Ron Struthers of Struthers’ Resource Stock Report shares his belief that all the strong growth and more is already priced into Nvidia. Meanwhile, a deep value situation like Greenbriar Sustainable has been overlooked, according to Struthers, but not for long.

A lot of investors simply jump on momentum, like the recent Magnificent 7. However, the majority get in too late and our left holding the bag when the mania subsides. All eyes are on Nvidia (NVDA:NASDAQ); perhaps they can be called the top gunslinger in the Magnificent 7.

They report earnings after the bell today with a consensus EPS estimate for Q4 coming in at US$4.63 (+426% Y/Y), with a revenue forecast of US$20.5B (+236% Y/Y), up from US$6.1B in the prior year. That is awesome growth, but it is already priced in and much more. When the numbers grow this strong, it is just too hard to repeat from this much higher base in revenue and earnings. For example, for revenue to jump +236% from US$20.5B, it would have to go to over US$48 billion. Not going to happen in the next couple of years for sure.

However, the market is pricing in this spectacular growth into the future. According to marketwatch.com, NVDA has a p/e of 416, trading at 19 times the sale, 22.7 times the book value, and 90.5 times the cash flow.

This is a bubble, sure and simple, and it will pop; maybe it has, but this will happen in 2024.

I pointed out earlier that management/insiders are dumping the Magnificent 7. It was just announced that Jeff Bezos of Amazon just sold another 14 million shares for a total of 50 million.

Where are these guys putting the money?

One place is mining. Meanwhile, a deep value situation like Greenbriar has been overlooked, but not for long.

Greenbriar Sustainable

Recent Price – US$1.00

Entry Price – US$1.15

Opinion – Strong Buy to US$1.25

Investors that know the story of Greenbriar Sustainable Living (GRB:TSX.V; GEBRF:OTC) have been impatient waiting for government approvals/permits, but I said not for long because I have been invited to the sod-turning event for Sage Ranch in April so this is going to happen and soon. So is the construction starting at their Montavla solar project.

Not Greenbriar, but independent third parties have estimated their future cash flow for Sage Ranch and Montavla at US$260 million. I am ignoring Cordero Ranch in Utah because construction is a couple of years out. That third-party estimate is about 11 times the current Greenbriar market valuation.

I also estimated an annual free cash flow of about US$35 million for the two projects. Stocks will normally trade between three and ten times cash flow. At five times, that would put the stock at about US$5.00 or about CA$6.50

Greenbriar just announced a dividend policy where 35% of their free cash flow would go to dividends. Using a more conservative US$30M per year in free cash flow, we can value the future stock price on dividend yield. To be conservative, let’s use an even US$10m for dividends annually. That would be about US$0.29 per share each year in dividends. If the stock gave a yield of 7%, the stock would be US$4.15 or CA$5.50.

A target of CA$6 for 2025 looks quite realistic. That might seem too bullish, but ask yourself, why would the former CEO of JP Morgan Securities, Chris Harvey, come on as a director of a little unknown micro-cap company like Greenbriar?

I bet it is because he sees the huge potential. You can make five or ten times your investment on Greenbriar, and you cannot do that now with the Magnificent 7; that ship has sailed.

Chris began his career at JP Morgan 39 years ago and helped build out the firm’s overall investment banking capabilities. After several roles and then spending several years as the Chief Country Officer for Japan, Chris then ran the Wealth Management business for Latin America, with his final position as the CEO of JP Morgan Securities for four years.

Sven Vande Broek has a European newsletter and just wrote a very in-depth analysis of Greenbriar. I have known Sven for several years through email, and he has graciously shared his report. You can view the complete 24-page analysis here.

I would like to show one graphic from the report because it gives a timeline for when Greenbriar starts to generate revenue, which will be in 2024. Sage Ranch will come on in phases over six years, so it will generate revenue in that time frame. Montavla, a solar farm, will be much quicker as it takes about six to 12 months to build a solar farm of this size (80MW). It will then start generating its full yearly revenue over the next 25 years, the planned life span. It could go longer, and there is potential to expand this to up to 160MW, so revenues would double.

Like Canada, the U.S. faces a shortage of affordable homes, and Greenbriar is a solution for this. For those familiar with mining, Greenbriar has gone through the slow process of permitting that investors find boring, but the inflection point has arrived where they start producing revenue, just like when a mine building is finished. These stocks then see a large move higher as they start to trade at a multiple of earnings and cash flow. The chart is also quite interesting.

