By Jesse Colombo

For the past few years, gold has been treading water with no clear direction and causing even the most die-hard gold bugs to scratch their heads in confusion regarding the yellow metal’s next major move. Though gold surged during the most acute phase of the 2020 COVID-19 pandemic due to the unprecedented tsunami of liquidity from global central banks, it has since bounced around between $1,600 to $2,100. In this piece, I will show that gold is still in a confirmed long-term uptrend despite the choppy action of the past few years. I will also show several factors that should create a tailwind for gold in the next decade and beyond.

The Technical Backdrop

It’s helpful to take a step back and look at the big picture when the short-term picture is unclear. Gold’s monthly chart going back to the year 2000 shows that the metal is in a confirmed uptrend according to the most basic, widely accepted tenets of technical analysis. For starters, gold has been consistently making higher highs and higher lows over the past quarter-century. In addition, gold has been climbing up a long-term uptrend line that formed in the early-2000s. From a technical perspective, gold will remain in a confirmed long-term uptrend as long as it stays above that uptrend line — after all, a trend in motion tends to remain in motion.

If you look at gold’s price action of the past five years, you can see that there has been a strong resistance zone overhead from $2,000 to $2,100. Gold has attempted to break above that resistance zone several times since 2020 to no avail. If gold can finally close decisively above its $2,000 to $2,100 resistance zone, that would indicate that another phase of the bull market has likely begun (update: as of Monday, March 4th, gold has broken above this zone).

(Of course, I need to point out that gold and silver’s price discovery process has been corrupted and distorted by the explosion of “paper” or synthetic gold and silver products including futures, options, swaps, and exchange traded funds that are not fully backed by actual physical gold and silver.

Over the past couple of decades, the amount of outstanding synthetic gold and silver has ballooned relative to the amount of physical gold and silver in existence, which has suppressed physical precious metals prices. In a genuine and fair market, physical gold and silver prices would be much higher than they currently are. You can learn more about this issue here and here.)

The Role of Paper Money Debasement

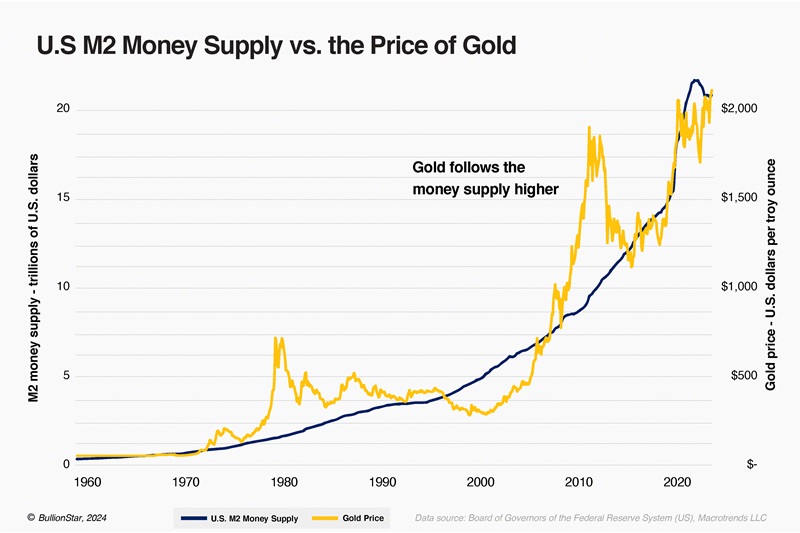

There are numerous factors that drive the price of gold, but dilution of fiat or “paper” currencies is one of the most glaring. For the past five decades, all of the world’s major currencies have been downgraded to mere “paper” currencies that are unbacked by gold, which has predictably resulted in an explosion of the global money supply and the ensuing erosion of those currencies’ purchasing power.

To put it in layman’s terms, a rising money supply harms the value of currencies and results in inflation or higher living costs. When the cost of housing, groceries, car insurance, healthcare, and college education all rise together, look no further than the debasement of paper money. When currencies were backed by gold, it was impossible to dilute them the way that paper currencies are diluted because every currency unit was required to have a certain amount of gold backing it up and it’s impossible to print or conjure gold out of thin air. For that same reason, people clamor to the safety of gold when paper money is being diluted to oblivion.

