StrikePoint Gold Inc. more than doubles the land package at its new Cuprite gold project in Nevada’s Walker Lane gold trend through staking.

StrikePoint Gold Inc. (SKP:TSX.V; STKXF:OTCQB) has more than doubled the land package at its new Cuprite gold project in Nevada’s Walker Lane gold trend through staking.

In January, StrikePoint announced it had acquired a 100% interest in the project from Orogen Royalties Inc. (OGN:TSX.V). StrikePoint says Cuprite is an analog to AngloGold Ashanti Ltd.’s (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) newly discovered Silicon gold project 75 kilometers away, where a maiden resource of 3.4 million ounces gold (Moz Au) has been defined.

“Early investigations by StrikePoint’s geological team lead to the speculation that the alteration system at Cuprite continued under cover to the north and south of the existing land package,” said Michael Allen, president, and chief executive officer of StrikePoint. “We were able to acquire approximately 310 new claims via staking to cover off these potential extensions and establish a dominant land position in the district.”

StrikePoint also announced closing the acquisition of the 264 Cuprite claims from Orogen.

It acquired a 100% interest in the project by issuing about 6.4 million shares with a deemed value of CA$450,000, reimbursing Orogen US$35,208 on project-related costs, and granting a 3% NSR royalty to Orogen, through which 0.5% of the NSR royalty can be purchased for US$2.5 million.

“Although that NSR is pretty high, it effectively is a low-cost acquisition with almost no cash to be paid to the (optioner),” Caesars Report newsletter editor Thibaut Lepouttre wrote about the transaction.

At the time of the original Cuprite announcement in January, when the company’s share price was CA$0.07, technical analyst Clive Maund of CliveMaund.com told Streetwise Reports that “we shouldn’t expect any fireworks soon,” but StrikePoint looked like a good value.

“It is down in a zone of strong support and oversold,” Maund said.

On Friday morning, SKP was at CA$0.055.

The Catalyst: District-Scale Opportunity Expanded

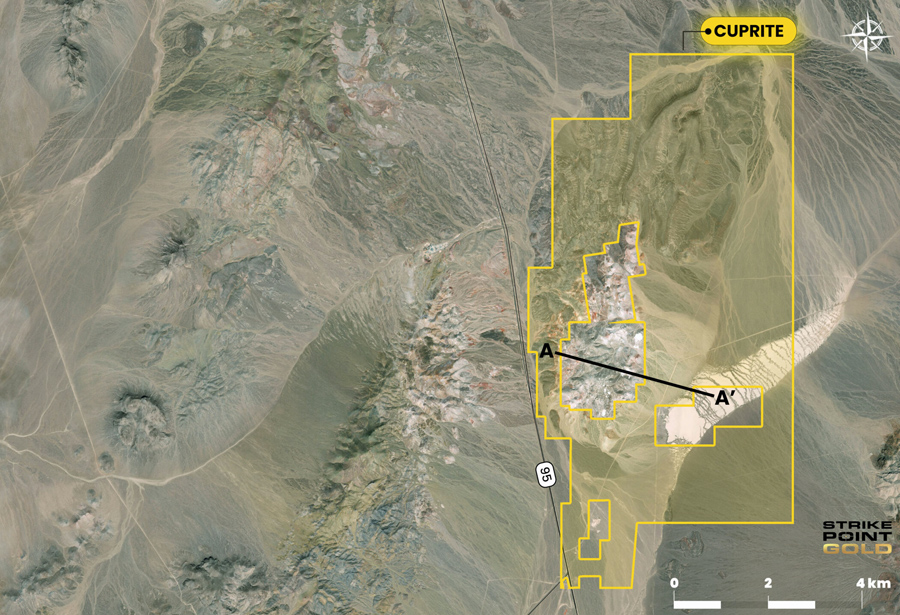

With the expanded claims, Cuprite consists of about 574 unpatented claims covering 44 square kilometers about 15 kilometers south of Goldfield, Nev., and 75 kilometers northwest of Beatty, within the Walker Lane Trend.

It’s a district-scale opportunity with more than 20 square kilometers of advanced argillic alteration visible at surface constituting one of the largest steam-heated cells in the Walker Lane Trend, the company said.

The project is underlain by Miocene and Oligocene tuff and is located on the western flank of the Stonewall Mountain Caldera. Several nearby gold deposits and mines are in similar locations within calderas of the Walker Lane Trend, including the Goldfield District Deposit now owned by Centerra Gold Inc. (CG:TSX; CADGF:OTCPK)

While StrikePoint also has its Porter and Willoughby projects in British Columbia’s Golden Triangle, Allen said Cuprite will also help extend the drilling season, which can be much shorter in Canada, for the company.

“We can now do work and create value for our shareholders year-round,” Allen said.

‘Prospectivity’ of the Walker Lane Trend

Allen said he was involved with another project on the Walker Lane trend when he was CEO of junior explorer Northern Empire Resources Corp. He said he had driven past the Cuprite site dozens of times but became interested when AngloGold revealed the Silicon discovery and Cuprite came on the market.

According to Orogen, Cuprite is one of the largest alteration cells in the Walker Lane trend, and prospective feeder structures are untested by historical drilling.

AngloGold Ashanti’s Silicon gold discovery is “in a similar geological and alteration setting” to Cuprite, Allen said.

In the last year, AngloGold Ashanti also acquired Corvus Gold Inc. for US$370 million and the Sterling Project (the one formerly owned by Northern Empire) from Coeur Mining Inc. (CDE:NYSE) for up to US$200 million.

“These transactions highlight the conviction that world-class mining companies have of the prospectivity of the Walker Lane in the vicinity of the Cuprite project,” according to Allen.

The next step is to take soil and geophysical samples, to explore Cuprite further and identify possible spots to drill. Allen said drilling could start as soon as the third quarter.

In Canada, a National Instrument 43-101 technical report estimated StrikePoint’s Porter project in British Columbia has 11 Moz silver (Ag) at a grade of 868 grams per tonne (g/t), and inferred resources of 1.7 Moz Ag at a grade of 595 g/t. StrikePoint called the estimate “historic.”

StrikePoint acquired Willoughby, which is about 6 kilometers east of Ascot Resources Ltd.’s Red Mountain, in 2019 for US$85,000. The company said it has found a massive new sulfide mineralization that was previously under ice at the project. Surface chip channel samples in 2021 returned 8.59 g/t gold equivalent (Au Eq) over 3 meters, 4.74 g/t Au Eq over 7 meters, and 3.48 g/t Au Eq over 18 meters.

Ownership and Share Structure

Some of the industry’s biggest players are shareholders in StrikePoint, including Eric Sprott, who owns about 14.5%. Institutions own about 46.7% of the company, management, and insiders own about 4.8%, and 33.9% is retail.

Some major institutional investors include Crescat Capital LLC with 5.15% or 10.67 million shares, and U.S. Global Investors Inc. with 1.33% or 2.75 million shares.

Major insider shareholders include Board Executive Chairman and Director Shawn Khunkhun with 0.56% or 1.17 million shares, and Director Ian Harris with 0.29% or 0.61 million shares.

StrikePoint’s market cap is CA$11 million with 213.78 million shares outstanding, according to the company. It trades in a 52-week range of CA$0.14 and CA$0.045.

Sign up for our FREE newsletter

Disclosures

1) Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: StrikePoint Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.