on the Kinesis exchange, the fee is 0.22%. These fees go into what they call the “master fee pool”. Of the master fee pool, 17.5% is allocated to keep the business running, vault storage, blockchain technology, tech support, etc. Businesses or governments who partner with Kinesis will receive a yield of 20% of the master fee pool, and white label companies will receive another 10%. The remaining 52.5% is distributed back to the users and holders in the system as shown below. This fee sharing structure both incentivizes using the system and allows a yield to be paid for metals held in the system.

Source: Kinesis Money

Kinesis is poised to bring cryptocurrency users into the gold and silver markets

Cryptocurrency and bullion represent two ends of a broad spectrum of financial instruments. Cryptocurrency is easy to obtain, has minimal fees, is free to hold for long periods, and is easily transferred across borders. However, the extreme volatility of bitcoin (BTC-USD) and Ethereum (ETH-USD) makes for a poor currency and questionable long term investment. Precious metals, on the other hand, have been continuously valued by most advanced civilizations over the past millennia. The gold and silver markets are easily explained and well-understood. Physical precious metal bullion is relatively difficult to obtain at prices near commodity exchange listed prices. Holding large amounts of bullion is often saddled with high fees for procurement and storage, and its bulk and poor divisibility make it essentially useless as an everyday currency. Kinesis aims to leverage the advantages of each of these financial instruments to offer a currency that is both modern and stable.

The term “stablecoin” has been used recently to describe a cryptocurrency that is pegged to a traditional fiat currency or a precious metal. Over the past few years gold and silver have become digitized as stablecoins. Some of the more well established gold linked coins are PaxGold and Tether Gold. Kinesis’ advantage over these existing products is that rather than simply storing bullion and digitizing it via the blockchain, Kinesis is working to remonetize gold and silver to make them a viable everyday currency via an entire payment ecosystem.