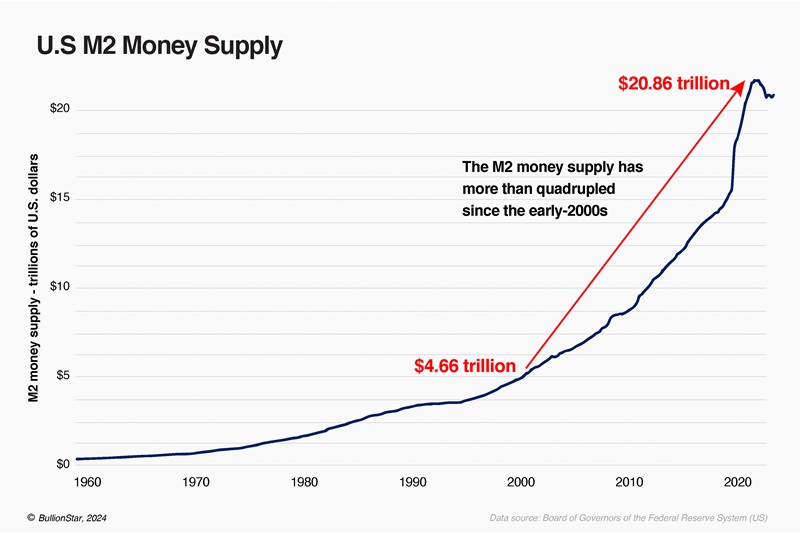

The chart below shows the United States M2 money supply, which is a measure of all notes and coins that are in circulation, checking accounts, travelers’ checks, savings deposits, time deposits under $100,000, and shares in retail money market mutual funds. The U.S. M2 money supply has more than quadrupled since the early-2000s, which was a major factor behind gold’s long-term uptrend that began at that time.

Though paper money is typically diluted as a function of time, this process accelerated dramatically after the Global Financial Crisis of 2007 – 2008 due to widespread government bailouts, fiscal and monetary stimulus, and quantitative easing (QE), which can be thought of as digital money printing for the purpose of propping up the economy and boosting the financial markets.

The 2020 COVID-19 pandemic resulted in an even more reckless printfest that caused nearly every measure of money supply in practically every country to go vertical in just a few months as central banks — including the U.S. Federal Reserve — desperately tried to prop up their economies and financial markets during the pandemic lockdowns with trillions upon trillions of dollars worth of stimulus.

The chart below shows how gold follows the M2 money supply higher over time:

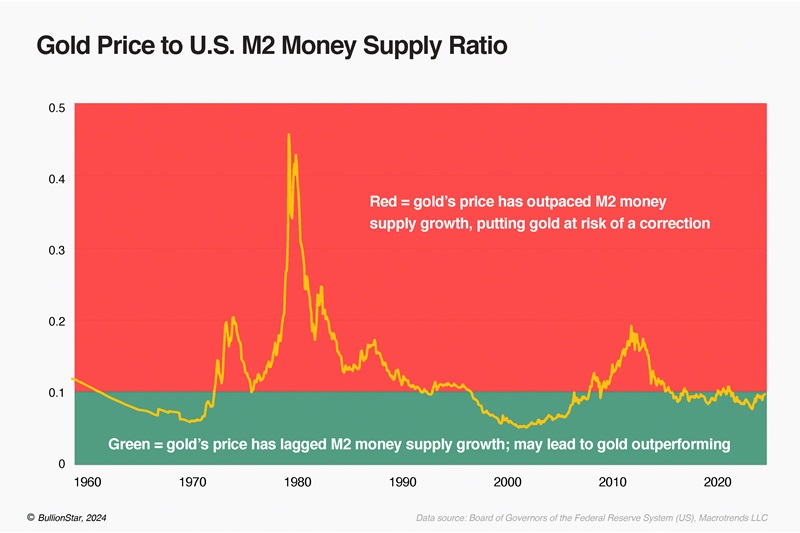

The next chart shows the ratio of gold’s price to the M2 money supply, which is helpful for seeing if gold is keeping up with money supply growth, outpacing it, or lagging it. If gold’s price greatly outpaces money supply growth (the red zone in the chart below), there is a heightened chance of a strong correction. If gold’s price lags money supply growth (the green zone in the chart below), however, there is a good chance that gold will soon experience of period of strength. Since the mid-2010s, gold has slightly lagged M2 money supply growth, which could set it up for a period of strength due to the other factors discussed in this piece.

