An earlier bulk sample from Omineca Mining and Metals Ltd.’s Wingdam project yielded almost 12 pounds of gold.

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) has successfully entered the placer gold-bearing paleochannel at its flagship Wingam underground project in British Columbia.

Workers saw visible placer gold on entering the paleochannel or buried remnant of an inactive river or stream channel.

The material was being stockpiled and would be processed at the wash plant. The results of the placer gold recovery will be announced when they are tabulated, the company said.

“We believe the announcement of the recovery of first gold from the new mining operation could be a near-term catalyst for the stock,” wrote Research Capital Corp. analyst Bill Newman in a March 3 note.

Newman of Research Capital Corp. rated the stock a Speculative Buy with a CA$0.75 target.

Newman rated the stock a Speculative Buy with a CA$0.75 target.

“Although getting to the gold recovery stage has taken longer than expected, … in the coming weeks/months, we expect OMM to report the recovery of placer gold, which we believe could be a major catalyst for the stock,” Newman wrote.

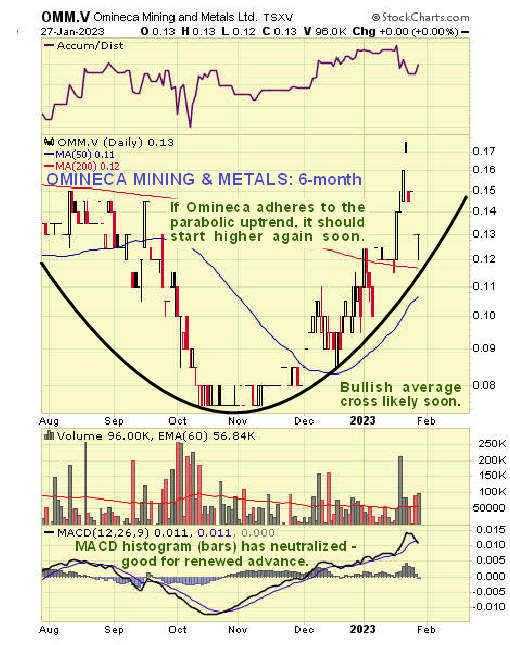

Newsletter writer Clive Maund of CliveMaund.com also rated the stock a Speculative Buy when he analyzed it in January, before the Wingdam news.

He said the stock went through a “serious rough patch” over 30 months or so, losing 90% of its value at one point.

“On the latest 6-month chart, we can see that after hitting bottom late last year (2022), Omineca is being shepherded higher by the Bowl pattern shown, which means that the advance should accelerate,” he wrote.

The Catalyst: 12 Pounds of Gold

Prospectors have been panning for gold in Lighting Creek since the late 1800s, and it was a bustling mining hub until World War II.

It sat largely undeveloped until a bulk sample late in mid-2012 was extracted from a 2.4-meter by 2.4-meter by 23-meter crosscut. It yielded 173.4 ounces gold — almost 12 pounds.

“After taking forever, it seemed, the news underscores the fact that they are hitting the paleochannel hard and on more than one front, now that they are happy with the front-end engineering work that had to come first,” Chris Temple wrote.

The excitement dissipated, however, after the gold market crashed and the project was placed on care and maintenance.

However, Chris Temple, editor of The National Investor newsletter, welcomed what he’s seeing now as a “nascent comeback.”

“After taking forever, it seemed, the news underscores the fact that they are hitting the paleochannel hard and on more than one front, now that they are happy with the front-end engineering work that had to come first,” Temple wrote March 3.

Shifts Working Day and Night

Omineca’s Wingdam project is more than 61,000 hectares and about 45 kilometers east of Quesnel, British Columbia. Hamilton Gold Royalties is a 50-50 joint venture partner with the company on the underground placer recovery.

Omineca was spun out from Copper Canyon Resources after its takeover by NOVAGOLD Resources Inc. (NG:TSX; NG:NYSE.MKT) in 2011. The junior initially sought lead-zinc deposits but soon pivoted.

Wingdam has 15 linear kilometers of placer claims covering a portion of Lightning Creek and the valley around it, where conditions created thick layers of unconsolidated gravel and clays that preserved and buried the paleochannel containing the placer gold.

Omineca said Fortis had doubled its workforce and is running on day and night shifts as mining operations continue. Fortis is beginning another crosscut and then will “advance into the heart of the channel on multiple headings to excavate the gold-bearing gravels between crosscuts,” Omineca said in a release.

The company said it was pleased with Fortis’ execution at the site.

Gold has been a more and more consistent performer than other precious metals when it comes to safeguarding wealth, wrote Anthony Tellez of Forbes.

“With the presence of visible placer gold upon entering the paleochannel in bedrock faults and the nearside extremity of the channel bed, the Company looks forward to the prospects of excavating the gravels from the central portion of the channel, where the majority of the placer gold was recovered in the 2012 bulk sample,” Omineca noted.

The company is also exploratory drilling at the site, focusing on two main areas in close proximity to the underground project. The Skopos target is located atop the mountain beside Lightning Creek and the underground placer project, and Mary Creek is on a trend to the north, which shares similar characteristics to Wingdam.

Why Gold?

