One trend in the precious metals markets which has yet to get widespread coverage but deserves more attention is the plummeting inventories of physical silver in the London vaults of the London Bullion Market Association (LBMA). These LBMA vaults comprise vaults in and around London run by the bullion banks JP Morgan, HSBC and ICBC Standard Bank, as well as the London vaults of three security operators, Brinks, Malca-Amit and Loomis. London sub-Billion Market Association

Hemorrhaging

Quietly, and almost under the radar, the quantity of silver held in the LBMA vaults has been consistently hemorrhaging for 7 straight months now. Latest data from the LBMA as of the end of June 2022 shows that the LBMA vaults now hold only 997.4 million ozs of silver (31,023 tonnes).

Compared to the end of June 2021 when LBMA silver inventories stood at 1.18 billion ozs (36,706 tonnes), the LBMA vaults’ June 2022 month-end silver inventories are now 182.7 million ozs (5,683 tonnes) lower than a year ago, in other words a whopping 15.48% lower compared to June 2021.

Notably, most of this freefall in London silver holdings has occurred since the end of November 2021, with LBMA silver inventories having consistently fallen each and every month since then. From the end of November 2021 when the LBMA London vaults reported holding 1.17 million ozs of silver (36,422 tonnes), silver inventories have fallen by a cumulative 173.5 million ozs (5,398 tonnes). That’s a 14.82% drop over 7 months from end of November 2021 to the end of June 2022.

Below 1 Billion Ounces

In addition, these June 2022 LBMA silver holdings are

-

- the lowest LBMA silver inventories since December 2016 and

- the first time since November 2016 that the LBMA silver inventories have fallen below 1 billion ozs

Over the exactly 6 year period since monthly LBMA silver inventory data was first published in July 2016, there has never before been a 7 month period (nor a 6 month period) in which the LBMA silver holdings fell consistently each and every month.

The only partially comparable time period across the data series was when LBMA silver holdings fell consistently in each of 5 months between April and August 2020, and that was during the LBMA – COMEX (Exchange for Physical (EFP)) crisis when the LBMA bullion banks in panic mode were forced to transport huge amounts of silver (and gold) bars from the LBMA London vaults to the COMEX vaults in New York to meet the delivery requirements on futures contracts so as to prevent gold and silver prices moving into real price discovery mode.

Over that 5 month period between April and August 2020, the LBMA silver inventories dropped by 102.2 million ozs (i.e. a drop of 8.7%). But to put it into context, the current hemorrhaging of silver from London of 182.7 million ozs that has been ongoing since June 2021 is now approaching a figure that is twice as large as the April – August 2020 LBMA silver vault outflows from London.

Lack of Underpinning

On its website, the LBMA disingenuously claims that the silver (and gold) held in its London vaults “provide an important insight into London’s ability to underpin the physical OTC market.”