The stock started to come down in mid-2022, but since that time, it has been under strong accumulation, shown by the positive balance volume. That means more buyers taking out offers than sellers hitting bids. Insiders have bought about 90,000 shares so far in 2024. The first resistance is $1.25, and that is my short-term target. Once there, some positive news should take it to the next level.

Midnight Sun

Recent Price – US$0.29

Entry Price – US$0.27

Opinion – Buy on weakness <$0.25 and break out at US$0.34

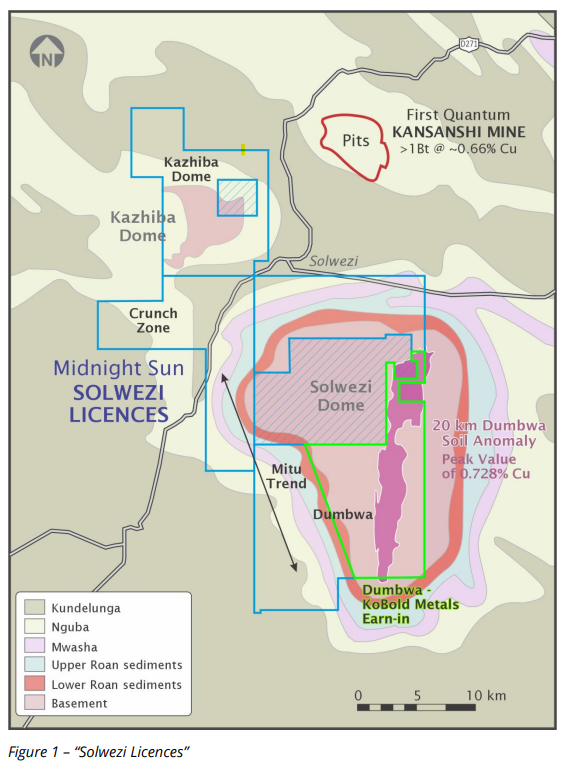

Some awesome news with Midnight Sun Mining Corp. (MMA:TSX.V; MDNGF:OTCQB) yesterday. They have signed a JV deal with Kobold Metals. This is the mining company backed by Bill Gates, Jeff Bezos, Richard Branson, and other key investors. As I mentioned, they are selling the Magnificent 7 and investing in mining. Investors should wake up!!!

KoBold is to earn a 75% interest in Dumbwa by incurring US$15 million in exploration expenditures and making cumulative cash payments to Midnight Sun of US$500,000 over 4.5 years.

Midnight Sun President & CEO Al Fabbro stated: “KoBold has assembled one of the top global sediment-hosted copper teams – including Dr. David Broughton – and I cannot overstate how pleased we are to have them at the helm on Dumbwa. Their bench strength speaks to the quality of this outstanding tier-one exploration target and the seriousness of their approach. As evidenced by the impressive roster of keystone investors in KoBold, they are on track to become new industry leaders using incredibly sophisticated proprietary technology to fast-track the discovery of critical minerals. We look forward to KoBold applying their groundbreaking exploration approach to the Dumbwa target and moving this important Zambian copper asset toward development together, which we view as perfectly timed to coincide with an upcoming phase of unprecedented global copper demand.”

KoBold Metals Africa Chief Executive Officer Mfikeyi Makayi stated: “KoBold is looking forward to exploring the Dumbwa target alongside Midnight Sun as we have long been interested in the Solwezi Dome. The Dumbwa target hosts intriguing copper-in-soil anomalies and a structural setting comparable to other major deposits in the region. The KoBold sediment-hosted copper team has decades of experience working in the African Copperbelt, which we will combine with our library of analytical tools and proprietary technology to aggressively explore at Dumbwa. We look forward to working with Midnight Sun and drilling at Dumbwa in 2024.”

The most interesting thing about this deal is that Midnight Sun did the JV on only a fraction of their property. The Dumbwa exploration target is located in the heart of the Zambia-Congo Copperbelt and is one of four key prospects that comprise Midnight Sun’s 5062-kilometer Solwezi Project.

The Dumbwa target area included in the KoBold agreement is 1082 sq. kilometers. The remaining 3982 kilometers of property that make up the Solwezi Project will remain with Midnight Sun.

The stock has been range-bound between US$0.20 and US$0.33 for a long time, so there is a solid base here.

That is why I have suggested buying on weakness below US$0.25, and if the stock breaks out of this range, say a close at US$0.34/US$0.35.

| Want to be the first to know about interesting Critical Metals, Base Metals, Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities Greenbriar.

- Ron Struthers: I, or members of my immediate household or family, own securities of: Greenbriar and Midnight Sun. My company has a financial relationship with Greenbriar. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.