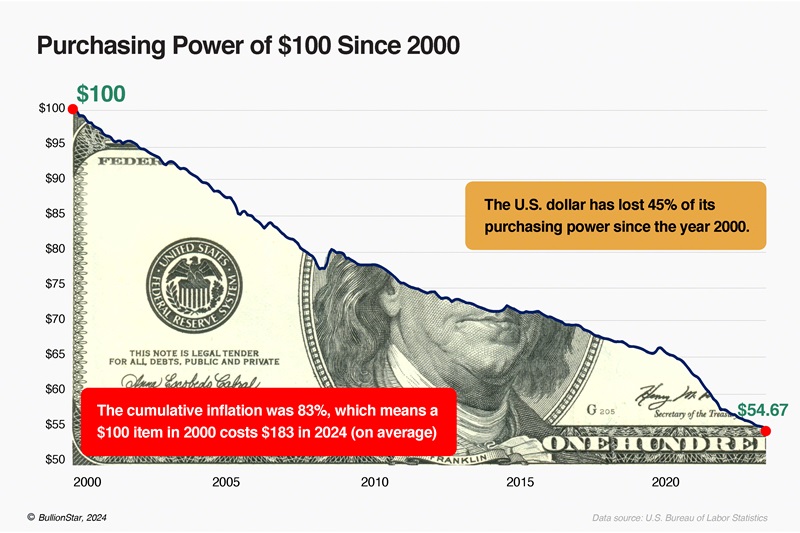

The U.S. Dollar’s Declining Purchasing Power

As discussed earlier, a rising money supply erodes the purchasing power of paper currencies over time. The Noble Prize-winning economist Milton Friedman described this process succinctly: “Inflation is always and everywhere a monetary phenomenon…” Since the year 2000, the U.S. dollar has lost nearly half of its purchasing power largely due to reckless monetary experiments conducted by the U.S. Federal Reserve, which is supposed to be a good steward of America’s currency but has proven to be the exact opposite.

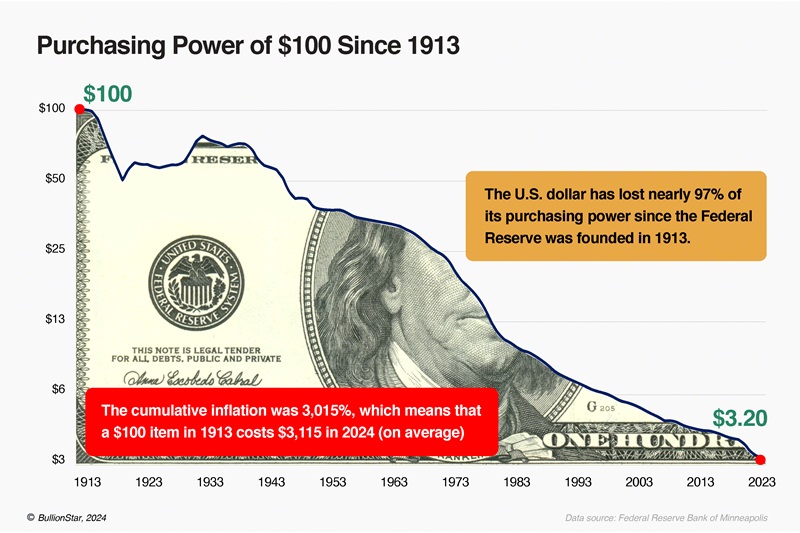

Unfortunately, the U.S. dollar’s debasement since the year 2000 wasn’t a fluke — it was just a continuation of the trend that started almost immediately after the Federal Reserve was founded in 1913. Since then, the American currency has lost a jaw-dropping 97% of its purchasing power with no end in sight. As long as the U.S. dollar remains an unbacked fiat currency, it is going to keep losing purchasing power as a function of time.