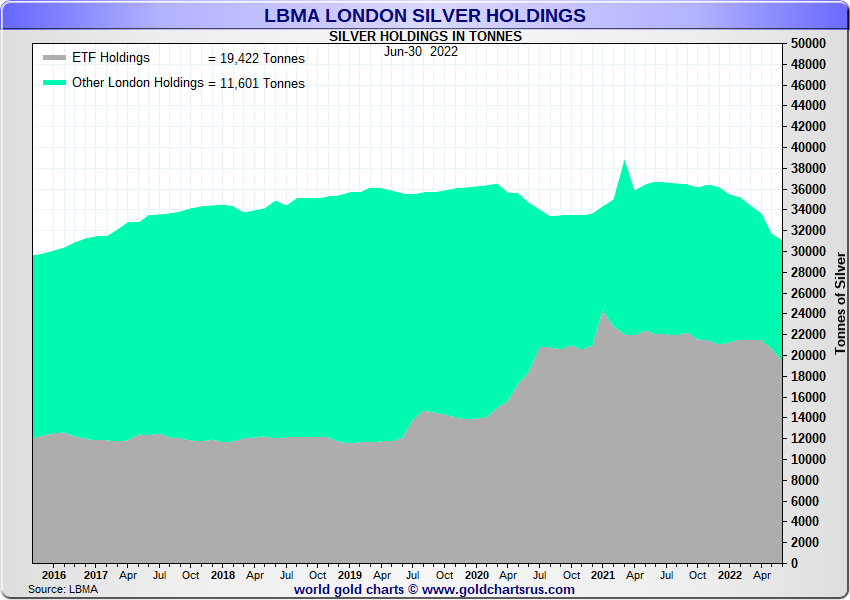

What the LBMA doesn’t say however, is that of the 31,023 tonnes of silver that it claims was held in the LBMA London vault warehouses at the end of June 2022, a massive 19,422 tonnes, or 62.6% of this total, represented silver held in the LBMA London vaults that was owned by Exchange Traded Funds (ETFs) such as the iShares Silver Trust (SLV), the Wisdomtree Physical Silver ETC (PHAG), and the Aberdeen (abrdn) Physical Silver Shares ETF (SIVR).

Which means that as of month-end June 2002, only 11,601 tonnes of silver, or 37.4% of the 31,023 tonne LBMA vault total, was not held within ETFs.

Based on a quick calculation to update those June month-end figures with data from 25-26 July 2022, the current position of ETFs which store their silver in the LBMA London vaults and the amount of silver which they store in London is as follows:

SLV ishares Silver Trust 12,357.7 tonnes

SSLN iShares Physical Silver ETC 710.3 tonnes

PHAG Wisdomtree Physical Silver ETC 2,514.2 tonnes

PHPP Wisdomtree Physical PM ETC 42.7 tonnes

SIVR Aberdeen Physical Silver Shares ETF 1,466.0 tonnes

GLTR Aberdeen PM Baskets shares ETF 382.7 tonnes

PMAG ETFS Physical Silver 239.0 tonnes

PMPM ETFS Physical PM Basket (part of PMAG total)

SSLV Invesco physical silver ETC 355.8 tonnes

4 ETFs Xtrackers Physical silver ETCs (4 combined) 766.6 tonnes

Together these 13 ETFs currently hold 18,835 tonnes of silver in the LBMA London vaults.

But there’s more. Because as well as the ETFs listed above, additional silver which is part of the LBMA vault figures is held by clients of BullionVault and GoldMoney. BullionVault clients hold 491.2 tonnes of silver in the LBMA vaults in London, while GoldMoney clients hold 187.8 tonnes in the LBMA vaults. Adding these two figures to the ETF total means that as of 26 July 2022, a massive 19,514 tonnes of silver claimed to be held in the LBMA London vaults is held by silver-backed ETFs and private client investors, and has nothing to do with “London’s ability to underpin the physical OTC market”.

But wait, there’s more, because while the silver inventories held by ETFs and platforms such as BullionVault and GoldMoney are ‘transparent’, or in other words ‘reported bullion stocks’, there are also custodian vaulted stocks in the LBMA London vaults which go unreported, these being the allocated silver holdings of the wealth management sector, such as physical silver held by investment institutions, family offices and High Net Worth individuals.

#SilverSqueeze

Back in February 2021 during the initial weeks of the #SilverSqueeze, you may recall that at that time, ETFs storing their silver in London accounted for an incredible 85% of all the silver held in the LBMA London vaults. At that time, the London LBMA vaults claimed to hold 33,600 tonnes of silver while ETFs accounted for 28,700 tonnes of that total, leaving less than 5000 tonnes of physical silver as a residual to meet all other silver demand.

See BullionStar article ‘“Houston, we have a Problem”: 85% of Silver in London already held by ETFs’.

This led the iShares Silver Trust (SLV) to quietly change its prospectus on 3 February 2021 where it added a warning that:“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares”, and that “Authorized Participants [market makers of the Trust] may be unable to acquire sufficient silver that is acceptable for delivery to the Trust… due to a limited then-available supply coupled with a surge in demand for the Shares.”

See BullionStar article “#SilverSqueeze hits London as SLV warns of Limited Available Silver Supply”.

Given that at that time there were (on paper) about 5000 tonnes of silver in London that were not held in ETFs, but at the same time the iShares Silver Trust (SLV) panicked that it could not source supply, this reaction of SLV shows that a lot of the LBMA vault silver that’s not in ETFs (the residual) is not available for sale, and not available to lease by the bullion banks.

