After a relatively quiet winter season with no drilling news, hybrid prospect generator Alianza Minerals Ltd. (ANZ:TSX.V; TARSF:OTCQB) is getting ready for potentially up to five drill programs this year at the company’s various projects.

The optioned-out [Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB)] Klondike and Stateline copper projects in Colorado, operated by Alianza, are both in the targeting phase, with exploration permits expected in a few weeks.

Coeur Mining Inc. (CDE:NYSE), which has optioned the Tim silver project in Yukon, has already notified Alianza that it intends to do a drill program this year, and Alianza expects to hear more about a budget and meters soon.

The Twin Canyon gold project in Colorado also has seen its fair share of prioritizing drill targets, and a drill permit for a 10-hole, reverse-circulation (RC) drill program is also expected shortly. Alianza intends to seek a partner for this drill program.

Last but not least is Alianza’s 100%-owned Haldane silver project in Yukon.

Alianza is looking to conduct a minimum 2,000-meter drilling program, with a priority on the West Fault target, which returned results like 3.14 meters grading 1,351 grams per tonne silver, 2.91% zinc and 2.43% lead (1,351 g/t Ag, 2.91% Zn and 2.43% Pb) last year. The company needs fresh cash for this program, and is looking to raise roughly CA$2M soon, which will likely not be a problem given that Pacific Opportunity Capital is backing them (as always).

About Alianza Minerals

Alianza Minerals is a prospect generator with a hybrid business model of joint-venture funding and self-funded projects to maximize the opportunity for exploration success. The company currently has silver, gold and copper/zinc projects in Yukon, British Columbia, Nevada and Peru, and several royalties in Mexico.

The 100%-owned Haldane project in the Yukon is Alianza’s flagship project. Other important projects are Tim (Yukon), Klondike and Stateline (Colorado), and Twin Canyon and Horsethief in Nevada. Besides these, the company owns or has optioned more projects, like White River and Mor in Yukon; KRL in BC; and Ashby, East Walker, BP and Bellview in Nevada.

These are all well-known jurisdictions for mining projects as all are home to many mines, deposits and ongoing exploration, although most (except Nevada) have slipped in the Policy Perception Index (PPI) rankings in the most recent Annual Survey of Mining Companies published by the B.C.-based Fraser Institute.

Yukon ranked 39 out of 77 jurisdictions; Colorado was 33; BC, 41; followed by Peru at 42; and Mexico (for the royalties) was 61. Nevada was near the top at 5.

The PPI is the most important figure in this survey, as it indicates the mining friendliness of a jurisdiction, which encompasses corruption, permitting, speed of administrative processing, politics, local sentiment, etc.

The survey is usually published in the last week of February, so a new version is likely coming soon. If you’re interested, you can check it out here.

Alianza’s management team is led by prospect-generator veteran President and CEO Jason Weber.

Despite his relatively young age (51) he has been a president and CEO since 2007 of various prospect generators (Rimfire Minerals, Estrella Gold Corp. (EST:TSX.V) and a developer (Kiska Metals Corp. (KSK:TSX.V), Whistler Gold project in Alaska). With Rimfire, he managed to reel in over $30M for exploration from JV partners like Newmont Corp. (NEM:NYSE), Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE), First Quantum Minerals Ltd. (FM:TSX; FQM:LSE) and Xstrata Plc (XTA:LSE).

On the exploration side, Alianza is in the capable hands of Rob Duncan, who is the VP, Exploration. He has over 30 years’ experience, ranging from juniors like Rimfire, Evrim Resources Corp. (EVM:TSX.V) and Kutcho Copper Corp. (KC:TSX.V), to majors like Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) and Inmet Mining Corp. (IMN:TSX).

On the financial front, the most important figure is Executive Chairman Mark Brown, who merged Tarsis Resources with Estrella Gold to form Alianza Minerals. Brown is also president of Pacific Opportunity Capital, his family fund, which basically serves as an incubator for many junior mining companies.

Brown’s most successful exit was with Rare Element Resources. He entered the rare earth space in 1999, well before almost anyone else, based on watching China cornering the rare earths market at an early stage. He had to wait until 2011 for the exit, but it was worth the wait many times over. Brown was the CFO of Miramar Mining and Eldorado Gold before he joined his father, John, to build Pacific Opportunity Capital.

