Michael Ballanger of GGM Advisory Inc. shares his thoughts on current movements in the stock market as well as one gold stock he believes is a Buy.

If Nvidia (NVDA:NASDAQ) is the poster child for “irrational exuberance version-2024,” then the clarion call for “irrational revulsion” must be Newmont Corp. (NEM:NYSE), the largest gold producer in the world that just decided to dump six bottom-tier projects that cost them an arm and a leg over the past decade in an expansion plan that has resulted in the following result:

- The reported net loss of $2.5 billion was driven by $1.9 billion in impairment charges, $1.5 billion in reclamation charges, and $464 million in Newcrest transaction and integration costs; these items are excluded from adjusted earnings results.

Their AISC has risen from $1,233/oz. in 2023 to $1,444/oz. while Net Free Cash Flow for a company generating $2.8 billion in revenue was a paltry $88 million. The decision to dump those bottom-tier projects is simple: their institutional shareholders are totally disgusted with the way the company is being run. They say that the brokerage industry is notorious for its “Hire at the top; Fire at the bottom” approach to recruiting.

In the gold mining business, every major producer has streamlined operations to reflect better cash management except Newmont. So, with only a pittance of free cash” being generated from that mountain of processed rock, they decide to bring to perfection the “Buy high; Sell low” expansion strategy. It is no wonder that the Senior Gold Miner ETF (GDX:US) is sitting here at within $0.54 of a 52-week low.

Thank you, Newmont.

After over 45 years in the capital markets, most of which were focused on the precious metals exploration and development names, I am constantly amazed that any young person looking to build a portfolio of winners would ever be drawn to the mining industry. Forget the fact that technology is sexier, trendier, and more socially acceptable than climate-threatening resource extraction. Instead, focus on one simple reality: gold miners are lousy investments.

GDX:US topped out in August 2020 along with a gold price that broke the $2,000/oz. barrier for the first time. Since then, gold has been able to stay elevated as central banks and Asian buyers inhale the physical product. However, thanks largely to the overweighted position held in Newmont by the GDX:US ETF, investors seeking the leverage of shares over physical have lost money. You could have bought shares in Tesla Inc. (TSLA:NASDAQ) rather than the GDX:US in August 2020 at $100 and still have a double despite TSLA’s horrid operating performance and 53.7% decline from its 2022 top.

The gold bugs have been talking about the looming upside explosion in gold for years, and they are even more adamant about silver. Eric Sprott was recently saying that “the silver bull will only start at $50!” while Peter Schiff continues to tell Bitcoin holders that they had better dump their crypto and reallocate to gold immediately lest they lose all their money.

In August 2020, when GDX traded at $42, BTC could have been bought at $11,000 per coin. Today, it is over $50,000, with GDX at $26.16. Is it any wonder that the youngsters who run all the money these days avoid the gold miners?

Now, I am a fervent bull on the outlook for gold bullion prices and think that, eventually, silver will follow along. However, in the cold, hard light of day, gold mining companies are not gold bullion. Back before the turn of the century, they were beautiful leverage plays to the gold price, but since the GFC in 2008 and the creation of all forms of surrogate welfare-state programs aimed at protecting the U.S. equity markets, the Pavlovian dinner bell prompted the new wave of youthful stock investors to own anything but the gold miners.

Fed rate cuts coming?

Buy NVidia.

Unemployment figures rising?

Buy Super Micro Computer Inc.

Inflation running “hot”?

Buy Bitcoin and avoid currency debasement.

High-traffic podcast celebrities love to use the old horse chestnut that “I love to buy that which is hated” but investors that have followed that steaming pile of dogma since 2020 and bought into the most-hated asset class — silver stocks followed closely by gold stocks — have been taught a valuable lesson that may have been neglected by these rockstar resource gurus and that is you might want to wait until the “hate meter” goes total “red line” before you let your contrarian investment strategy take you kicking and screaming into the poor house.

Having been a firm believer back in 2020 that soaring debt levels and deficits the world over would send investors piling into gold first and then the miners with the biggest leverage plays being the junior gold developers, I look into the mirror and ask what set of circumstances could be more gold-bullish than where we are today. Fiscal and monetary mayhem, geopolitical unrest, pandemics, shutdowns, and raging inflation have failed to send the kiddies into the gold and silver space.