This same panic was also commented on by consultancy Metals Focus, in of all places, an April 2021 report it wrote for the LBMA, where it said that “there were concerns that London would run out of silver if ETP [ETF] demand remained at a high level” and “fears emerged as to whether there was enough silver [in London] should demand continue at this pace.”

See BullionStar article ‘LBMA acknowledges “Buying Frenzy” in Silver Market and silver shortage Fears’.

Silver Market Deficit

While this time around in July 2022, the ETFs and other transparent holdings account for about 63% of all the silver in the LBMA London vaults, the situation for the LBMA is still worrying. LBMA silver vault inventories are at a five and a half year low, and in total are less than 1 billion ounces. The declining inventory trend is still intact each and every month since November of last year.

But why is there a large outflow of silver from the LBMA London vaults? Why has a net 173.5 million ozs (5,398 tonnes) of silver left the LBMA vaults since early December 2021?

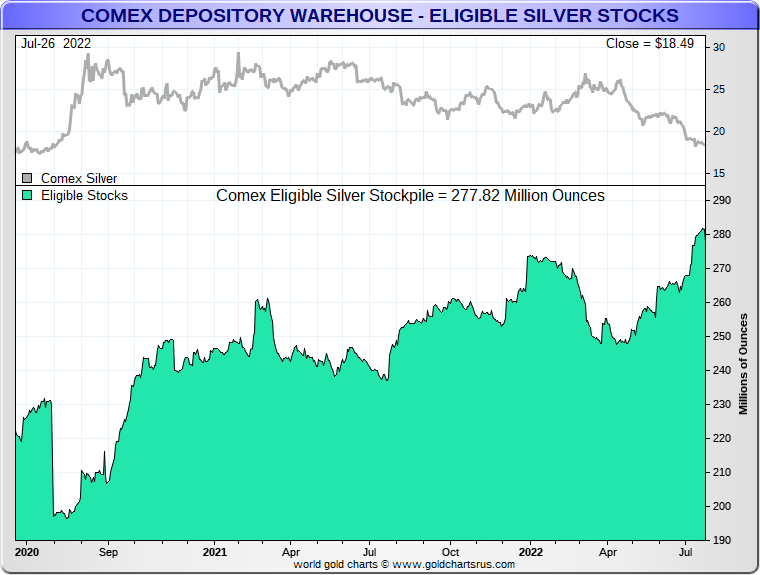

COMEX eligible inventory (silver which is not registered for COMEX trading), does not explain it, since COMEX eligible inventory has not really moved much overall during that time.

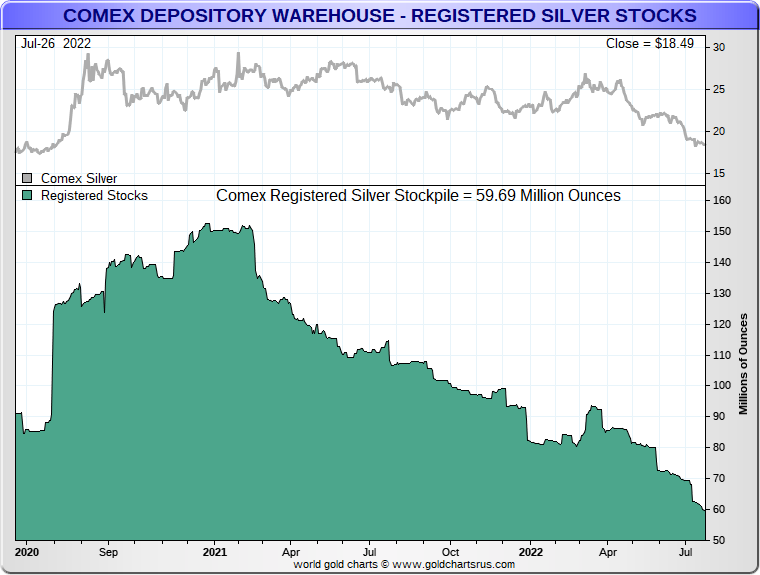

COMEX registered inventory (which is available for COMEX trading) may explain as small portion of the London outflows, but not a lot. COMEX registered inventory have been plummeting consistently during the year so far and actually have continued to plummet since early 2021. COMEX registered inventory is now at a 4 year low of 59.63 million ozs, having begun 2022 at 80 million ozs (and begun 2021 at 150 million ozs. But still, a net 20 million ozs disappearing from registered COMEX this year does not explain a net outflow of over 160 million ozs of silver from London in the same timeframe.