Alianza also has a mining veteran on its board in Marc Blythe (Almaden Minerals Ltd. (AMM:TSX; AAU:NYSE), Nevsun, Placer Dome, WMC). Furthermore, Alianza recently added another financial director, Sven Gollan, a former investment banker. Gollan represents FruchtExpress Grabher, a prolific investor in the junior mining space and one of Alianza’s largest shareholders.

Alianza’s main listing on the TSX Venture Exchange trades at an average daily volume of about 54,000 shares. The company’s trading pattern is not overly liquid at the moment, but I expect this to improve when drilling results start to filter in come late Q2 or early Q3.

The company currently has 148.95 million (148.95M) shares outstanding (195.61M fully diluted), 34M warrants (with a weighted average exercise price of CA$0.11 and a weighted average life of 18 months) and several option series to the tune of 4.5M options in total, with a weighted average exercise price of CA$0.12 and a weighted average life of 2.3 years.

Alianza sports a tiny market capitalization of CA$11.17M based on the April 11, 2022 closing share price of CA$0.075. Management has sufficient skin in the game, as it holds 11% of the outstanding shares. Mark Brown is the largest shareholder with 11.6M shares (7.8%); institutional funds hold 36%; and several high-net-worth individuals own another 19% — so 67% is in tight hands.

Alianza has an estimated working capital position of about CA$150K at the moment, but a financing is in the works.

As can be seen in the chart, Alianza Minerals has been side ranging for many years between CA$0.05-CA$0.15, except for a spike in January 2021, when a strong drill intercept of 1.78 meters at 818g/t Ag was announced.

A July 2021 assay returned an even better 1.26 meters at 3,267 g/t Ag, but it was a bit puzzling to witness no reaction whatsoever in the share price, although we were experiencing some summer doldrums.

According to Weber, a possible explanation was the weakness in the silver market from January onwards, which muted the response to the excellent results. As always, I view lows in a story that hasn’t fundamentally changed as a buying opportunity.

The hybrid prospect generator model is for exploration companies that seem to have good odds of success. These companies typically form joint ventures with other, larger companies which finance exploration efforts for most of the project. The hybrid aspect consists of the junior self-financing (by raising money in the markets or selling royalties) exploration on one or more of its fully owned projects, without having to option large stakes in their projects.

Advantages of a prospect generator are limited share dilution, strong partners and spreading out risk over multiple exploration projects with different partners.

These advantages are obviously not free and as such this less-risky exploration model can be a double-edged sword.

Sometimes the junior loses its majority stake in a project and thus most of the upside, too. And the agenda of a JV partner isn’t always the same as the junior, especially when major producers are involved. Sometimes a major will exit a project after the first drill holes don’t indicate Tier I potential, despite the project still being potentially attractive to a smaller producer.

As can be concluded, all junior explorer concepts have their pros and cons.

Alianza’s Projects

Since Alianza Minerals is involved in quite a few projects, I will focus on the aforementioned ones that will most likely see exploration activity this year.

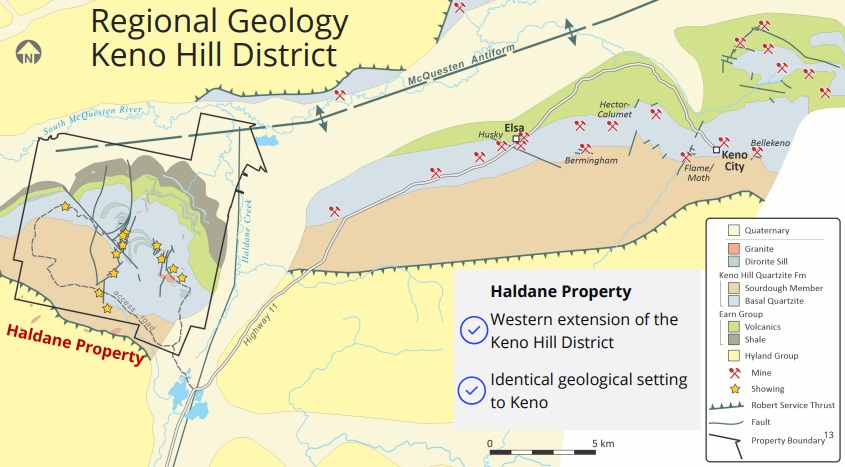

Alianza’s Haldane silver project is still considered an under-explored high-grade silver property (considering the ongoing exploration activity at the central/eastern part of the Keno Hill Silver District) in a historic silver mining region. The 8,579-hectare Haldane is located 25 km west of Keno City, Yukon, in the western portion of Keno Hill, where companies like Alexco Resource Corp. (AXU:NYSE.MKT; AXR:TSX) and Metallic Minerals Corp. (MMG:TSX.V; MMNGF:OTCQB) are currently exploring.

