Dominic Frisby of The Flying Frisby takes a look at Bitcoin, as well as one gold stock believes is worth keeping an eye on.

Bitcoin has gone bananas. I’m sure you heard. There were new all-time highs yesterday, albeit briefly.

Here is a stat to get you salivating: the time it took for Bitcoin to double following previous all-time highs:

Dec 2020: 18 days.

March 2017: 84 days.

Nov 2013: 10 days.

March 2013: 18 days.

Each double is always harder than the last because of the amount of new capital required. Then again, the ETFs are enabling a lot of that new capital.

Our way-to-play-via-a-broker, MicroStrategy Inc. (MSTR:NASDAQ), has gone even more bananas. How about this for a chart?

I know some readers have been trying to trade it. Probably best to close your eyes and hold.

It’s a good time to be a holder.

Bull markets don’t last forever, though. Enjoy them while they last.

There is an outside chance we put in a top — a double top — at $69,000, the old high. Some selling at that level was inevitable, as forecast. I think it more likely is that, as I mentioned last week, this bull market has another year in it.

That said, there really is so much noise about Bitcoin that I am a little concerned. It might just be my social media feeds, though.

One major positive is that I haven’t been asked on TV yet to talk about it, so we are probably good for the time being.

The U.S. stock markets, meanwhile, are flirting with all-time highs as well and getting lots of attention. Like Bitcoin, the S&P 500 also makes up a core part of the Dolce Far’ Niente portfolio.

Meanwhile, under the radar, in what must be the most unhyped breakout in history, another of our core holdings, gold, is also hitting new highs. Monday was its highest close of all time. It’s like a crack-up boom.

Silver has been lagging. That is not normally a good sign. Miners have been woeful, though they have turned up a bit, albeit from extreme lows. That is not a good sign, either. But the lack of hype is good. As is the fact that it has come in the face of a dollar that is by no means weak, while real yields are on the high side too. As my friend Charlie Morris puts it, “A quiet bull market is a good bull market.” (You should subscribe to his letters, by the way. He is the mutts’ nuts. Get a month’s trial here).

If you are interested in buying gold and are not sure how I have recently put together a guide (see PDF below). I have a feeling we are going to need it in the not-too-distant future. My recommended bullion dealer is Pure Gold Company.

I’m also going to update my guide to buying Bitcoin as soon as I get a moment.

Gold Miners

But today, I’d like to turn to what must be the most unloved, overlooked, and loathed sector in the stock market: gold miners.

How long can this sector remain so bombed out? It’s hard to see how it can go much lower.

In particular, I’d like to focus on one specific gold miner, the excitement over which was what led me to start this Substack two years ago.

I met with management last week. Here is what I found out.

Late last year, Moneta Gold Inc. (MEAUF:OTCMKTS) merged with another Canadian development play, Nighthawk Gold Corp. (NHK:TSX.V), to form what might be the worst-named company on the entire Toronto Stock Exchange: STLLR Gold Inc. (MEAUD:OTCMKTS;STLR:TO). My original write-up on the deal is here.

What’s In A Name?

During the lunch, several disgruntled shareholders asked management what they were thinking with a name like that. Apparently, some brand consultant somewhere suggested it, advising that vowels are passé. Presumably, lowercase letters are, too. They then ran a poll — though not a poll of shareholders, just a poll of randoms — and of all the possible names, STLLR came out on top. How bad must the other names have been, we wonder. STLLR is pronounced “stellar,” by the way.

Why not run something as fundamental as a name past shareholders and poll those who actually have a vested interest? It would have engaged shareholders straight away with the future of the company. Instead, it has alienated them.

To me, this immediately bodes badly. First, because it reveals that management’s first instinct is not shareholders, this concern is amplified when you discover management only owns 1% of the company. Second, it shows poor judgment and a lack of vision.

Still, what’s underground is more important to a mining company than what it’s called, so let’s move on.