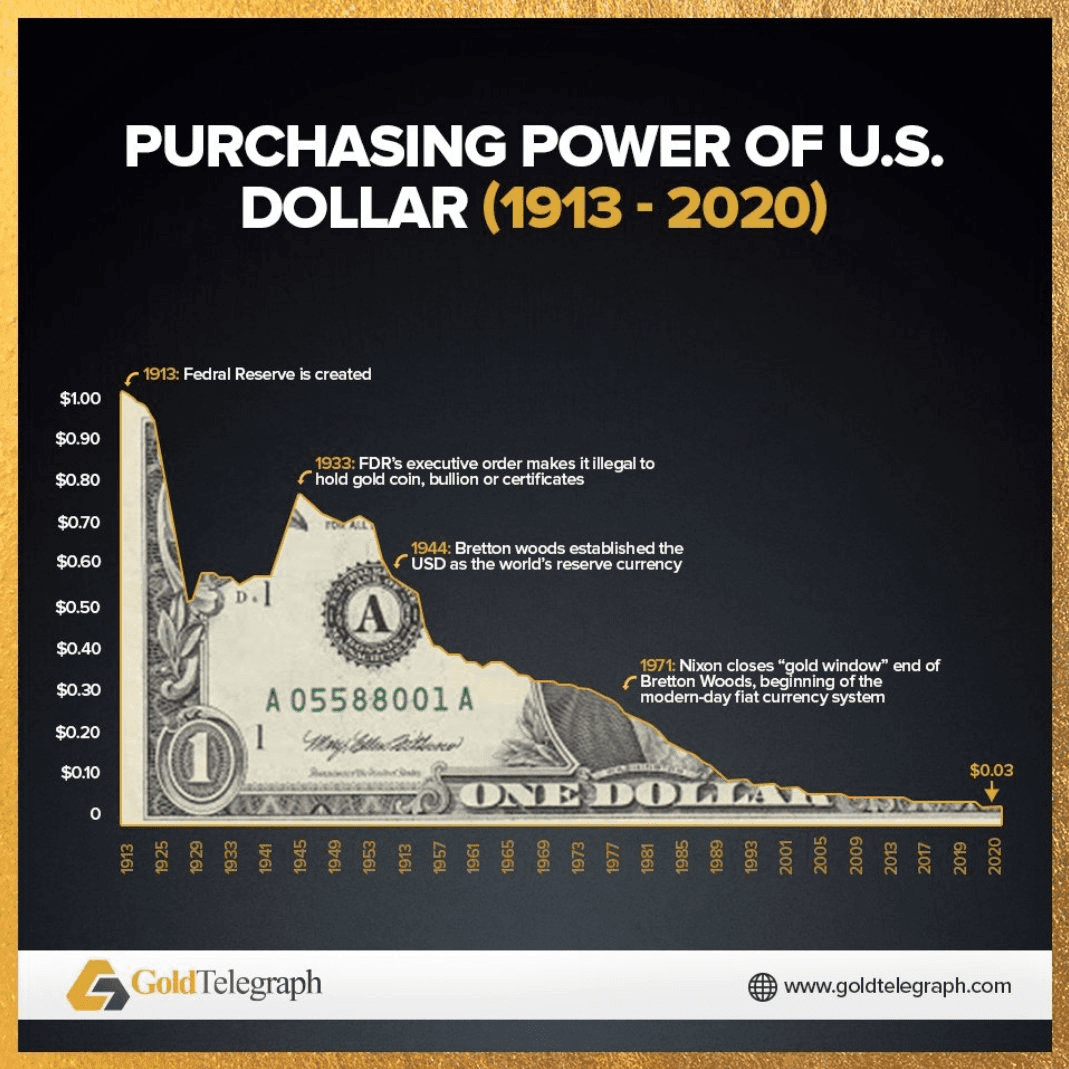

In essence, Kinesis is attempting to use the blockchain to defeat Gresham’s Law. This is an economic principle that “bad money drives out good.” In other words, absent some meaningful incentive, people are more likely to hoard “good money” (gold or silver) and spend “bad money” (fiat currency) which slowly loses its value over time due to inflation. Currently, the cost and inconvenience associated with obtaining and spending gold and silver make these undesirable everyday currencies. The Kinesis yield system incentivizes the holding, spending, and trading of KAU and KAG, thereby eliminating these obstacles.

Source: Gold Telegraph

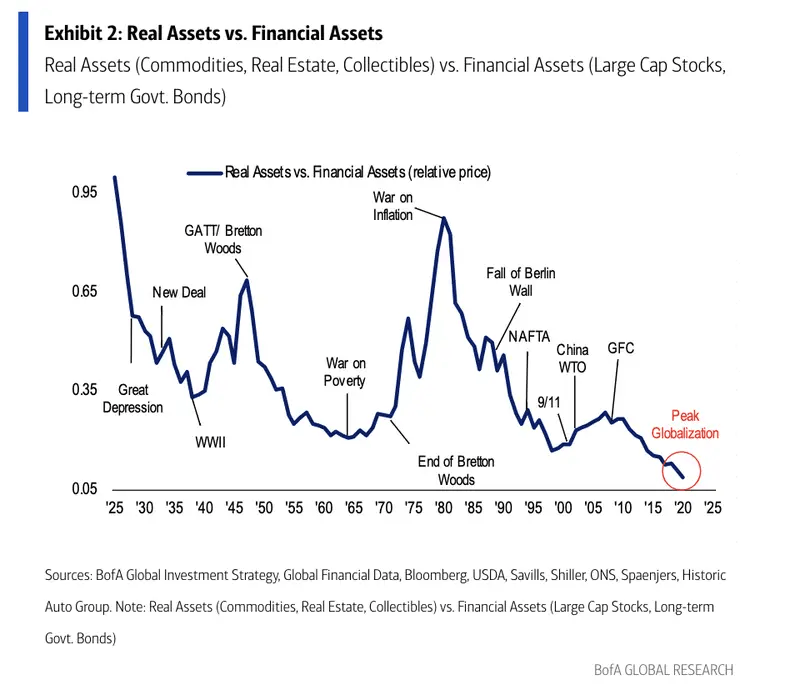

Real assets vs. financialized assets

We are at historic lows in regard to investments in real assets compared to financialized assets. The relative value of financialized assets such as stocks or bonds has never been so high compared to “real” or “hard” assets like real estate, commodities, and collectibles. In 2021, Americans are at historic low rates of allocation to gold or silver in their personal investment portfolios. Indeed, the average US investor only has about 0.5% of their total investments in gold and silver. If this increases to the 8% seen during the precious metals bull market of the late 1970s to early 1980’s we will see a significant rise in both demand and price.