Please note the Robert Service Thrust (in the image above), which runs south of the entire Keno Hill District, and most importantly the Basal Quartzite (in blue grey), which hosts most of the silver deposits. Mineralization in the district consists of structurally-controlled, silver-bearing veins.

The Keno Hill silver deposits produced over 200 Moz Ag from 1913 to 1989, with production recommencing briefly from 2011-2013. Alexco recently started producing again, and continues to hit high-grade silver in drilling to add to its reserves. The Keno Hill District ranks as one of the highest-grade silver districts in the world, with some 4.87 Mt mined at an average grade of 1,389 g/t Ag, 5.62% Pb and 3.14% Zn.

For comparison, the highest mined silver grade at the moment is at Excellon Resources Inc.’s (EXN:TSX; EXLLF:OTCPK) Platosa mine in Mexico, the world’s number one silver-producing country. Platosa sports a grade of 549 g/t Ag.

Haldane witnessed some high-grade silver-lead mining of its own in the distant past. One underground development produced 24.7 tonnes of hand-sorted ore that graded at 3,102 g/t Ag and 59% Pb, while another produced 2.1 tonnes at 4,602 g/t Ag and 57.9% Pb. More than 65 deposits and prospects have been identified in the district. Most occur in the Keno Hill quartzite as structurally-controlled veins in proximity to the Robert Service Thrust.

This is exactly the case with the Haldane project (quartzite in greyish blue). Haldane shares lots of aspects with the Keno Hill mining camp, such as:

- Quartzite (Keno Hill) host.

- Proximity to the Robert Service Thrust.

- Vein and breccia mineralization hosted by complex fault systems..

- Galena, sphalerite, plus tetrahedrite and possibly pyrargyrite.

- Quartz and manganiferous-carbonate gangue are prevalent.

- Better grade commonly in proximity to northwest cross-faults.

Considering the historical high grade already sampled and produced and the recent veins already hit, Alianza could be circling around some very interesting mineralization.