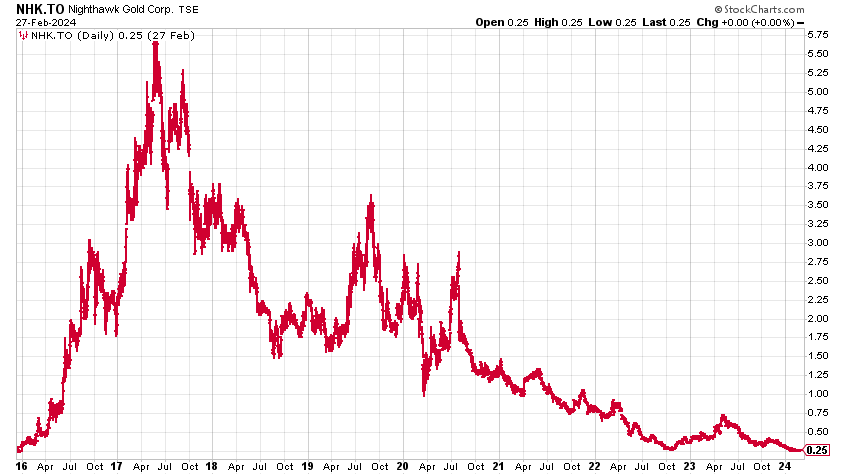

The new board is more Nighthawk-heavy than Moneta. Then, when we look at how Nighthawk has performed, we have another alarm bell. From CA$5.75 to 25 cents in six years.

I have to say, I warmed to the new CEO, Keyvan Salehi, a lot. He is an Iraqi-born Canadian national, a mining engineer by trade. He keeps himself in good shape — always a good sign — and he looks the part. He presented well, competently dealing with the room and the verbose shareholders. He has been involved in four mine builds, including two in Timmins (where STLLR’s flagship asset, the Tower Gold project, is located), so he knows the district and the project well (he has tried to buy it twice in the past). He is also married to a mine-builder (she is the COO of Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), which is one of the companies I hoped might buy Moneta). He’s a mining guy through and through in a mining family. The vast majority of his time will be spent promoting rather than engineering or building, but he’s good at it.

The new board is young by mining standards, which may or may not be a good thing.

Salehi described this market as the worst he has known in 20 years. I’m not sure I agree with that. 2011 to 2015 was worse. But it’s a horrible market; I’ll give him that. He then went on to explain the reasons for the merger.

Reasons for the Merger

- There are too many names in the junior market. This merger creates a standout name. With over 20 million ounces, this becomes the largest development play in North America.

- With 100 million total shares and 5 million warrants about to expire worthless, the consolidated structure is much tighter and cleaner.

- It will save some US$3 million in G&A costs alone.

- It created an opportunity to raise capital. The company raised CA$30 million (including flow-through), and that will get it through the next 24-30 months, by which time numerous milestones will be reached. That capital reduces the chance of an opportunistic bid, which would see either company taken out on the cheap.

- Even though Nighthawk is located a long way away from Timmins in the Arctic Circle, so there are no regional synergies, there are plenty of operational synergies: for example, one asset they can only drill in the summer, the other only in winter, so now there can be year-round drilling, rather than six months off. (There is also that saving in G&A)

Ownership of the company is roughly 40% retail, 45% institutions, 15% strategics, and just that 1% management. I don’t like that last number. But Salehi was at pains to point out he has reinvested his last four years of salary and bonuses in the stock.

That is good. Like the rest of us, he is sitting on a big loss. Salehi likes Moneta’s Tower Gold project a lot. As already noted, he tried to buy it twice before. In terms of jurisdictional and political risk, with so many existing and past-producing mines in the region, the Abitibi Green Belt must be one of if not the best mining districts in the world.