Copper

Time has proven that tech stocks are a better inflation hedge than anything, and that is not going to change until the markets make it change. Until then, I will focus on the one metal that the kiddies can understand — copper. They understood and bought into the lithium narrative until it no longer worked, but not before taking enormous profits out of the battery metals mania.

Next, they fully grasped the notion that the cleanest replacement for fossil fuels in the expansion of the electrification movement was nuclear power, and the metal driving that mania was (and is) uranium. They have been taking enormous profits out of that frenzy as well. While fundamentals for lithium and uranium are diametrically opposite, uranium demand is going to go vertical as newly constructed reactors go online. The kiddies get that.

However, they have learned that when a sector stops treating them nicely, they bolt. Since the arrival of 2024, the uranium stocks have been correcting, with Cameco Corp. (CCO:TSX; CCJ:NYSE) now closing in on bear market territory. That leaves the one metal so critical to the electrification movement — copper — and it is my opinion that this new wave of money managers looking to build upon the massive profits bestowed upon them by avoiding the gold and silver space is going to see the demand-supply dynamic that is estimated by every analyst on the planet to take copper to $6-8/lb. by the end of the decade. Just as the move in lithium from 35,000 CNY/mt to 600,000 CNY/mt made billionaires in 2022, the move in uranium from $20/lb. to $106/lb. made billionaires in 2023. A move in copper from $3.80 to $6-8 will have the same effect on the junior copper stories that similar moves had on the junior lithium and uranium stories.

That is why I am loading the portfolio cannon with copper names, and that will continue until I see fifty tweets an hour talking about $10/lb. copper. Right now, nobody is even glimpsing at copper, and that is why I want to own it.

That is why I am loading the portfolio cannon with copper names, and that will continue until I see fifty tweets an hour talking about $10/lb. copper. Right now, nobody is even glimpsing at copper, and that is why I want to own it.

I do not know whether to melt down in a fit of envy or simply to resign myself to the inconvenient truth that today’s emerging legions of stock investors prefer the finished product to the raw materials when it comes to a microchip that sells for $10,000 that allows a robot to have a semi-lucid conversation with you.

The fact remains that copper remains a critical component of the technology sector whether found in motherboards, the power cords, or the microchips described in the graphic posted to the left.

GLD:US

For the past three weeks, I had been drawing reference to those two rising moving averages (100 and 200-dma lines) and how my entry level was going to be in the mid-range of that convergence zone. Well, I got that move on Valentine’s Day, but I was so busy dealing with overpriced “wilty” long stems for my sweetheart that I missed the move.

GLD:US traded beautifully down through the upper boundary of the convergence zone to $183.78 (100-dma was at $184.33) and promptly reversed upward, triggering a textbook MACD “buy signal” and an upturn in the Money Flow Indicator as well. I could have sworn it was waving “bye-bye” at me (while thumbing its nose) as it rocketed northward, closing higher last week and again this week to go out at $188.62 after trading as high as $189.18.

They say that a man has to “pay the price” for love, so I guess I will have to grin and bear it, but I waited for nearly a month to re-establish that position and to have it elude me in favor of domestic harmony is somewhat maddening. Based on my revised entry point for the GLD call options, I figure that a dozen roses cost U.S. $2,300, and while my significant other most certainly is worth the consideration, I may need to learn how to set price alarms on my cell phone to avoid costly mistakes like that in the future.

I wound up taking a 60% position in the GLD June $185 calls under $8 but refrained from adding on Friday as prices took a sizeable leap northward as the Chinese buyers returned to the market after their New Year celebrations. As exasperated as I am with the gold miners, there is nothing wrong whatsoever in the technical set-up for gold bullion. I am adamant that new, all-time, sustainable highs will be seen by the end of Spring and that once the shackles of suppression are broken, the move in gold will drag the miners (and silver) higher. If mean reversion is to be normalized, the amplitude of the move in gold mining stocks will turn more than a few heads.

Cameco Corp.

It was on January 12 that I told subscribers that I was liquidating all Cameco Corp. (CCO:TSX; CCJ:NYSE) stock and option holdings as well as a long-term position in Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) with the former trading above $51 and the later on its way to its 52-week high at CA$2.60.

Hard to imagine but the first purchase I made of WUC shares was in 2017 at $1.70 so it took seven years to finally muster up the courage to exit. Within a few hours of the blogosphere and Twitterverse learning of my decision to exit, my email and Twitter inboxes were inundated with accusatory messages, with the common theme being that I did not “get it,” as in the correct interpretation of the uranium story and why I was going to regret my decision “for the rest of my life.”