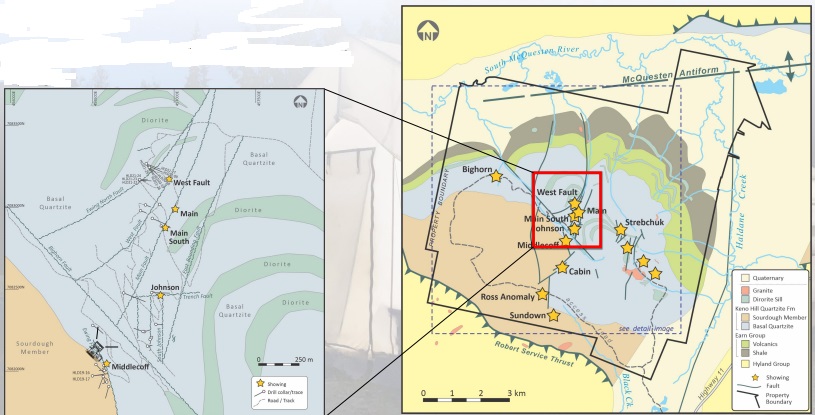

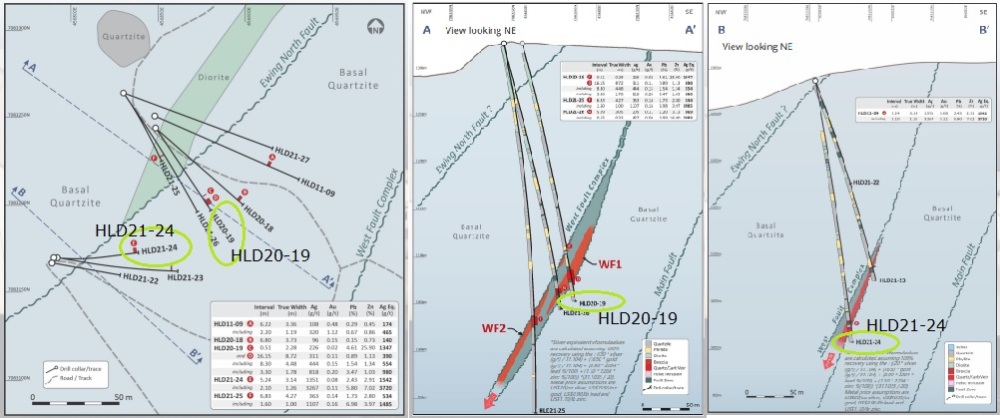

Exploration over the past few years has focused on the Mount Haldane Vein System (MHVS), and considering the aforementioned high-grade results (HLD20-19: 1.78 meters at 818 g/t Ag and HLD21-24: and 1.26 meters at 3,267 g/t Ag) at the West Fault target, management is narrowing its focus at this specific target:

These two best holes can be observed in some more detail here:

As can be observed, the West Fault Complex seems to be a parallel structure, offset to the Ewing North Fault and the Main Fault.

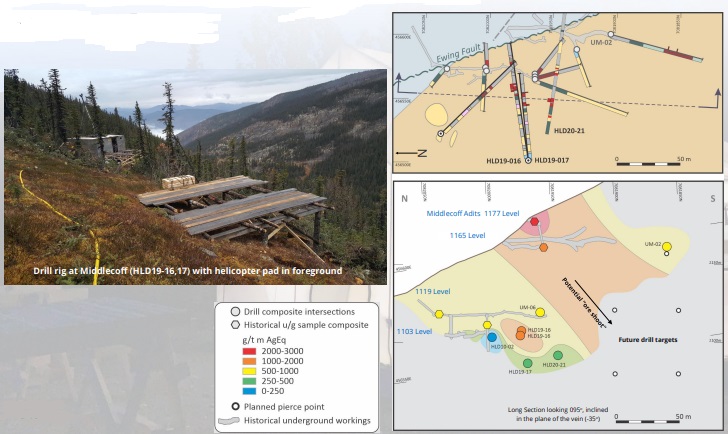

Mineralization in the West Fault Complex appears at greater depth compared to the mineralization hit at the second-highest priority, the Middlecoff target, which also had some historical high-grade near-surface drill results (2,000-3,000 g/t Ag), located 2 kilometers to the south:

According to Weber, Alianza’s insights on Haldane mineralization are improving and the company is looking to delineate a deposit. He regularly talks to Alexco geologists exploring nearby and they have confirmed that Alianza has hit the right type of geology, veins and structures. Weber expects to drill further stepout holes at the West Fault and Middlecoff targets in June, depending on the availability of drill rigs. Drill Targets for Bighorn and Ross will be finalized in the spring, with drilling to likely start later in the summer.

Weber elaborated a bit more on exploration at Haldane: “The knowledge gained at West Fault as Alianza delineates that target may be valuable in its application to targets such as Middlecoff and Bighorn. Alianza now understands silver-bearing veins can exist in multiple levels within the host structures, and can migrate from one level to another. This knowledge may help in targeting drilling and unravelling the structural geology in real time and prioritizing follow-up holes as drilling tests these targets.”

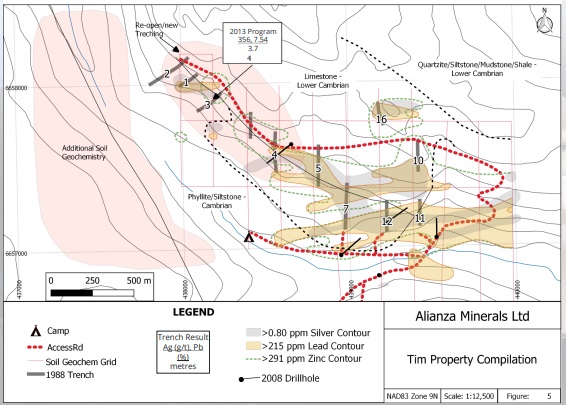

Alianza’s second most important project is the Tim silver project in Yukon, which has been optioned to Coeur. The company can earn an 80% interest by completing CA$3.55M in exploration work over five years, making CA$575k in cash payments, and completing a feasibility study by year eight. Tim underwent sampling and trenching in the 1980s and generated interesting results: trench samples from 1988 returned 352.4 g/t Ag and 9.12% Pb over 4 meters, and two grab samples taken from another trench returned assays of 1248.1 g/t Ag and 49.5% Pb, and 978.7 g/t Ag and 32% Pb.