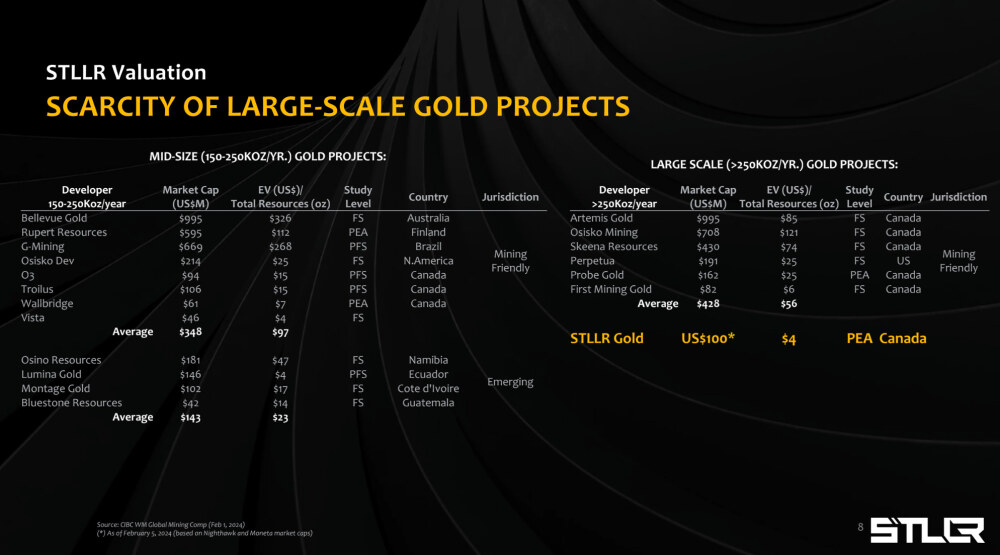

Salehi was at pains to show just how undervalued the Tower Gold project is on a per-ounce basis relative to peers, both locally and worldwide. Moneta, at the time of the merger, was valued at around US$6/oz against a peer average north of US$50/oz. In this regard, he showed this table.

He then ventured the following theory: that Moneta and, like it, First Mining Gold Corp. (FF:TSX), are valued this low because people do not believe there will ever actually be a mine there. Artemis, Osisko, and Skeena get higher valuations because the market knows there will eventually be a mine.

So How To Persuade the Market Tower Gold Can Be a Mine?

To provide geological assurance, there are three categories of ounces in the ground: Measured, Indicated, and Inferred. A measured resource has the most geological confidence, and an inferred the least.

At present, Tower Gold has 8.3 million ounces of inferred gold and 4.5 million ounces of indicated. Salehi feels that if he can get a large portion of those ounces upgraded from inferred to indicated, that will go a long way to persuading the market of Tower Gold’s potential.

This was, I should say, already part of the Moneta strategy, and a large allocation of last season’s efforts were spent on in-fill drilling with this in mind. There were 75,000 meters of drilling last year, and over the next six months, these will be reflected in an upgraded Mineral Resource Estimate (MRE) and an upgraded Preliminary Economic Assessment (PEA), both of which, it is hoped, will go a long way to persuading the market of the legitimacy of the Tower Gold project.

One thing we may even see if Salehi uses a higher cut-off, which he thinks he is going to do, is that the overall number of ounces will come down, even if the quality of those ounces improves. Fewer ounces, but of better grade, then, and grade, as they say, is king. (A 10% increase in grade can mean a 30% increase in profitability).

Will the market care? It hasn’t so far. But I’m persuaded that it might.

The other hope is that the projected mine life at Tower Gold will get a lot longer. It will all look a bit more shovel-ready, as they say.

Tower Gold is the priority for the moment, as Salehi feels an upgraded MRE there is worth more to the company than an upgraded MRE at Colomac, which already has a higher number of indicated ounces. (Broadly speaking, Moneta had more ounces than Nighthawk, but Nighthawk had better ounces. This enabled the merger).

There are several mills close to the Tower Gold project with excess capacity, and another possibility Salehi will examine is the potential for a bulk sample. That is something I would really like to see. Bulk samples can transform expectations. I’ve seen it many times.

Meanwhile, there is Colomac in the Arctic Circle, Nighthawk’s flagship project. At 950 km², it is enormous, and the potential here is huge. We could be talking about an entire district, three times the size of Timmins, with decades of potential production. It will need a lot of drilling — that means money spent — first though. That will have to wait. Currently, it has 5m ounces of gold (3.4m indicated, 1.7m inferred) at its main property.

Conclusion

Moneta Gold started so well for readers, appreciating by 50% in the first few months. It has since slid and slid with the broader markets, and now we need a triple or a quadruple to get back to breakeven. It may not feel like it, but such a thing and more is possible with a bit of a bull market energy.

I think STLLR is as reasonable a play as you will find on junior gold mining. I like this management. I’m happy to leave my money with them to make a go of this. I think the strategy is right. It may be that we don’t even need a proper bull market to get this thing moving, just no more relentless bear market. An upgraded MRE and PEA might prove enough to get the company perceived alongside its peers. Heck, if we could get Tower Gold valued at US$50/oz, then the drinks are on me.

Thanks very much for reading this. If you would like to read more you can subscribe at The Flying Frisby.

| Want to be the first to know about interesting Cryptocurrency / Blockchain, Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Agnico Eagle Mines Ltd.

- Dominic Frisby: I, or members of my immediate household or family, own securities of: MicroStrategy Inc. and STLLR Gold Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Dominic Frisby Disclosures: This letter is not regulated by the FCA or any other body as a financial advisor, so anything you read above does not constitute regulated financial advice. It is an expression of opinion only. Please do your own due diligence and if in any doubt consult with a financial advisor. Markets go down as well as up, especially junior resource stocks. We do not know your personal financial circumstances, only you do. Never speculate with money you can’t afford to lose.