Barry Dawes of Martin Place Securities takes a look at the current state of the market, reviewing various charts to explain the big moves he sees in gold as well as oil and gas.

Key Points

Gold

- All-time high closing price for US$ gold

- End of the price suppression

- Gold surges in most currencies

- Short covering to come

- Out-of-the-box move now underway

Gold Stocks

- Very important market trend change here

- DT break

- 25% sharp move to 130 on the XAU coming

- Reversal in gold stocks vs gold

TSX-V

- Canadian small caps break out on Friday

- Very long-term H&S being resolved

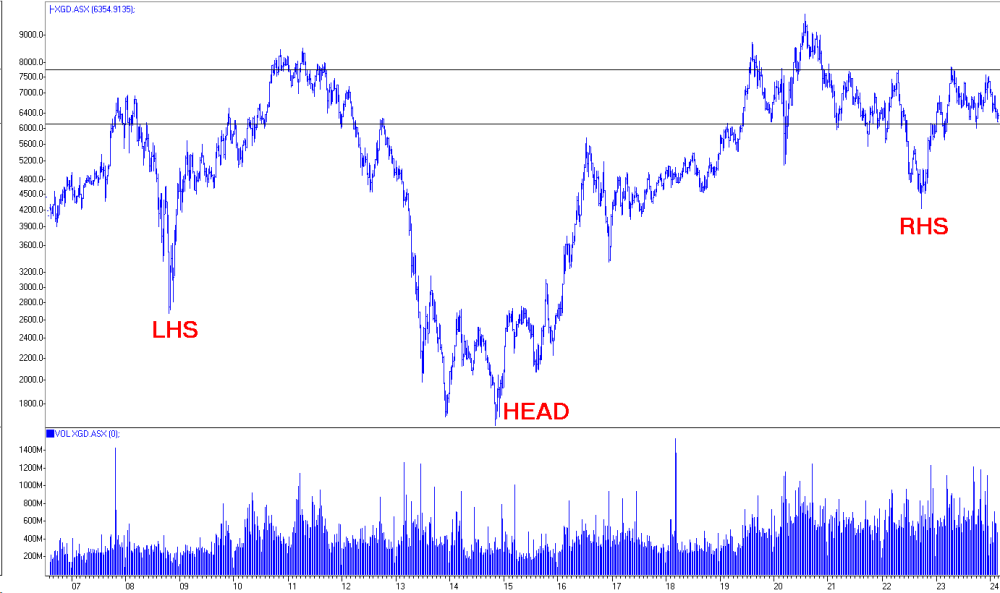

ASX Gold Stocks

- XGD has bottomed

- Head and Shoulders within bigger H&S

- Expect a strong rally from here

- WGX is very well-placed

- CYL is super cheap

- Small cap golds are super cheap AUC AME AAR BC8 KSN KZR NVA SNG ICL

Bonds

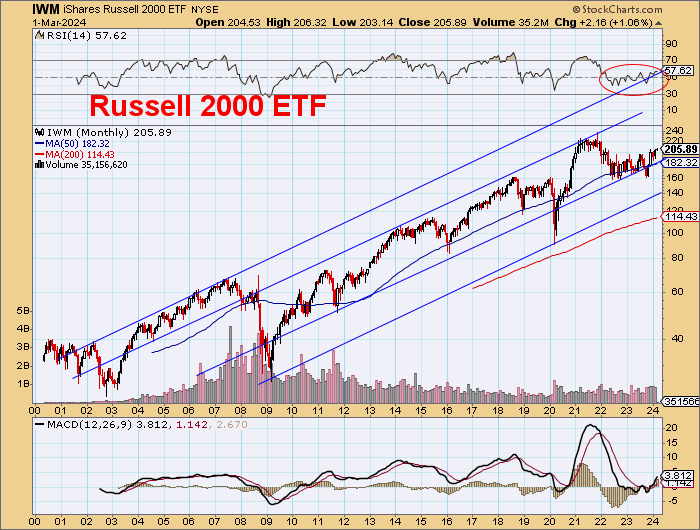

US Stocks

- Bull run continues

- Not just the Mag 7

- Market breadth expanding

- S&P 600 Small Caps and Russell 2000 moving up

Palladium

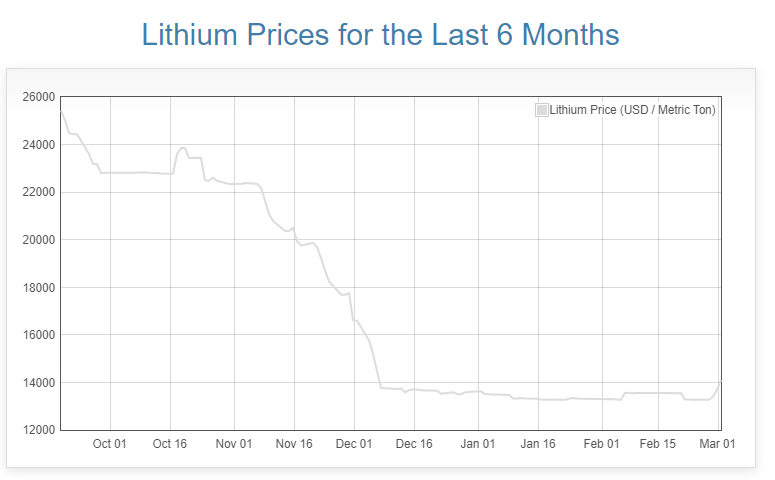

Lithium

- Lithium price jumps again

- Three month high

