We’re seeing the first signs that Western investors are moving into gold. If past form holds true, this could turbocharge this already-powerful gold rally.

This new gold bull run has been absolutely shocking in its intensity.

Since it started just 10 days ago, gold has added $150 in price. It’s up another $30 in the three trading sessions since I last wrote you.

Looking at that chart, it seems apparent that the rally is cooling off a bit, and indeed, gold is trading flat today as I write.

Frankly, I welcome this. Gold has gotten extremely oversold, and it can solve this condition by either correcting lower or simply biding time for a while. I prefer the latter, but either will do to help form a firm foundation for the next leg upward.

Look Who’s Joining The Party

If the intensity of this price move has been the most shocking aspect of the rally, the second-most part has been who’s been involved…and who hasn’t.

Specifically, central bank and Chinese buyers have driven gold’s big move, while Western/U.S. investors have been noticeably absent.

This is starting to change, but in a still-inconsistent manner.

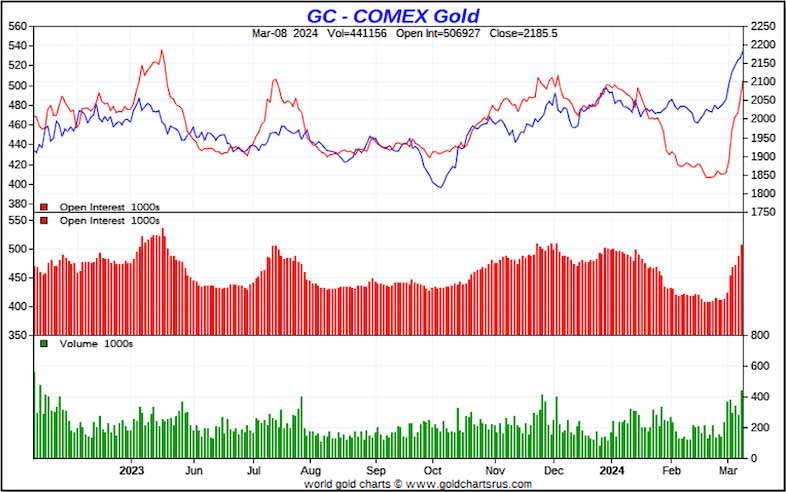

For example, consider this chart of open interest and trading volume for gold on the Comex futures exchange:

As you can see, open interest (red line in the top panel) has begun to chase the gold price (blue line) higher. In the bottom panels you can see that we’re rising strongly off the lows in open interest and volume.

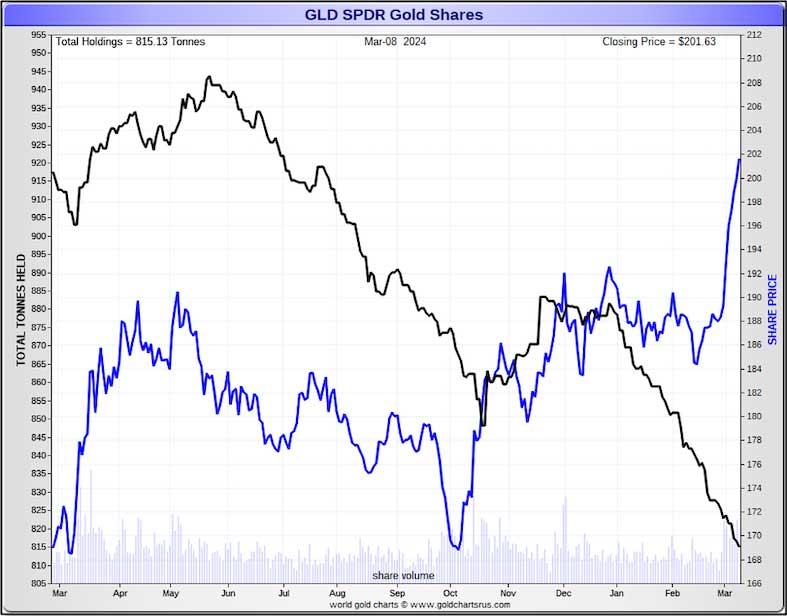

But the evidence of Western participation is still spotty. Most notable is the continued selling in the GLD gold ETF:

This is a truly amazing chart. It shows that, as of last Friday, selling in GLD has accelerated to the downside even as the gold price has accelerated to the upside.

Something truly strange is going on here. It’s impossible to tell what at this point, but it’s apparent that those Western investors who are buying gold right now are seeking greater leverage via futures.

So you might think that this mixed picture is still negative for gold stocks.

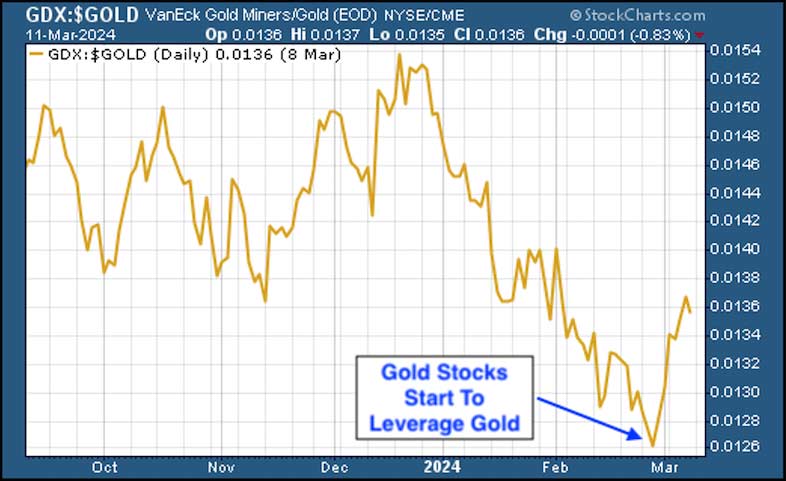

On the contrary, it’s in this sector that we see the next phase of the gold bull market taking shape. Consider this chart of the GDX gold stock index divided by the gold price:

While many have been bemoaning the performance of gold stocks during this rally, the record shows that the equities have in fact been outperforming gold. So has silver.

This is precisely what we want to see, as it’s a prime characteristic of a secular, monetarily-based gold bull market.

You’ll also notice that the relative valuations for gold stocks have a long way to go just to get back to where they were at the beginning of this year. And a longer-term chart would show that huge gains — over and on top of those for gold — are long overdue.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.