One email exchange had the sender reciting the ten reasons that uranium was going to $300/lb. and why CCJ was going to $100. It reminded me of the lithium narrative a year ago going into PDAC 2023 with lithium deals the talk of the town.

Cabbies shuttling conference attendees back and forth between Yorkville and the Metro Convention Centre were reciting the ten reasons why lithium was headed to $1 million per pound and why anyone selling was “an idiot.”

I tried to explain that every single one of those ten reasons contained in the uranium narrative perfectly rationalized the move from under $20 in 2017 to over $100 in 2024. If the average investor is able to recite the reasons why any particular narrative justifies a move, the move is usually over. That is just the reality of how the discounting mechanism works in capital markets.

Now, despite the outrage in the retail community over this much-needed correction, I am no longer a seller of the uranium or lithium names; in fact, I am looking to buy back my position in Cameco Corp. at around the 200-dma at $38.09. since my sell above $51, it has shed over 21% from the all-time high at $51.33, so while it is technically now in bear market territory, I urge the angry young men out there to revisit the ten reasons why uranium trades 400% higher than where it was in 2020.

The CCJ exit was based 100% on sentiment and had nothing to do with the demand-supply equilibrium that is as bullish as I have ever encountered in forty-five years of carving up capital markets. I remain a bear on the lithium space because EV demand is quickly waning, and that spells “glut” in the lithium-ion battery world.

If that structural deficit fails to return before 2028, a great many hard-rock projects are going to be mothballed, and if there is any three-word combination that is universally hated by mining investors, it is “care and maintenance.”

Getchell Gold

One of the biggest challenges of my career was completed successfully last month thanks to the contributions made by Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) shareholders in raising over CA$3.5mm in an extremely difficult funding environment.