Investors typically jump back to gold as a safe harbor and a hedge against inflation in tough times. Dan Burrows of Kiplinger said investing in the precious metal “does tend to work in times of trouble.”

However, investors need to proceed with caution, or gold will “too often break your heart.”

“To be sure, gold ETFs and gold miner stocks can be effective tools in the hands of traders and tactical investors,” he wrote. “But that means knowing when to get in — and when to get out.”

Gold has been a more and more consistent performer than other precious metals when it comes to safeguarding wealth, wrote Anthony Tellez of Forbes.

“Gold can be bought to diversify one’s portfolio as it increases in value when paper investments, such as stocks and bonds, decline in value, even though gold is more volatile in the short term,” he wrote.

Ownership and Share Structure

About 37% of Omineca is owned by management and insiders, according to the company. Chief Executive Officer Tom MacNeill’s 49 North Resources Inc. owns 31.1% or 45.4 million shares, MacNeill directly owns 4.05% or 5.9 million shares, Chief Financial Officer and Director Andrew Davidson owns 1.92% or 2.8 million shares, and Director Sylvain Laberge owns 0.14% or 205,000 shares, Reuters said.

The rest, 63%, is retail.

Omineca has a market cap of CA$19.7 million, and has about 146 million outstanding shares, including 92.9 million of them free-floating. It trades in a 52-week range of CA$0.20 and CA$0.075.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Omineca Mining and Metals Ltd. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Ltd., a company mentioned in this article.

Research Capital Corp. Disclosures

Analyst Certification: I, Bill Newman, CFA, certify the views expressed in this report were formed by my review of relevant company data and industry investigation, and accurately reflect my opinion about the investment merits of the securities mentioned in the report. I also certify that my compensation is not related to specific recommendations or views expressed in this report. Research Capital Corporation publishes research and investment recommendations for the use of its clients. Information regarding our categories of recommendations, quarterly summaries of the percentage of our recommendations which fall into each category and our policies regarding the release of our research reports is available at www.researchcapital.com or may be requested by contacting the analyst. Each analyst of Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.

Relevant Disclosures Applicable to Companies Under Coverage: Relevant disclosures required under IIROC Rule 3400 applicable to companies under coverage discussed in this research report are available on our website at www.researchcapital.ca

General Disclosures: The opinions, estimates and projections contained in all Research Reports published by Research Capital Corporation (“RCC”) are those of RCC as of the date of publication and are subject to change without notice. RCC makes every effort to ensure that the contents have been compiled or derived from sources believed to be reliable and that contain information and opinions that are accurate and complete; RCC makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions which may be contained therein and accepts no liability whatsoever for any loss arising from any use of or reliance on its Research Reports or its contents. Information may be available to RCC that is not contained therein. Research Reports disseminated by RCC are not a solicitation to buy or sell. All securities not available in all jurisdictions.

Distribution Policy: Through www.researchcapital.com, our institutional and corporate clients can access our research as soon as it becomes available, 24-7. New reports are continually uploaded to the site as they become available throughout the day. Clients may also receive our research via Reuters, Bloomberg, FactSet, and Capital IQ. All of our research is made widely available at the same time to all Research Capital client groups entitled to our research. In addition, research reports are sent directly to our clients based on their delivery preference (mail, fax, e-mail).

Fair Dissemination of Research Reports and Ratings: To the extent reasonably practicable, Research Reports will be disseminated contemporaneously to all of Research Capital Corporation (“RCC”) customers who are entitled to receive the firm’s research. Until such time, Research Analysts will not discuss the contents of their reports with Sales and Trading or Investment Banking employees. RCC equity research is posted to our proprietary website to ensure eligible clients receive coverage initiations and changes in rating, targets and opinions in a timely manner. Additional distribution may be done by the sales personnel via email, fax or regular mail. Please contact your investment advisor for more information regarding RCC research.

Percentage Distribution of Research Ratings: As required by the Investment Industry Regulatory Organization of Canada, Research Capital provides a summary of the percentage of its recommendations that fall into each category of our ratings. Please click this link Our Research – Research Capital Corporation to see our distribution of ratings.

Potential Conflicts of Interest: All Research Capital Corporation (“RCC”) Analysts are compensated based in part on the overall revenues of RCC, a portion of which are generated by investment banking activities. RCC may have had, or seek to have, an investment banking relationship with companies mentioned in this report. RCC and/or its officers, directors and employees may from time to time acquire, hold or sell securities mentioned in our Research Reports as principal or agent. RCC makes every effort possible to avoid conflicts of interest, however readers should assume that a conflict might exist, and therefore not rely solely on this report when evaluating whether or not to buy or sell the securities of subject companies.

The information contained in this report has been drawn from sources believed to be reliable but its accuracy or completeness is not guaranteed, nor in providing it does Research Capital Corporation assume any responsibility or liability. Research Capital Corporation, its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein. Contents of this report cannot be reproduced in whole or in part without the express permission of Research Capital Corporation. US Institutional Clients – Research Capital USA Inc., a wholly owned subsidiary of Research Capital Corporation, accepts responsibility for the contents of this report subject to the terms and limitations set out above. US firms or institutions receiving this report should effect transactions in securities discussed in the report through Research Capital USA Inc., a Broker – Dealer registered with the Financial Industry Regulatory Authority (FINRA).