One junior explorer has defined a gold resource along the “Rim of Fire,” a rift between tectonic plates in the South Pacific. Recent drilling has shown there is even more gold at depth. Maybe a lot more.

Drilling by Vancouver-based Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX; LLO:ASX; LY1:FSE) has found high-grade mineralization some 300 meters below the current resource at its steadily-growing Tuvatu alkaline gold project in Fiji.

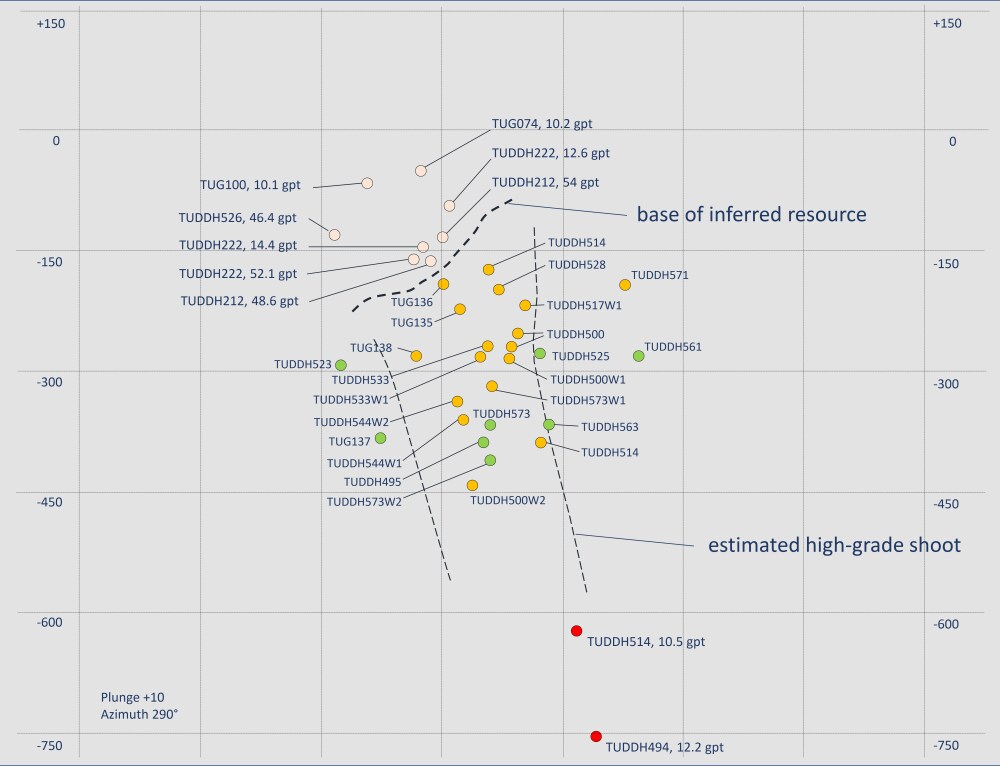

In fact, two holes in an area known as the Deep Feeder Zone 500 at Tuvatu, hit mineralization 350 meters below the mineralized envelope that contains the current resource.

The company also completed re-entry hole TUDDH-494, a kind of pilot hole where the drill continued deeper in an existing hole in an attempt to find additional mineralization. It hit 0.3 meter of 12.2 grams per tonne gold (12.2 g/t Au) and 0.39% copper at 1,106 meters down-hole.

Hole TUDDH494 at 1,106 meters depth that returned 12.2 g/t Au and 0.39% copper. Source: Lion One Metals Ltd.

TUDDH-494 is what is referred to as a “skinny interval” but nonetheless the hole demonstrates that mineralization extends more than 650 meters vertically below the base (1,150 meters total) of the current resource.

Denver, Colo.-based Crescat Capital is a significant shareholder in Lion One and Crescat Geologic and Technical Director Quinton Hennigh says the picture is forming at Tuvatu.

“(Lion One) hit a whole bunch of high-grade intervals down deep on the 500 zone and the other associated lodes down there. (The company is) starting to develop a picture of what’s going on. They see four lodes all tied together, like a network of high-grade lodes. And then they’ve also hit high-grade gold down to 1,150 meters below surface — a skinny interval, but it tells you there’s high grade down there,” Hennigh told Streetwise Reports.