Source: Bank of America, Business Insider

The total gold market is valued around $11 trillion. The yield offered on gold via Kinesis could eventually take a very significant share of the gold market. The gold price has traditionally had a high negative correlation to bond yields since gold has no yield. In December of 2020 we hit a new record of over $18 trillion dollars in bonds that were negative yielding (guaranteed loss of principal over time.) Kinesis could potentially disrupt this huge market as large investment managers increasingly move capital into precious metals and out of capital destroying bonds.

Major industries that Kinesis may be able to disrupt

Banking

Kinesis just launched a public private partnership with the government of Indonesia to provide a new payment system for their entire postal service. Of Indonesia’s 275 million people, it is estimated that two thirds do not have a bank account or have very limited banking access. Now, if you have a smartphone you can use Kinesis as your banking system. Kinesis is building a gold and silver vault in Jakarta to service the country’s needs. Indonesia, the worlds most populated Muslim majority country, previously banned all cryptocurrencies in 2017; fortunately, the Kinesis gold and silver system is Sharia (Islamic) law compliant because it is not based on debt and interest collection.

Kinesis is reportedly currently in talks with other countries about building public private partnerships as well. In Thomas Coughlin’s (Kinesis CEO) recent update he stated that, “This important Public Private Partnership has been a long time in the making with many complicated moving parts but sets a strong precedent and case study for other similar PPPs with other governments. It has been followed closely by the United Nations along with other governments and acclaimed for its satisfaction of the UN Sustainable Development Goals.”

Public private partnerships could bring a tremendous new user base into the system. In 2018 the World Bank Group reported that of the 1.7 billion people worldwide without a formal bank account, two thirds own a cellphone. Kinesis could help over a billion people access a digital banking system while providing a stable currency to save and transact with.

Credit Cards

Kinesis also could disrupt the established payment systems of Visa (V), Mastercard (MA), American Express (AXP), and Discover (DFS). Credit card companies charge merchants a 1.4-3.5% transaction fee every time you make a purchase. Businesses eat this cost so it is not passed directly on to the consumer, but consumers pay this via higher prices. If a merchant adopted Kinesis as a direct payment method, the associated fees would be substantially lower than those charged by credit card companies. This would require much broader adoption of the Kinesis system than currently exists but presents an enormous market to go after.

In the meantime, Kinesis has introduced a Visa debit card to make spending KAU and KAG in everyday transactions feasible. You sell KAU or KAG to load the card with funds, for which Kinesis charges their standard 0.22% fee. Kinesis has already rolled out a physical debit card with a limit of $20,000 in the US. Later this year this card should also be available in the UK and Europe. They also have a virtual Visa debit card for worldwide use with a modest limit of $500 dollars.

The goal of Kinesis is to get merchants to start transacting directly via KAU/KAG transfers. Instead of paying 1.4-3.5% to the credit card companies, Kinesis’ 0.45% fee would add up to significant savings for merchants doing a high volume of credit card transactions. Kinesis also offers larger businesses the ability to partner with them and earn a 20% return of the fees on transactions that go through their system. Lower fees plus a yield sharing program should help drive online, high transaction volume retailers towards the Kinesis system.