Subsequent confirmation sampling in 2013 returned 6.4 meters grading 220 g/t Ag and 4.74% Pb. Within this interval, 3.7 meters assayed 365 g/t Ag and 7.54% Pb, so it sure looks interesting.

Tim has a lot of similarities (geological setting, style of mineralization) with the Silvertip mine, some 20 kilometers away, and bought in October 2017 by Coeur from privately held JDS Silver Holdings Ltd. for CA$250M. Coeur is now working on the Silvertip mill to improve production figures.

As the Silvertip story goes, when the original discovery was made the owners were evaluating both Tim and Silvertip and had to choose which property to drill first. So, basically, a roll of the dice picked Silvertip. Maybe Alianza could get lucky and have Silvertip potential on its hands here.

Coeur, as operator of the Tim Silver JV, has completed a reconnaissance exploration program. It included a SkyTEM airborne geophysical survey that was followed up by mapping, trenching and soil geochemical surveys. Weber says Alianza should be in a position to announce the 2021 results and the details of the 2022 program this month.

Next up are the Klondike and Stateline copper projects that Alianza and Cloudbreak Discovery Plc., under an alliance agreement, optioned to Allied Copper with an eye toward 100% ownership. Both projects should soon have drill permits.

The strategy of the alliance with Cloudbreak is to acquire and explore copper deposits in the United States, more precisely in Arizona, Colorado, New Mexico and Utah. Under the terms, either company can introduce projects to the alliance.

Projects accepted will be held 50/50 but funding of the initial acquisition and any preliminary work programs will be funded 40% by the introducing partner and 60% by the other party.

The Klondike copper project lies in the Paradox Copper Belt, which includes the producing Lisbon Valley Copper Mine (LVCM). There are numerous historical copper occurrences that have been identified throughout the district, however, many of these have not been explored using modern exploration techniques.

At Klondike, documented copper exploration ceased in the 1960s with subsequent exploration targeting uranium during the 1970s. Previous workers reported high-grade copper mineralization, highlighted by 6.3% Cu and 23.3 g/t Ag in samples from an outcrop. In addition to its high-grade potential, disseminated copper-silver mineralization has been observed, which may be amenable to modern open-pit mining with Solvent Extraction Electro-Winning (SXEW) processing similar to the LVCM. Sedimentary-hosted copper deposits are an important contributor to world copper production, accounting for more than 20% of the world’s copper supply annually.