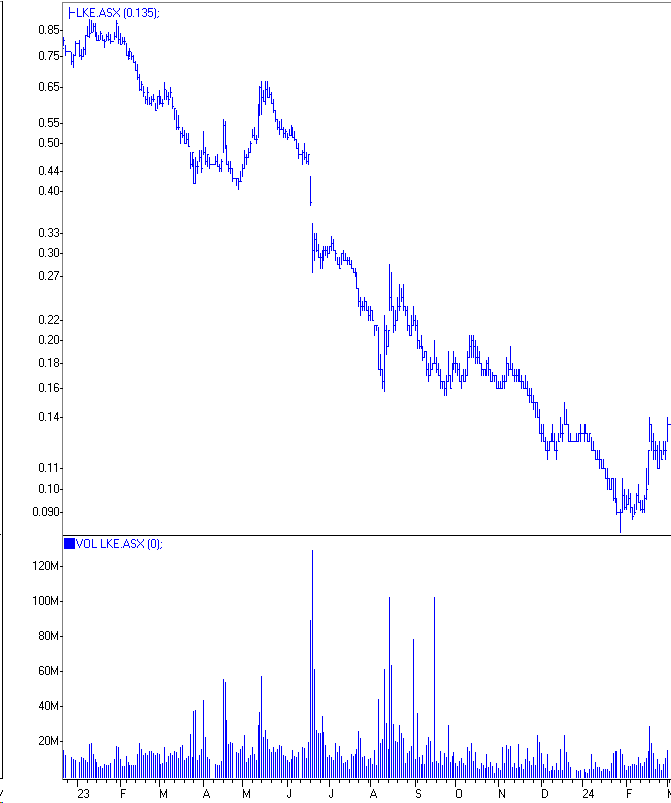

- LKE

CRB Index

- Turning up again after 2-year consolidation

US$

- European currencies breaking down

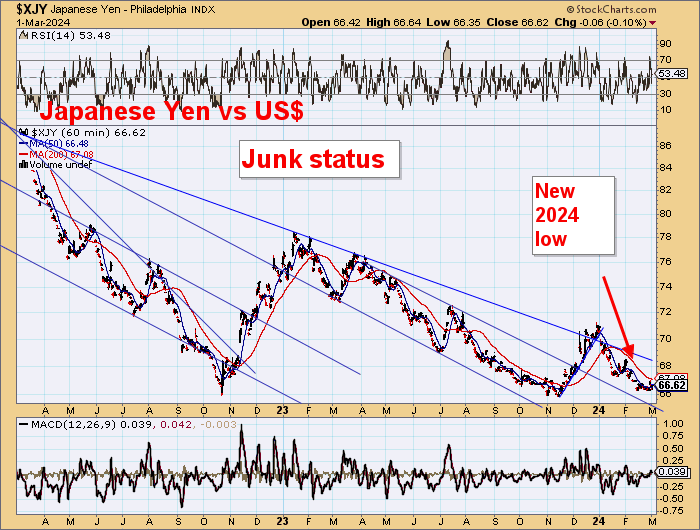

- Yen hits Devil’s Number again

Gold

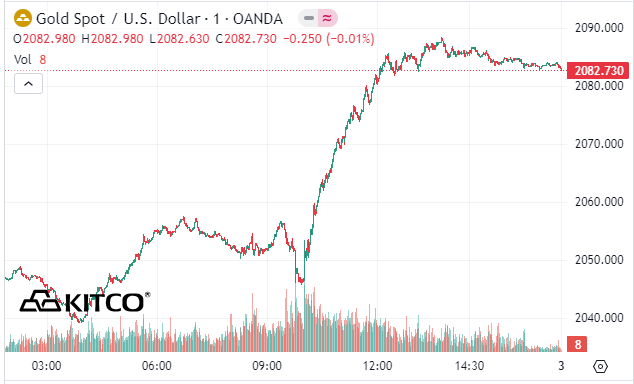

Gold has passed that final stage that has taken it out of the box and is ready to break through US$2100.

Gold was sitting on a near-term downtrend at the close on Thursday, so a small rise and backtest was all that was required before a US$40 intraday move. I was hoping this would happen in the month of February but I am sure you will give me a day’s grace here.

Friday’s note clearly had some external input!

Pleasing to see gold hold on to achieve a second consecutive monthly close above US$2000 and even break a ten week downtrend.

Gold is so close to previous highs, and after consolidating for ten weeks, the power build-up could be strong, and anything could happen now.

After so many false starts, it is a brave soul who shouts out THIS TIME ITS GO, but I think I have to now!

Repeat. THIS TIME ITS GO!

Gold has clearly been suppressed by the banksters who are really . . . If you know, you know.