He added: “My hunch is if there’s pops and whistles of high grade like that at depth, it’s really just a matter of finding that root feeder zone and targeting it at depth and that should deliver nice big widths (of gold mineralization).”

The drill program consisted of 11 drill holes for a total of 9,113 meters.

Some drilling highlights are as follows:

- Hole 138 hit 23.14 grams per tonne gold (23.24 g/t Au) over 3 meters, including a sweet spot of 118.60 g/t Au over 0.3 meter from 571.5 meters down-hole.

- Hole 136 hit 87.83 g/t Au over 1.5 meters, including 108.41 g/t Au over 0.6 meter from 445 meters down-hole.

- And hole 573W1 returned 25.83 g/t Au over 2.7 meters, including 43.64 g/t Au over 0.3 meter from 582 meters down-hole.

A quick back-of-the-napkin calculation suggests that the company is getting between 2,000-3000 oz gold per vertical meter. So if the mineralization goes down 1,000 meters, the resource, hypothetically speaking, could reach as high as 3 million oz (there has not been a study confirming this number).

Hennigh, a geologist by training, explains that alkaline gold systems tend to be deep-rooted, driven by magmas (liquid rock) that have cooled somewhere around two to three kilometers below the Earth’s crust. The gold veins form when tectonic forces push gold-bearing fluids up from the parent magma chamber into the rock fractures and cool there.

“That’s what makes these things so special. You can end up with these very deep-rooted systems, like Vatukoula, which is a nearby. I think they have mined down in excess of 1,200 meters (below surface) there or like Porgera in Papua New Guinea, where they have mined down closer to 1,500 meters,” Hennigh said.

The Vatukoula underground gold mine is on Viti Levu, Fiji’s main island, and is operated by London-based Vatukoula Gold Mines (VGM). VGM is controlled by Chinese interests.

The last accessible report on production from Vatukoula said the company mined 522,769 tonnes in 2019 at an average head grade of 2.95 g/t Au for 35,560 oz. The company has since undergone a restructuring.

The Porgera gold mine, meanwhile, has been on care and maintenance since 2020 when a dispute with Papua New Guinea’s national government led to the cancellation of a mining permit held by Barrick Niugini Ltd. (BNL), the company operating the mine. BNL is held equally between Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Chinese firm, Zijin Mining Group Co. Ltd., which bought a stake in Porgera in 2015.

Following a settlement signed in early April, the government of Papua Guinea (and other PNG-based parties) now own 49% of the Porgera Joint Venture (PJV), with the option to buy out Barrick and Zijin for “fair market value” after 10 years. Barrick and Zijin own 51% of PJV.

Porgera produced 20 million oz (20 Moz) gold between 1990 and 2017.

The Tuvatu gold project is on the island of Viti Levu, one of the many islands in the South Pacific Archipelago that make up Fiji.

A September 2020 Preliminary Economic Assessment on the 100% owned Tuvatu outlined an indicated resource of 1,007,000 tonnes grading 8.48 g/t Au for 274.6 Koz Au and an inferred resource of 1,325,000 tonnes grading 9 g/t Au for 384,000 Koz Au. The study used a cut-off grade of 3 g/t Au.

Lion One CEO Walter Berukoff once founded Miramar Mining, which developed the 10 Moz Hope Bay gold project in Canada’s Arctic. Berukoff sold Miramar to Newmont Corp. (NEM:NYSE) in 2007 for CA$1.5 billion in cash. That deal came on the heels of Berukoff and his team selling Northern Orion Resources to Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) for CA$1.07 billion earlier that year.

Lion One has about 166 million shares fully diluted. It trades in a 52-week range of CA$0.97 and CA$1.42.

| Want to be the first to know about interesting Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Disclosure:

1) Brian Sylvester compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He and members of his household are paid by the following companies mentioned in this article: None. His company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: Lion One Metals. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Lion One Metals, a company mentioned in this article.