Kinesis as a protection against inflation

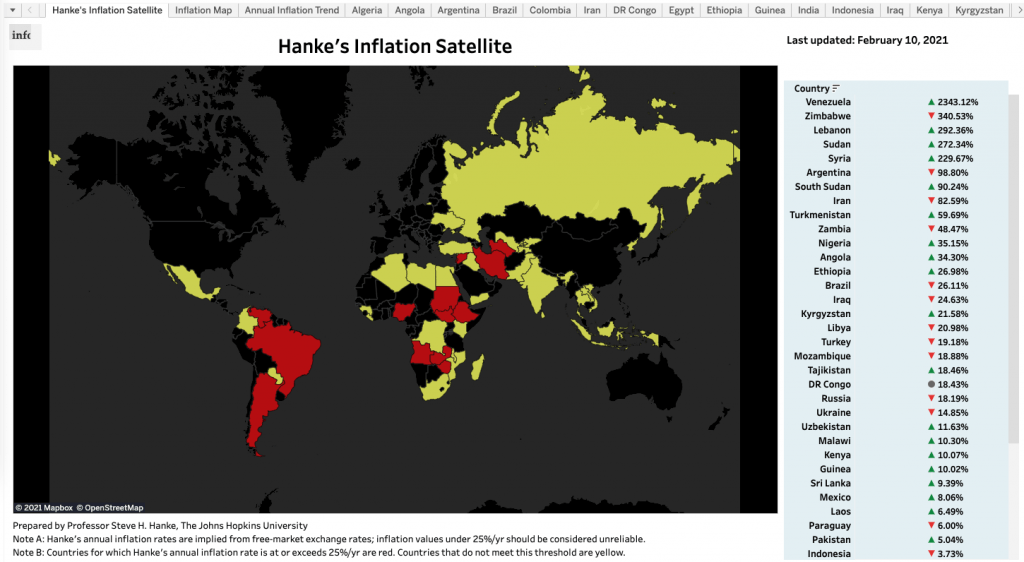

People who live in advanced economies should be concerned that their governments are printing trillions of dollars in aid and stimulus (again and again!). Many developing economies often have unstable local currencies and their citizens may not want to store or save money in their local currency due to potential for rapid devaluation. Venezuela, Turkey, and Lebanon have all been in the news recently due to loss of faith in their currency. For consumers and investors in developed and developing economies alike, Kinesis can help protect your purchasing power into the future and prevent politicians from destroying your savings.

Source: Professor Steve H. Hanke, John Hopkins University

International money transfer and remittances

Kinesis Money charges a flat 0.45% fee to transfer your digital gold and silver to anyone in the world with an account. This would be an ideal system for international workers looking to send money back home to their families. With Kinesis there are no forex fees because you are sending gold or silver. The transfer happens immediately. They report their system can handle over 3000 transactions per second so there is a significant ability to scale.

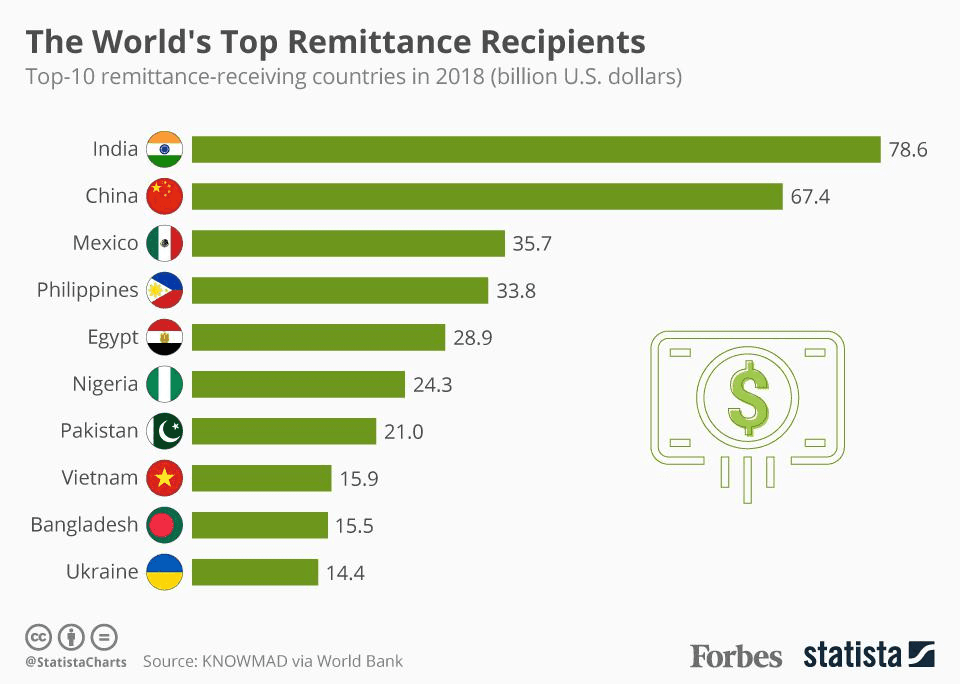

Typical Western Union (WU) or PayPal (PYPL) International transfer fees are about 5% plus up to 6% forex conversion and another 2-3% if you paid via credit card. The yearly remittance transfers across the globe are quite substantial and Kinesis’ low fees and availability to anyone with a smartphone could earn them a large share of this market.