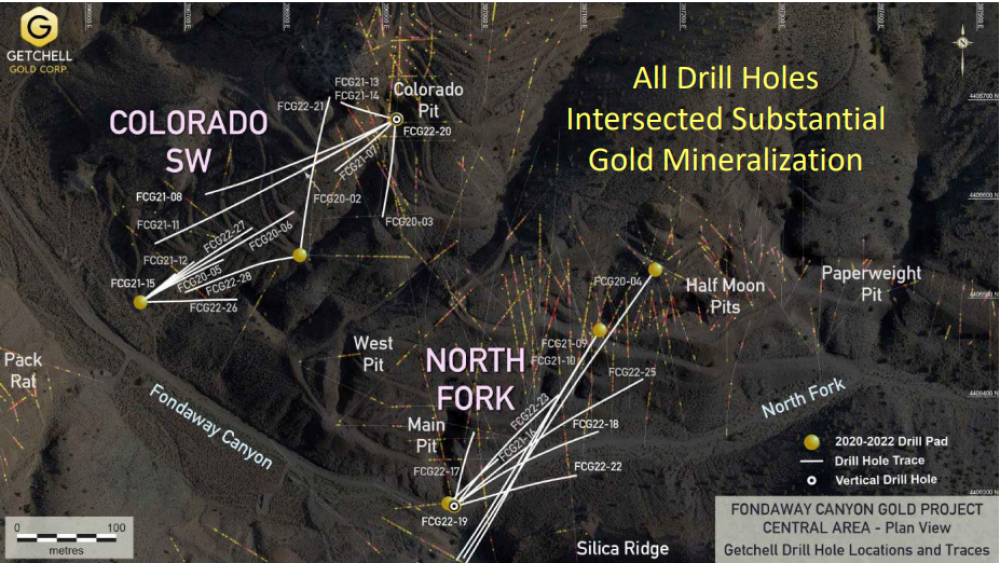

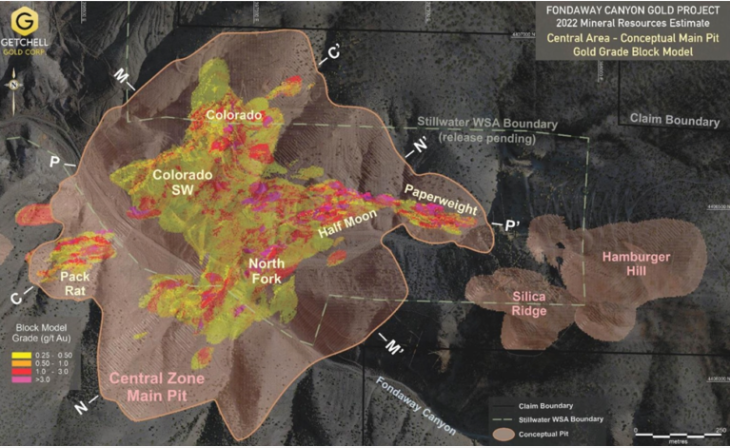

When I was in the investment banking world in my past life, I recall some difficult raises that involved actually earning one’s fees, but nothing will ever compare to the difficulty in winning over new investors to a project (Fondaway Canyon, Nevada) that has an inferred and indicated resource of over 2 million ounces of gold, wide open along strike in all directions and to depth.

This successful financing allowed GTCH to make the final payment of US$1.6 million to Canagold Resources Ltd. and secure 100% ownership of the Fondaway Canyon project. During the last quarter of 2023, in discussions with various investor groups, it became apparent that Getchell was suffering from an image problem.

Having been a shareholder since 2018 and during the acquisition of the project, I could never understand why the prior owners sold it to Getchell because some of the high-grade intercepts (like 25m of 10.4 g/t Au in 2022) were simply spectacular.

However, I found that many of the prospective investors were getting negative feedback from bankers and brokers that Fondaway has either metallurgical issues that prompted many of the prior owners to walk away.

Yesterday, I learned that the actual reason that prior operators declined to advance the project had nothing to do with the drilling results or the metallurgy. Up until last year, there was a zone called the Stillwater “Wilderness Survey Area” (“WSA”) that was actually infringing upon the boundaries of the proposed open pit. In fact, former operators Canagold Resource Corp. completed a 43101-compliant report in April 2017 that makes reference to “possible pit constraints” related to the WSA boundary.

Well, in 2023, the state ruled on the boundary, and it was pushed back by over a kilometer from the proposed pit locations. In other words, the presence of the WSA is no longer an issue. In the past, operators felt that any exploration along strike would infringe upon the WSA so not only did they refrain from engaging in further exploration efforts, they felt that the issue was far too sensitive to engage the legislators. Getchell management did engage, and after the ruling opened up the ground, they moved with laser-like speed to stake the ground required to protect them and thus ensure that it remained wide open along strike and able to model a starter pit on 100%-owned ground.

If one follows the chain of events in the history of Fondaway Canyon dating back to the 1980s, it was never about the geology or the prospective nature of the deposit; it was always about the implications of the WSA on long-term planning. Each operator that owned it engaged in exploration and in limited open-pit mining, but they could never advance it. As for why I missed it is beyond me but if you drill down into the timeline, each prior operator got stymied by the WSA and Getchell was reluctant to broadcast the pending ruling because they did not want to alert competitors to the land being opened up because Getchell wanted to stake it.

Getchell is in the process of completing a metallurgical survey on Fondaway that will be needed in advance of the upcoming PEA and revised resource estimate. The deposit is classified as a “Tier Three Asset,” but at 3 million ounces, it moves to a “Tier Two Asset,” and while majors are inclined to stick with only a “Tier One Asset” (5 million ounces or more), a “Tier Two Asset” could easily attract the interest of a mid-tier suitor. It is estimated that a $5 million budget could move the needle to “Tier Two,” and if that happens with an improved funding environment in 2024, I can see a value-per-ounce threshold of at least $50/ounce.

If gold prices catch the bid that I expect by year-end and see a major break-out above $2,500/oz., that value-per-ounce number will be closer to $100/oz. A “Tier Two Asset” in that environment would be worth $300 million in M&A verbiage. If one assumes that there will be 200 million shares issued by the time the drilling funds are raised and if one further assumes that President Mike Sieb can duplicate the uncanny “hit ratio” demonstrated from 2020 to 2022, the valuation for Getchell will grow to around $1.50 per share. (Last trade was $0.1015.)

Now, the junior gold developers are still mired in the muck of dour sentiment that emanates from the top and resonates right down the gold miner food chain, starting with the NEM fiasco impacting everyone. However, this too shall pass, and when sentiment shifts with the resolution of the gold price revaluation, the leverage contained in the junior developer space will be compelling. It has been a long grind with GTCH, but I see the light at the end of what has been a very long tunnel it is indeed daylight and not the twinkle of quartz halogens barrelling towards us. Getchell Gold is a “Buy.”

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp., Western Uranium and Vanadium Corp., Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Nvidia Corp. and Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice, and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.