The U.S. National Debt

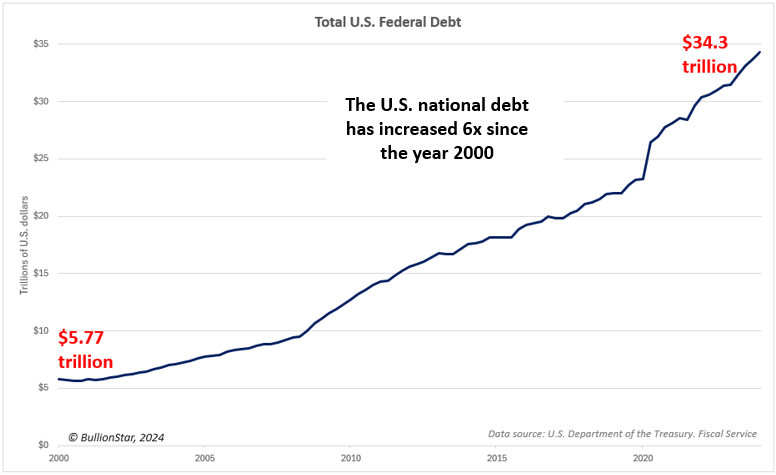

America’s surging national debt has been another driver of gold’s bull market since the early-2000s. A combination of costly wars in Afghanistan and Iraq, bailouts and stimulus programs during the Global Financial Crisis of 2007 – 2008, and stimulus programs during the 2020 COVID-19 pandemic caused the U.S. national debt to explode sixfold from $5.77 trillion in 2000 to $34.3 trillion in 2024.

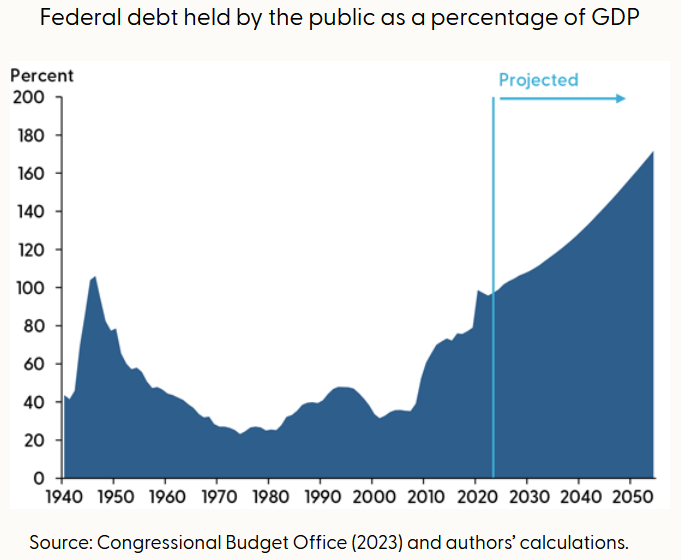

Even more concerning is the fact that the U.S. Congressional Budget Office expects the federal debt held by the public as a percentage of GDP to surge from just below 100% currently to approximately 170% over the next couple decades:

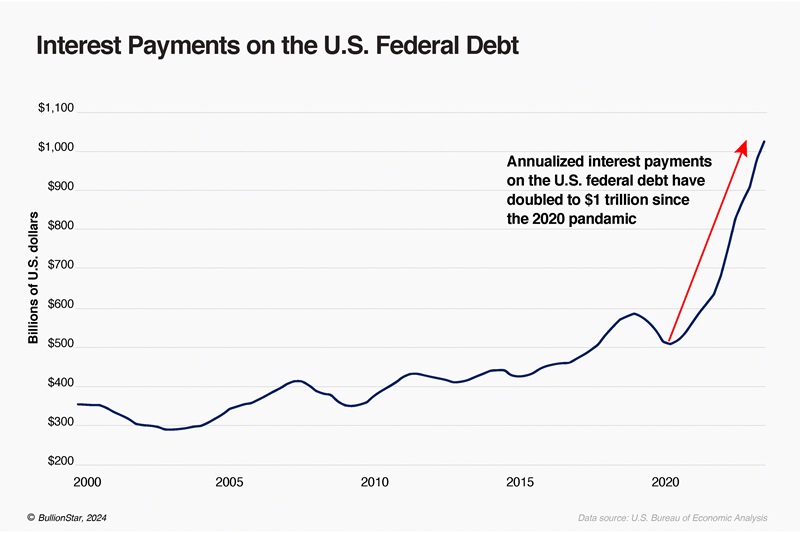

Since the 2020 pandemic, America’s exploding national debt combined with rising interest rates have caused annual interest payments to double to nearly $1 trillion:

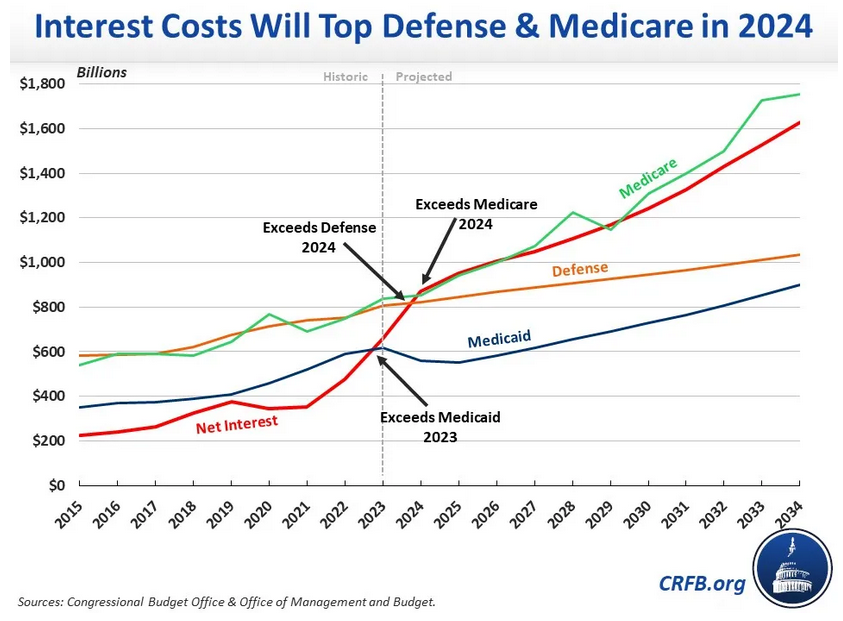

Now costing U.S. taxpayers a mind-boggling $1 trillion per year, federal interest payments are set to exceed both the cost of defense and Medicare this year for the first time ever:

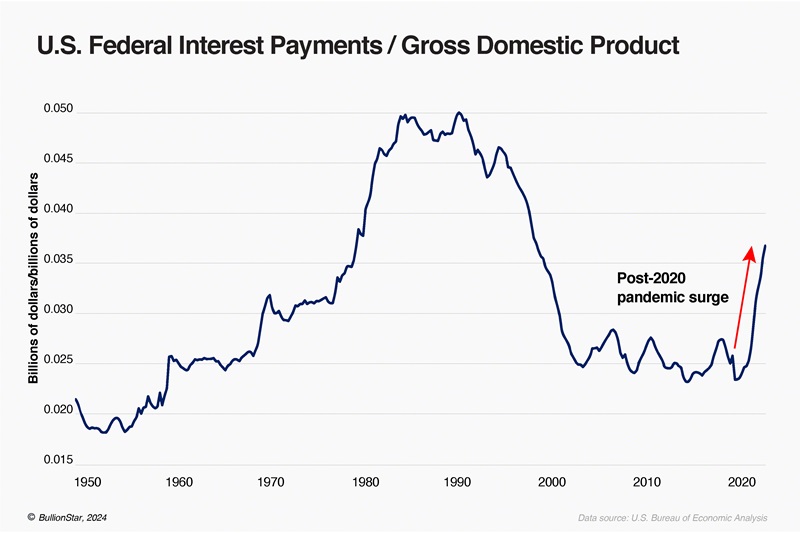

Over the past few years, U.S. federal interest payments as a percentage of GDP have increased at the sharpest rate in at least seventy years:

As a country’s national debt burden increases, the probability of a fiscal, economic, and currency crisis increases, which was what gold has been pricing in over the past quarter century. America’s surging debts — both public and private — are ultimately setting the stage for the destruction of the U.S. dollar, which will be sacrificed by the Federal Reserve and U.S. federal government as they run the printing presses on overdrive in a desperate attempt to pay for the spiraling cost of interest, Medicare, Social Security, welfare benefits, inevitable future bailouts and fiscal stimulus programs, and all other government spending. Throughout history, every paper currency has succumbed to the same fate as governments prove unable to resist the temptation of the printing press.

Conclusion

To summarize, gold began a powerful uptrend in the early-2000s and it is still in that same uptrend despite the choppy price action of the past few years. The factors that originally drove gold’s uptrend are still in effect and, in many cases, are accelerating. Over the next decade and beyond, we are going to see a staggering increase in debt and the money supply, which will result in terrible inflation and, ultimately, hyperinflation. Though this piece focused primarily on the U.S. monetary and fiscal situation, make no mistake — practically every major economy is in the same boat and has its own version of the charts and data shown here.

Though the paper money supply will increase exponentially in the years ahead, the supply of physical precious metals like gold and silver will remain relatively constant in comparison, which is a recipe for much higher gold and silver prices. I personally favor physical gold and silver bullion over all other investments (including gold ETFs and mining shares) in these unprecedented times.

If you feel the way that I do about the serious risks that we face and precious metals, I welcome you to check out our wide selection of gold, silver, and platinum bullion products.