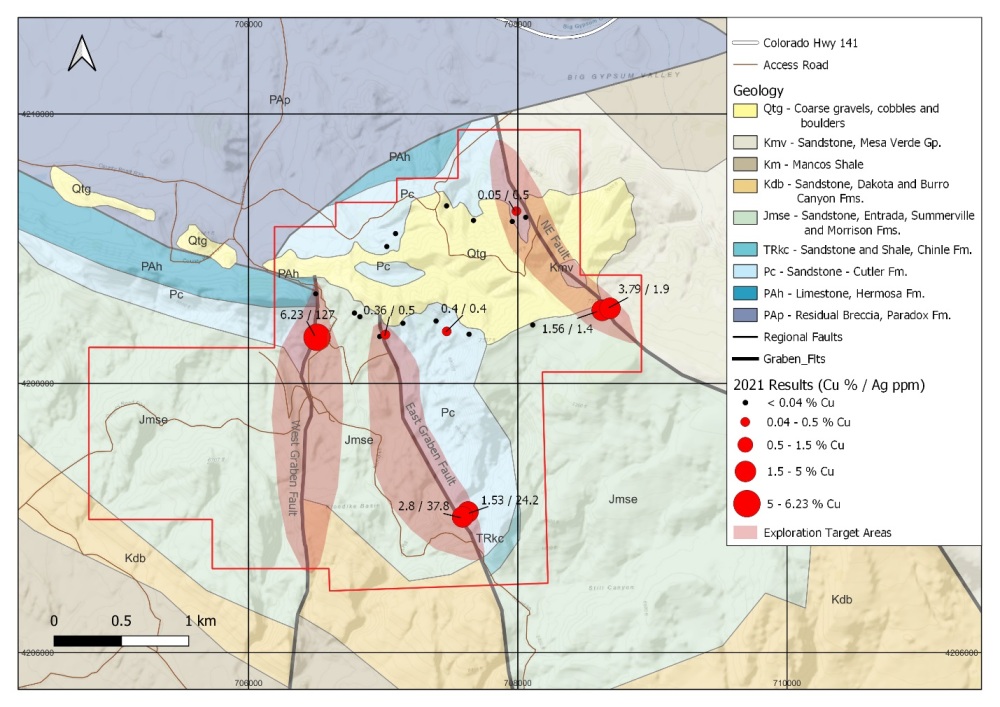

Keep in mind that Alianza and Cloudbreak paid just CA$20,000 and an additional CA$40,000 in cash /share payments for Klondike. Besides this, the alliance spent CA$52,000 for a reconnaissance program consisting of mapping, stream sediment sampling and rock sampling. This program further defined existing drill targets at the West Graben Fault and East Graben Fault targets, and rock sampling and mapping successfully expanded the footprint of both targets and identified a new target named the Northeast Fault.

Sampling at the Northeast Fault returned 1.56% Cu and 1.4 g/t Ag over a 4.6-meter chip sample of altered Jurassic sandstones of the Saltwash member of the Morrison Formation:

As can be seen, the scale of the zones of interest are of significant size. All-in costs for the Alliance were CA$105,000. I wondered why Allied Copper was so interested, as some samples are indeed very high grade for copper samples, but usually you see entire grids of sampling results before drilling is undertaken. Weber explained: “One of the prime targets at Klondike is the copper mineralization hosted in the fault structures. While the mineralization sampled on surface is interesting, we want to jointly test these structures and prospective sandstones at depth for their potential to host high-grade copper. Allied is focused on copper in the U.S. and not afraid to test earlier-stage targets so the concept at Klondike was appealing to them. Strong copper mineralization at surface suggests a compelling subsurface target. ”

Allied Copper obviously agreed with Weber, and optioned the property on generous terms:

- Allied will incur an aggregate of CA$4.75M in exploration expenditures on the property, with at least C$500K to be spent prior to the first anniversary of the closing date.

- Allied will issue 7M common shares and pay an aggregate of CA$400K cash to the alliance over three years.

- Upon completion of these option agreement obligations, the alliance will transfer 100% interest in Klondike to Allied. Allied will also issue 3M warrants exercisable for a three-year term at a price equal to the 10-day volume-weighted average price (VWAP) of Allied’s common shares at the time of the shares were issued.

- The alliance will retain a 2% net smelter royalty, which is subject to a buy down provision where Allied may, at its discretion, repurchase half of the royalty for CA$1.5M within 30 days of commercial production.

Shares in Allied closed on April 11, 2022 at CA$0.18 per share, so 7M shares would equal CA$1.26M in equity at the same share price over three years, which is impressive considering the extremely cheap buying price. There are also 3M warrants, of which the 10-day VWAP is close to CA$0.24.

If Allied files a National Instrument 43-101 technical report on SEDAR establishing the existence of a resource on any portion of the Klondike property of at least 50 Mt of either copper or copper-equivalent at a minimum cut-off grade of 0.5% copper or copper-equivalent and categorized as a combination of inferred resources, indicated resources and measured resources, then Allied will issue a further 3M warrants exercisable for a three-year term at a price equal to the 10-day VWAP of Allied’s common shares at the time of the issuance.

Looking at the total price Allied has to pay over three years (closing in on CA$2.6M, excluding the royalty), it seems Alianza has found a new way of much more aggressively adding value to properties. Some early-stage exploration is being completed, as a magnetic survey will be finalized in a week.