More realistically, the fact that the global silver market is in deficit this year (with demand greater than supply) – and after having been in deficit in 2021 for the first time in years – can help explain why the London silver inventories (and the COMEX registered inventories) are being drained.

Because as everyone knows, when demand is greater than supply the market has to find supply by tapping above ground stockpiles, both reported inventories (such as the LBMA and COMEX stockpiles), and also unreported inventories (those custodian stockpiles which remain opaque and secretive around the world).

If you look at the demand – supply data from the Silver Institute, physical silver supply is growing very slowly and will be about 32,000 tonnes for 2022. On the demand side, demand for silver is growing strongly in all components, from industrial demand to photovoltaic demand, to jewelry and to silverware. And in terms of investor demand (for coins and bars), 2022 is shaping up to be at least as strong as 2021.

Conclusion

Renewed strength in the #SilverSqueeze movement with a momentum in taking physical silver off the market would undoubtedly be a real headache again for the bullion banking cartel. For this reason the bullion bank paper traders are continually motivated to paint the tape and bring down the paper trading generated silver price, while not allowing it to break out to new multi year highs above $30.

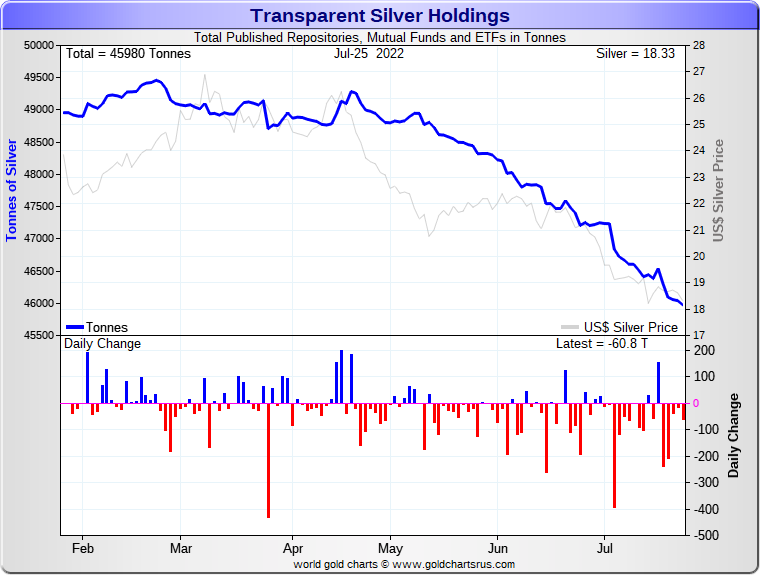

Likewise, as witnessed in early 2021, the bullion banking cartel is terrified of the silver-backed ETFs gobbling up greater percentages of the London LBMA vault stocks. If you were a detective, you might say that this explains why, since mid April, the silver price has been falling. Because since mid April, there is a strong positive correlation between sharp falls in the silver price and sharp falls in the amount of silver held in silver-backed ETFs (such as in SLV and the Deutsche XTrackers ETFs). It’s as if they are inducing the ETFs to shed silver by creating a lower silver price to literally flush silver out of the ETFs.

This flushing out serves two purposes.

a) it creates a negative psychology and prevents ETF investors adding buying pressure that might break the LBMA shell game and lead to a situation where there is not enough metal in London to fulfill ETF silver demand

b) it flushes out existing silver from the ETFs that can then be channeled off into meeting physical silver demand requests coming in from all over the world.

Each month on the fifth business day, the LBMA publishes the LBMA silver vault holdings for the end of the previous month. With the next monthly update (for month-end July) due out on 5 August, it will be intriguing to see if the London silver inventories can make it “8 in a row” with another monthly fall, and so break the current record, or whether the next set of data (with a bit of LBMA tweaking) will make a turnaround and buck the trend.