Deutsche Bank has announced the establishment of a new custodial and vaulting service in Singapore on the back of physical gold buying in Asia. The recent plunge in the price of gold has triggered investor demand as buyers enter the market to soak up what might be the right time to buy before another rally.

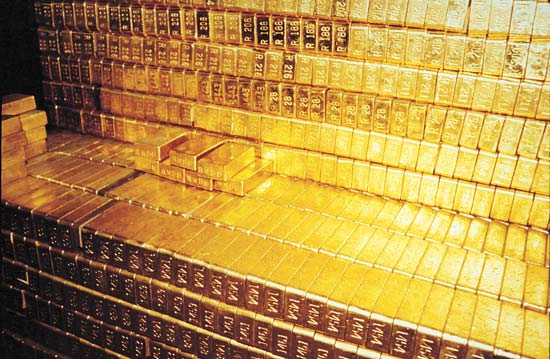

The vault which is located in Singapore Freeport will be able to handle 200 tonnes of gold bullion. The move puts Deutsche Bank, a clearing member of the London Bullion Market Association in top spot as a full service provide of; hedging, financing, trading and physical distribution of precious metals.

Ronan Donohoe, Deutsche Bank’s Global Head of Metals and Dry Bulk Trading, said in a statement: “The new facility enables us to provide best-in-class precious metals storage and confirms our strategy to offer clients solutions they require to protect their wealth.”

Safe haven

In times of economic gloom gold is seen as a safe haven for investors, during the height of the economic crisis analysts at major banks expected the precious metal to reach the all important $2000 mark. Between 2008 and the metal’s record highs of around $1,920 an ounce in September 2011, the value of gold has almost tripled due to financial uncertainty, with the help of the Greek debt debacle.

The Federal Reserve’s QE3 program as well the recent bull moves in the US equity markets have put downward pressure on gold and hence the yellow metal is floating around $1400.

Singapore premier destination for gold

Singapore, one of Asia’s leading financial centres has been battling with rival Hong Kong to secure the top spot, the new vault will open up doors to new wealth in Thailand, Vietnam and Indonesia. Last year Singapore removed a tax of 7% on the sale of bullion, Finance Minister Tharman Shanmugaratnam removed the tax to make Singapore more competitive and the prefered destination in the region for physical gold.

Mr. Donohoe added: “This offering will encourage a significant development in a Singapore-based precious metals market. Holding gold in an allocated account in Singapore is an effective way of protecting your wealth against unforeseen external shocks. Given Singapore’s exceptional transportation linkages along with the International Enterprise Agency’s objective to make Singapore a global hub for gold, the establishment of Deutsche’s facility is a natural progression.”

In December (2012) the Royal Mint, supplier of gold coins in the United Kingdom, launched a new vault. Barclays and JP Morgan have also been setting up new facilities to cater for the demand in gold buying.

Mark Smallwood, head of Wealth Planning within Deutsche Asset & Wealth Management, APAC, said in the official press release: “We are seeing considerable interest on the part of our Ultra High Net Worth clients in this asset class for its well known qualities. Through this new platform, our private clients have the ability to achieve three vital objectives when seeking exposure to this asset class, namely a highly regulated and stable jurisdiction in which to custody these assets, the ability to store their gold holdings in its physical form, and finally to use their physical gold holdings as collateral against loans.”

Singapore Mercantile Exchange (SMX) launched its first US dollar denominated gold contract which is based on the MCX priced in INR. The contract opens up Arbitrage Read this Term opportunities between the exchanges, in addition to new trade opportunities in INR currency futures or the NDF contract.

Deutsche Bank’s commitment to emerging market currencies was extended when the bank carried out the first Singapore Dollar/Offshore Renminbi (SGD/RMB) spot trade that was cleared in Singapore. This came on the back of the country’s financial watchdog’s decision to go live with RMB clearing in Singapore in May 2013.

Deutsche Bank has announced the establishment of a new custodial and vaulting service in Singapore on the back of physical gold buying in Asia. The recent plunge in the price of gold has triggered investor demand as buyers enter the market to soak up what might be the right time to buy before another rally.

The vault which is located in Singapore Freeport will be able to handle 200 tonnes of gold bullion. The move puts Deutsche Bank, a clearing member of the London Bullion Market Association in top spot as a full service provide of; hedging, financing, trading and physical distribution of precious metals.

Ronan Donohoe, Deutsche Bank’s Global Head of Metals and Dry Bulk Trading, said in a statement: “The new facility enables us to provide best-in-class precious metals storage and confirms our strategy to offer clients solutions they require to protect their wealth.”

Safe haven

In times of economic gloom gold is seen as a safe haven for investors, during the height of the economic crisis analysts at major banks expected the precious metal to reach the all important $2000 mark. Between 2008 and the metal’s record highs of around $1,920 an ounce in September 2011, the value of gold has almost tripled due to financial uncertainty, with the help of the Greek debt debacle.

The Federal Reserve’s QE3 program as well the recent bull moves in the US equity markets have put downward pressure on gold and hence the yellow metal is floating around $1400.

Singapore premier destination for gold

Singapore, one of Asia’s leading financial centres has been battling with rival Hong Kong to secure the top spot, the new vault will open up doors to new wealth in Thailand, Vietnam and Indonesia. Last year Singapore removed a tax of 7% on the sale of bullion, Finance Minister Tharman Shanmugaratnam removed the tax to make Singapore more competitive and the prefered destination in the region for physical gold.

Mr. Donohoe added: “This offering will encourage a significant development in a Singapore-based precious metals market. Holding gold in an allocated account in Singapore is an effective way of protecting your wealth against unforeseen external shocks. Given Singapore’s exceptional transportation linkages along with the International Enterprise Agency’s objective to make Singapore a global hub for gold, the establishment of Deutsche’s facility is a natural progression.”

In December (2012) the Royal Mint, supplier of gold coins in the United Kingdom, launched a new vault. Barclays and JP Morgan have also been setting up new facilities to cater for the demand in gold buying.

Mark Smallwood, head of Wealth Planning within Deutsche Asset & Wealth Management, APAC, said in the official press release: “We are seeing considerable interest on the part of our Ultra High Net Worth clients in this asset class for its well known qualities. Through this new platform, our private clients have the ability to achieve three vital objectives when seeking exposure to this asset class, namely a highly regulated and stable jurisdiction in which to custody these assets, the ability to store their gold holdings in its physical form, and finally to use their physical gold holdings as collateral against loans.”

Singapore Mercantile Exchange (SMX) launched its first US dollar denominated gold contract which is based on the MCX priced in INR. The contract opens up Arbitrage opportunities between the exchanges, in addition to new trade opportunities in INR currency futures or the NDF contract.

Deutsche Bank’s commitment to emerging market currencies was extended when the bank carried out the first Singapore Dollar/Offshore Renminbi (SGD/RMB) spot trade that was cleared in Singapore. This came on the back of the country’s financial watchdog’s decision to go live with RMB clearing in Singapore in May 2013.