Source: Forbes

Partnerships with large institutions or investment funds

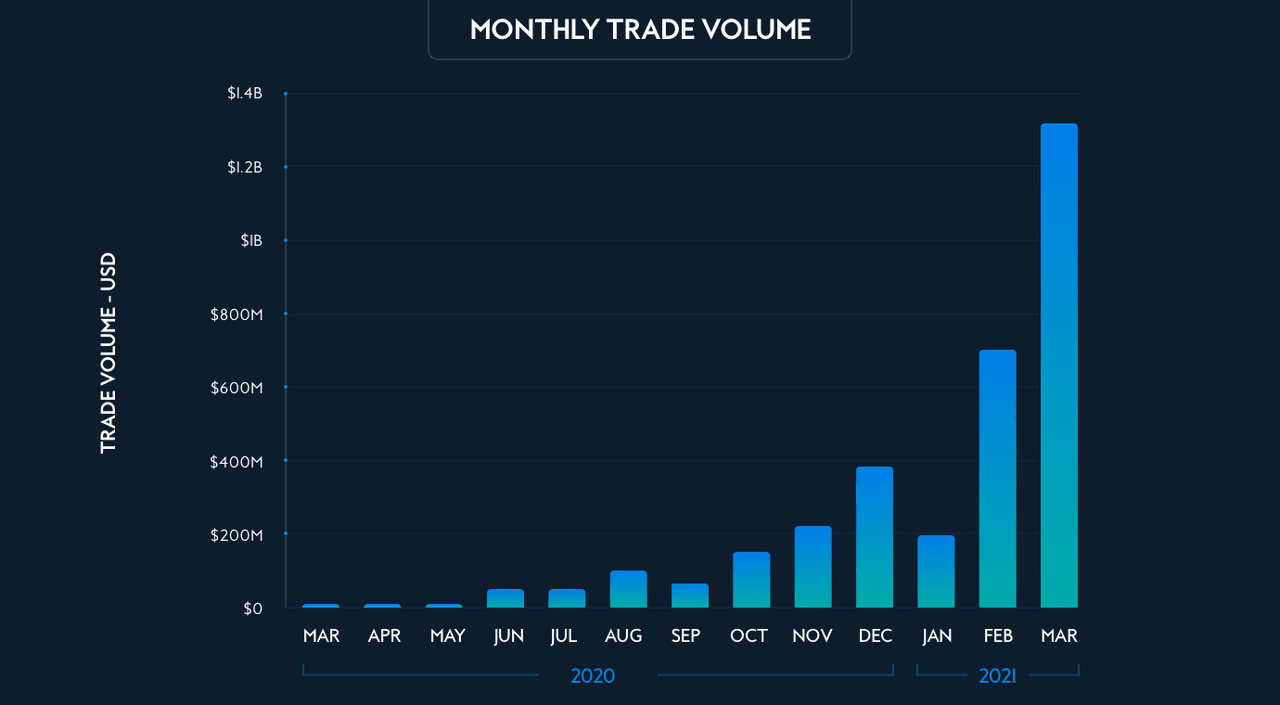

Kinesis states that they can tailor solutions for multinationals, investment banks, brokers, pension funds, asset managers, trading firms, cryptocurrency platforms, and precious metals refiners, brokers, and traders. They are partnered with Deutsche Börse/ECC, a European asset trading and clearing platform. This ability to partner with large groups opens the potential for exponential growth in precious metal and cryptocurrency trading on the platform. Kinesis has been seeing a nearly exponential rise in monthly trading volume on their precious metals exchanges.

Source: Kinesis Q1 update

Kinesis is also bringing in various fiat currencies including the Canadian Dollar, Swiss Franc, Australian Dollar, New Zealand Dollar, Hong Kong Dollar, Singapore Dollar, Offshore Chinese Yuan, and Indonesian Rupiah. The company reports that they are expanding the list of cryptocurrencies that are tradable on the platform as well. All this will serve to increase the overall volume of trading on the platform, thus increasing the amount of money that moves into the master fee pool. I will stay long in my KVT position as long as Kinesis continues to show growth and the ability to partner with large companies and countries.