With gold closing at an all-time US$ high, it means that almost every short (except those from that intraday spike in November 2023) is underwater.

Short covering is needed here, and elsewhere off the exchanges.

Their game is now over. All commodities will start to move higher now.

This is a very important move by gold.

This is a new closing high for US$ gold, and all-time highs in all currencies.

Note the weakness in the major currencies against the US$.

The technicals here are very strong.

A close at the high and out of the box.

Never been done before.

Switching to gold futures (and to the distortion of having a decaying futures premium) to see this in US$, the technicals suggest this:-

- From the ~US$1625 lows to US$2090 is US$465

- Add this to US$2090, and you get US$2555

- Probably within eight months

- Possibly the first part will be quite quick

The move on this one is to US$3,300.

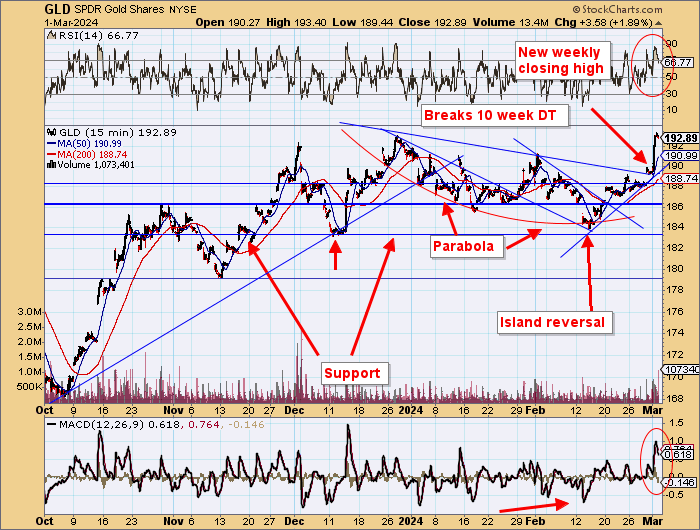

Gold Stocks

XAU broke this downtrend very nicely.

A 25% move to 130 is coming very quickly here, it would seem.

This does appear to be an extremely important long-term reversal.

Gold stocks should do very well.