When the snow is gone, a remote sensing program will be done to detect alterations with satellite imagery. Drill targets have already been defined, as there are lots of copper exposures, and the geologic structure that hosts the LVCM is well known.

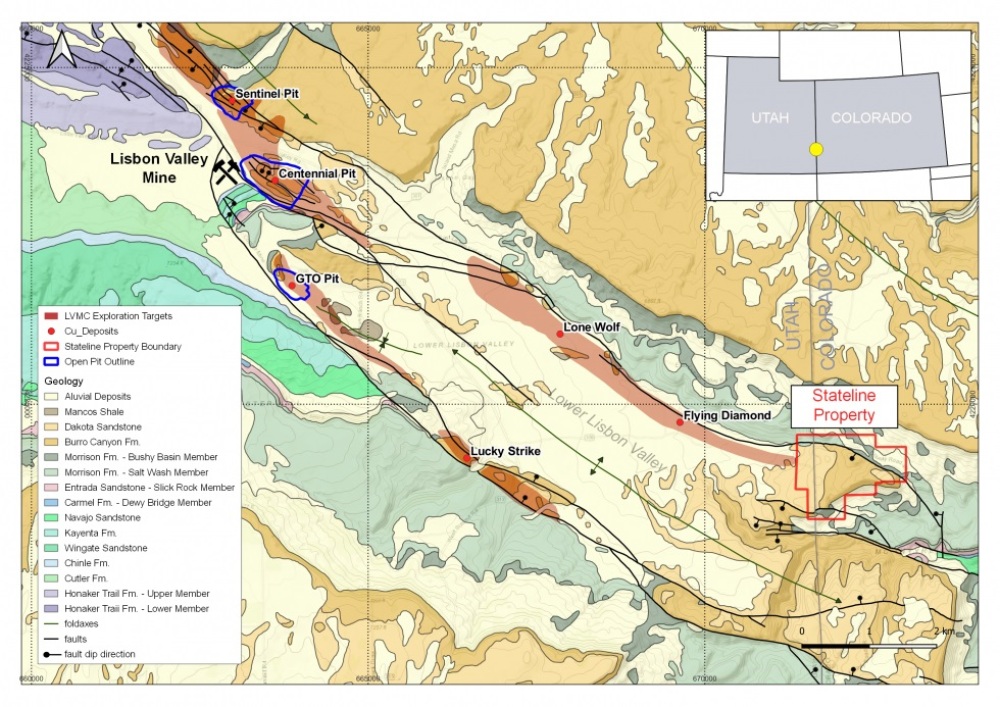

The Stateline project was purchased from the underlying vendors for an equally small US$20K cash payment and a further US$40K payment in the form of cash and/or shares. The project is road accessible year-round, via a network of roads through the valley, including those supporting access to the LVMC. The project is comprised of 22 mining claims on federal mineral rights managed by the Bureau of Land Management. Ground covered by the current claims was at one time part of the LVMC claim package.

The highlights of the Stateline copper project are:

- 148-hectare property covering Paradox Basin sedimentary package in San Miguel Cty., Colo., and San Juan Cty., Utah.

- Favourable stratigraphy known to host sediment-hosted copper deposits in the Paradox Copper Belt, including the producing LVMC, 8 kilometers northwest.

- Exposed copper oxide mineralization at surface within host sandstone units bearing strong similarities to copper deposits along trend at the LVMC.

- Mineralized outcrops have yielded assay results up to 1.6% Cu and 1.7 g/t Ag and 0.45% Cu and 2.1 g/t Ag.

- The Stateline project is located approximately 40 kilometers southwest of Naturita, Colo., covering the state boundary between Utah and Colorado at the southeast end of Lisbon Valley. This property is in the Paradox Copper Belt, as is the LVMC.

There are numerous historical copper occurrences that have been identified throughout the belt, however, many of these have not been explored using modern exploration techniques.

At Stateline, historical exploration was conducted as part of the regional programs associated with the LVMC. Previous explorers reported copper mineralization highlighted by results of 1.6% Cu and 1.7 g/t Ag in outcrop. Mineralization visible in outcrop occurs as disseminated malachite, which may be amenable to modern open-pit mining with SXEW processing, similar to the LVMC.

The mineralization noted to date is interpreted to be the southeast extension of the Flying Diamond mineralization, which is a current target of interest associated with the LVMC.