Potential problems and hurdles that Kinesis needs to overcome

It seems to me that the greatest threat to Kinesis’ business model is harsh regulation by government organizations like the SEC, FINRA, or their international counterparts. The company is cognizant of this and working to comply and partner with all the regulations in this area. They are headquartered in the Cayman Islands and Lichtenstein for the very strong protections that these countries offer in terms of banking and personal property laws. The development teams are located in Australia, Europe, and Latin America.

Another potential vulnerability for Kinesis is competition from another similar platform, although I think this is not likely to affect them in the near term. They currently have the most robust blockchain precious metals trading system on the market. Their competitors look very rudimentary compared to the system Kinesis has developed.

Currently, the process for purchasing KAU and KAG with fiat currency is slow and clunky, involving a costly and time-consuming international wire transfer. I think this represents a significant impediment to user participation and rapid onboarding. However, once the user receives a physical debit card, they can use the ACH feature which is relatively timely (a few days) and does not involve any fees. The fastest option is to send over cryptocurrency. I sent bitcoin into my account several times and it arrived in about 30 minutes.

I think helping people to understand and trust the platform and what’s going on behind the scenes will represent one of their greatest challenges for broad worldwide adoption. For many investors, cryptocurrency is thought of as a highly risky asset. The average consumer likely has very little experience with bullion or cryptocurrency. Since Kinesis represents such a radical new idea and concept, they will need to have a strong sales and promotions team to help drive the adoption of the platform. Their public private partnership model is likely to help in this regard as well. Reassuringly, the educational videos they have already produced thus far are high quality and help make this concept more understandable.

Overall the app and website need a bit more polishing but work pretty well. They are still releasing new features and continue to improve the app and desktop experience. The Kinesis support team is responsive and generally helpful with any issues that arise. The CEO is on record as being very open to user input and suggestions.

Investing in Kinesis as a company

The value of the Kinesis system to the Seeking Alpha community is not limited to participating as end users. A blockchain based share of top-line revenue, known as Kinesis Velocity Tokens (KVTs), are currently available to those wishing to benefit from the company’s success. KVTs will pay out dividends (in KAU and KAG) to the holder. Kinesis started the company by selling KVTs for $1000 each, raising about $190 million in startup capital.

The quantity of KVTs available is fixed at 300,000. Per the Kinesis hardcoded blockchain technology, no more KVTs can ever be created. They can be purchased outright, or as a limited time start up feature, “minted” by trading KAU and KAG on the Kinesis system. Part of the built in revenue sharing model Kinesis employs will pay out 20% of all transaction fees as KVT dividends once the system is fully up and running. If Kinesis is able to capture 1% of the total gold investment market over the next few years, a single KVT could pay out thousands of dollars in dividend yields each year. If you want to dive further into the math behind this I recommend reading through the Kinesis blueprint.

Conclusion

Kinesis is an emerging company with tremendous upside potential. Investors have the ability to invest in the company now and help shape the future of the company going forward. Kinesis has the potential to be adopted on a global scale similar to other large tech companies such as Google (GOOGL) or Facebook (FB) where the best product takes the majority share of a new market.

Getting in now allows you to become an early adopter of the fusion of the future of value transfer (blockchain) and the most trusted money supply across borders and continents for the past 5000+ years (precious metals). The Kinesis platform avoids the traditional problems of using gold and silver as everyday currency, including: Gresham’s law, poor divisibility of physical metals, transport, and storage concerns. Moreover, unlike traditional methods of holding physical metals, KAU and KAG pay a small yield. This yield allows you to increase your wealth over time instead of having inflation slowly strip away your buying power.

An investment in Kinesis KVTs at this early stage offers a very compelling and asymmetric risk to reward ratio. The current market capitalization of $390 million has significant room to grow for a multinational company. The yield and value of KVTs could be quite substantial when you consider the multiple large industries and markets Kinesis is poised to disrupt. Kinesis offers a technological bridge between the oldest and most trusted money supply and the digital blockchain revolution of the 21st century.