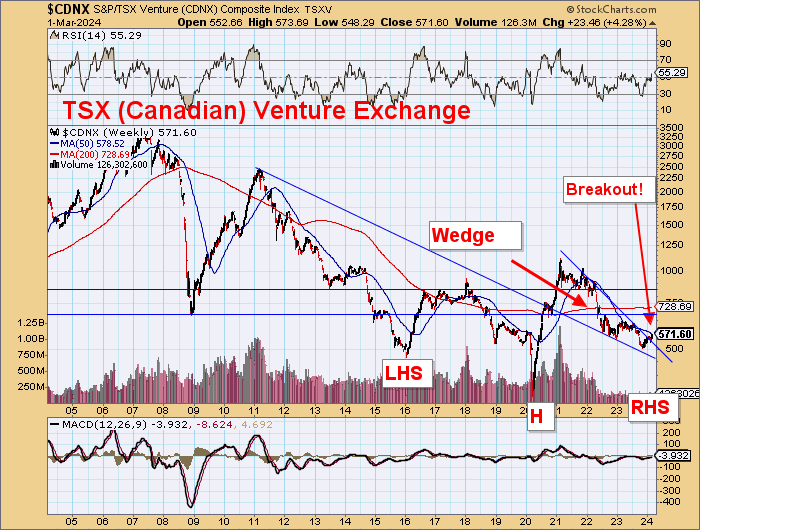

TSXV

- Very strong move on Friday

- Small resources caps moving at last

- 15-year bear market ending!

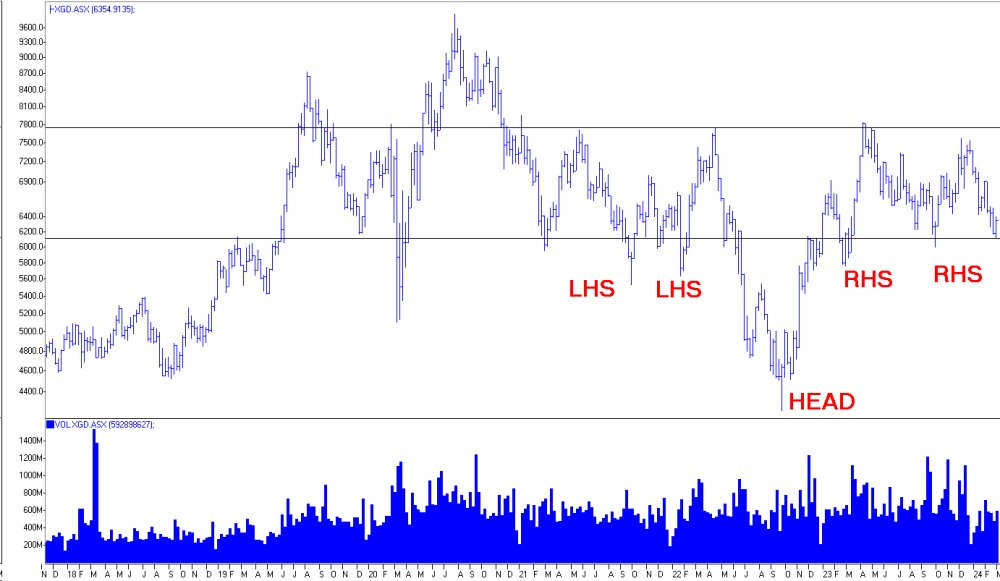

ASX Gold Stocks

- Completing the RHS extended

- Very good symmetry here

Much bigger H&S here.

The bigger the base, the higher the space.

Gold Stocks vs. AU$Gold

It’s buying time.

Bonds

Yields fall again.

Lithium

Lithium trades above US$14,000.

That makes a 3-month high.

This seems to have picked the low nicely.

A Wave 2!

Wave 3 is following to new highs.

LKE

So cheap!

US Stocks

- This is a bull market

- S&P500 heading for 5500

- Not just the Mag 7

- S&P 600 moving up

Moving up here.

And here.

Palladium

- Ready to break out!

- Very neat H&S reversal pattern forming here at the end of wave 5 in a C Wave

- On massive volume

- New highs are coming on this

Oil

Breaking higher.

CRB Index

Breaking higher after two years sideways.

The post-COVID rally was wild.

The next leg should start soon and could be just as wild.

What does this really mean?

US$

Heading higher.

Japanese Yen

At 666 again.

Head the markets, not the commentators.

| Want to be the first to know about interesting Oil & Gas – Exploration & Production and Gold investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.