After speaking with the president and CEO of Arizona Silver Exploration Inc., editor and publisher of The National Investor, Chris Temple, shares why he believes its Philadelphia Project is compelling.

I spoke with Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) president and CEO, Mike Stark, last Friday morning to get an update; and was reminded again why this company’s story and specifically its Philadelphia Project was so compelling to me when I added the company to my recommendations earlier this year.

This frugally-run company has quietly been adding potential resource ounces of gold and silver as it drills one of the most geologically unique projects I’ve ever seen.

Also, Friday morning, a video was released where Vice President of Exploration Greg Hahn summed up drilling success to date.

Check it out!

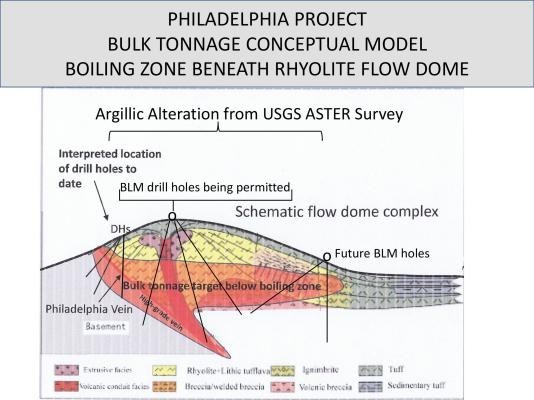

The old saying is that a picture is worth 1,000 words: and that’s especially true here, given this graphic that I shared first back in February.

What’s unique about what looks like a porphyry or similar structure the company is sitting on is that it’s been almost completely covered by a huge rhyolite dome.

Given that the overwhelming majority of historical mining activity in this area of Arizona — the Oatman Mining District — was done in decades past, little ability existed to understand what this huge dome might be covering.

Largely small-scale tinkering around the edges was done with what could be seen with the naked eye; not uncommon in most places in decades past, as you know.

The thesis the company has had is that this dome covers not only an array of vein and breccia systems, with some disseminated gold and silver also.

It’s also thought that — underneath the dome where a potential bulk tonnage, an open-pittable resource might lie (looking at the numbers to date, via drill intercepts and the like, a calculation of now just over one million ounces gold equivalent has been seen; NOT yet in a compliant NI 43-101 form, however!) there could be a FAR richer area that runs substantially higher grade than what has mostly been encountered thus far.

I say “mostly” because one recent hole that the company drilled — Hole 91 — which made it down 900 feet or so was noteworthy in that the final 15’ or so saw gold and silver grades which were respectable enough on the way, in several places, triple before the hole ended.

One global expert on such systems the company brought in concurred with the idea that they were just beginning to get into the far richer source of what’s been encountered higher.

It’s hoped that drilling in Q4 and into 2023 (among other things, of course, AZASF plans to drill a few holes in the vicinity of and deeper than Hole 91) will go a long way to demonstrating that — between the shallower open-pittable material and the higher grade source — Arizona Silver could be sitting on three-four million ounces just at Philadelphia.

With a CA$14 million market cap or so at last week’s end, Arizona Silver Exploration is hardly the only promising company priced at peanuts. But its geological model and story are more compelling than most.

Further, that most of the stock has obviously been in strong hands (notwithstanding last Friday’s drop, AZASF has still fared better than most of its peers in relative terms) is apparent.

And both Stark and Hahn have invested healthy six figures into the company’s shares from their own pockets.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Chris Temple Disclosures:

The National Investor is published and is e-mailed to subscribers from [email protected] The Editor/Publisher, Christopher L. Temple may be personally addressed at this address, or at our physical address, which is: National Investor Publishing, P.O. Box 1257, Saint Augustine, FL 32085. The Internet web site can be accessed at https://nationalinvestor.com/. Subscription Rates: $275 for 1 year, $475 for two years for “full service” membership (twice-monthly newsletter, Special Reports and between-issues e-mail alerts and commentaries.) Trial Rate: $75 for a one-time, 3-month full-service trial. Current sample may be obtained upon request (for first-time inquirers ONLY.) The information contained herein is conscientiously compiled and is correct and accurate to the best of the Editor’s knowledge. Commentary, opinion, suggestions and recommendations are of a general nature that are collectively deemed to be of potential interest and value to readers/investors. Opinions that are expressed herein are subject to change without notice, though our best efforts will be made to convey such changed opinions to then-current paid subscribers. We take due care to properly represent and to transcribe accurately any quotes, attributions or comments of others. No opinions or recommendations can be guaranteed. The Editor may have positions in some securities discussed. Subscribers are encouraged to investigate any situation or recommendation further before investing. The Editor receives no undisclosed kickbacks, fees, commissions, gratuities, honoraria or other emoluments from any companies, brokers or vendors discussed herein in exchange for his recommendation of them. All rights reserved. Copying or redistributing this proprietary information by any means without prior written permission is prohibited. No Offers being made to sell securities: within the above context, we, in part, make suggestions to readers/investors regarding markets, sectors, stocks and other financial investments. These are to be deemed informational in purpose. None of the content of this newsletter is to be considered as an offer to sell or a solicitation of an offer to buy any security. Readers/investors should be aware that the securities, investments and/or strategies mentioned herein, if any, contain varying degrees of risk for loss of principal. Investors are advised to seek the counsel of a competent financial adviser or other professional for utilizing these or any other investment strategies or purchasing or selling any securities mentioned. Chris Temple is not registered with the United States Securities and Exchange Commission (the “SEC”): as a “broker-dealer” under the Exchange Act, as an “investment adviser” under the Investment Advisers Act of 1940, or in any other capacity. He is also not registered with any state securities commission or authority as a broker-dealer or investment advisor or in any other capacity.

Notice regarding forward-looking statements: certain statements and commentary in this publication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 or other applicable laws in the U.S. or Canada. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of a particular company or industry to be materially different from what may be suggested herein. We caution readers/investors that any forward-looking statements made herein are not guarantees of any future performance, and that actual results may differ materially from those in forward-looking statements made herein.

Copyright issues or unintentional/inadvertent infringement: In compiling information for this publication the Editor regularly uses, quotes or mentions research, graphics content or other material of others, whether supplied directly or indirectly. Additionally he makes use of the vast amount of such information available on the Internet or in the public domain. Proper care is exercised to not improperly use information protected by copyright, to use information without prior permission, to use information or work intended for a specific audience or to use others’ information or work of a proprietary nature that was not intended to be already publicly disseminated. If you believe that your work has been used or copied in such a manner as to represent a copyright infringement, please notify the Editor at the contact information above so that the situation can be promptly addressed and resolved.

Disclosures:

1) Chris Temple: I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: Arizona Silver Exploration Inc. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None. Chris Temple’s and The National Investor disclosures are listed above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algernon Pharmaceuticals Inc., a company mentioned in this article.