The deal terms between Alianza/Cloudbreak and Allied Copper are equally attractive: Allied has to spend US$2.7M in exploration expenditures over four years, issue 4M shares and US$315,000 cash over the same period, and Allied must issue a still-to-be-determined amount of warrants, depending on the size of additional claims that could be added to the Stateline project.

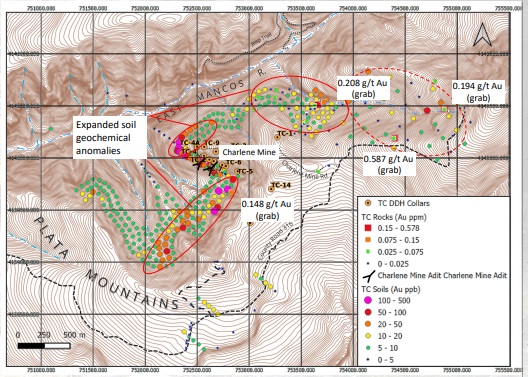

Besides Klondike and Stateline, Alianza Minerals is also working at Twin Canyon in Colorado. This is a gold project where there are several old developments underground, and placer mining produced grades of 9 g/t Au. Management is targeting a sandstone horizon, for a grade of about 2-3 g/t Au.

Historical sampling has also indicated potential for gold mineralization, reinforced by historic rotary drilling, which confirmed the presence of a gold grade about 0.5 g/t Au over a 500 by 500-meter area, indicating disseminated gold mineralization with low and high-grade areas.

Alianza completed several detailed prospecting and geological mapping programs within areas of gold-in-soil anomalies, including expansion of the first soil-sampling campaign, and detailed structural mapping to determine the primary controls focusing on gold mineralization.

For your information: soil sampling grades of 20 parts per billion Au are generally regarded as interesting by geologists, so there appear to be several zones exceeding this at Twin Canyon.

Alianza Minerals is working on a drill permit for Twin Canyon, which is expected within weeks. Discussions are ongoing with a potential JV partner.

The company is also involved in two projects in Peru: Yanac and Pucarana. Of the two, their interest in Pucarana has been converted into a 1.08% NSR royalty. Yanac is a drill-ready, large copper-moly porphyry target, and the result of a former JV with Cliffs Natural Resources Inc. (CLF:NYSE). It’s now 100% owned by Alianza, as Cliffs decided to discontinue all exploration initiatives in 2014.

Despite new Peruvian President Pedro Castillo being anti-mining, which already caused some run-ins with major producers, Alianza management is actively talking to potential partners in order to drill test its copper porphyry target there.

Lastly, Alianza holds three Net Smelter Royalties (NSR) on projects in Mexico. All three projects, Yago, San Pedro and Mesquite are owned by Almadex Minerals Ltd. (DEX:TSX.V). Alianza holds a 1% NSR on each (capped at $1 million per property). Yago has seen recent small-scale production of 28.8 Koz Au. The other two royalties are on properties that are many years from production.

On a closing note, it’s clear that Alianza Minerals has lots of opportunities to find a company-making discovery. At the 100% owned Haldane, Alianza could be on the brink of making such a discovery, as earlier drill results already indicate economic mineralization.

If this will lead to an Alexco-type high-grade deposit is by no means a guarantee, of course, but all indicators are green. Besides Haldane, there are many other, optioned out opportunities to strike it big, and as every prospect generator should, Alianza is going for as many opportunities as it can.

Conclusion

Alianza Minerals seems to have taken a slightly different road with partner Cloudbreak, by flipping cheap, quality assets in a 50/50 setting to partners that are willing to invest substantially in exploration. This could eventually provide a significant income stream for Alianza.

A solid start has been made with the Klondike and Stateline copper projects in Colorado, with drilling coming up for both projects this year.

The Tim silver project will likely also see drilling this year by JV partner Coeur.

Although Haldane is the flagship project, I view the Alliance with Cloudbreak as an interesting and profitable diversification into copper, which is red hot at the moment and trading close to all-time highs. Once the intended CA$2M is raised this quarter, drilling at Haldane can begin and I am curious to see if Alianza can expand the known mineralization into something significant.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high-quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Streetwise Reports Disclosures

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Allied Copper Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.